S&P 500 companies are returning cash to shareholders at an unsustainable rate, says Goldman Sachs analysts.

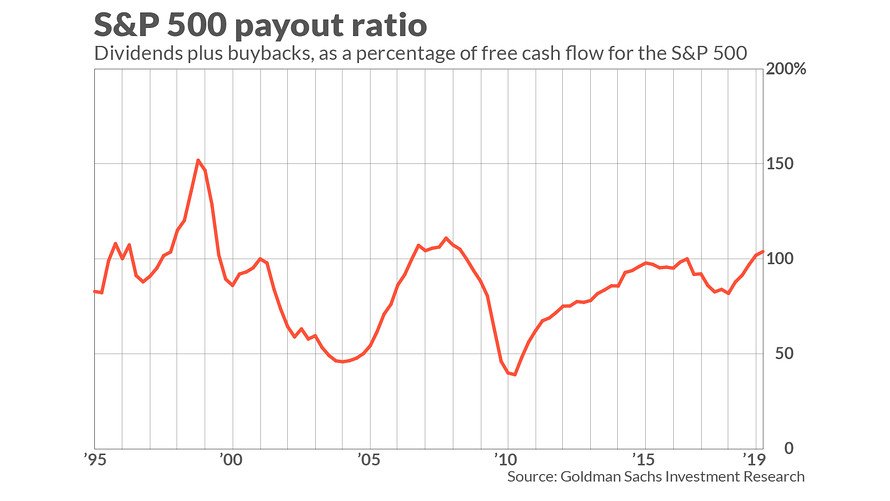

Goldman data show that in the 12 months ended on March 31, firms in the S&P 500 index SPX, -0.12% spent 103.8% of their free cash flow on stock buybacks and dividends, up from 101.9% in the fourth quarter of last year.

This latest spree is the first time that constituents of the index spent more cash than they earned on payouts since the period between September 2006 and March of 2008, when there was a seven-quarter stretch during which S&P 500 companies payed out more to shareholders than they earned in cash, on a trailing 12-month basis.

“S&P 500 share repurchases have continued to surge in 2019,” Goldman analysts wrote, led by chief U.S. equity strategist David Kostin. “Although S&P 500 repurchase authorizations have declined 20% versus the year-ago period, companies retain capacity to repurchases stock under multiyear authorizations.”

Kostin estimated that S&P 500 buybacks will climb by 13% to a new all-time high of $940 billion this year, and pointed to data showing “with payout ratios elevated, corporates have drawn on their cash balances to finance spending growth.”

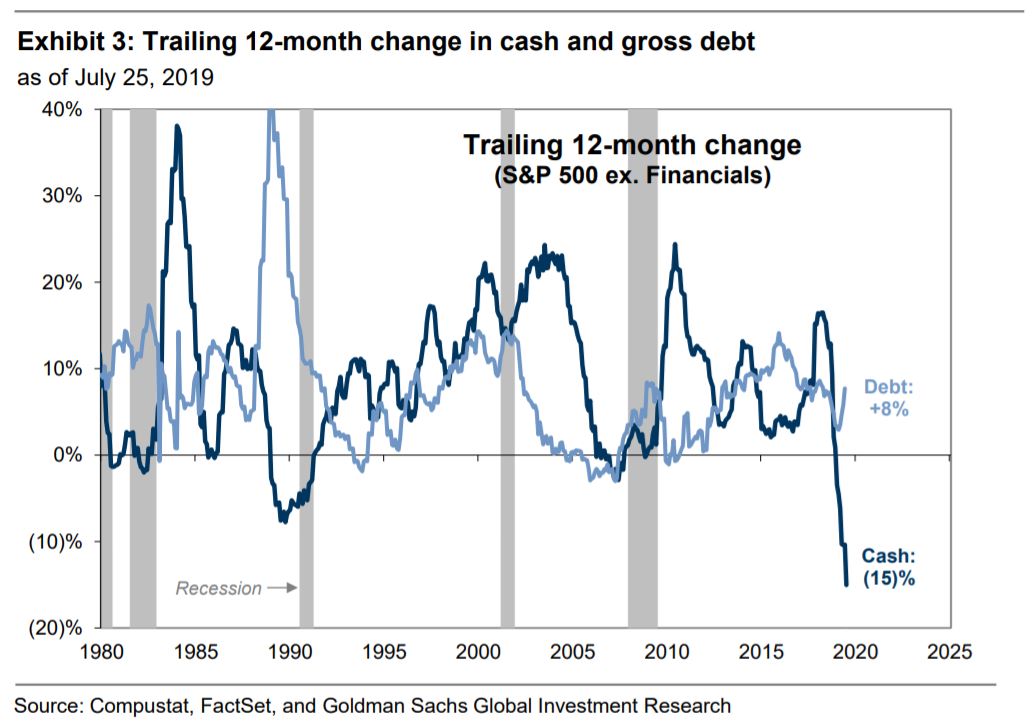

Indeed, during the past year, nonfinancial companies in the S&P 500 have seen their cash levels decline by $272 billion, a 15% decline represents the largest drop since at least 1980, according to a Goldman analysis. Another worrying sign is that the cash decline has coincided with a spike in corporate debt levels, with gross debt outstanding rising 8% over the same period.

Goldman Sachs Investment Research

Goldman Sachs Investment Research

According to Kostin, however, Federal Reserve policy is helping to blunt the damage wrought by rising debt and falling cash levels. A widely expected interest-rate cut on July 31 is helping to boost stocks with high debt levels.

Goldman’s basket of weak-balance-sheet stocks have outperformed stocks with a strong balance sheet by 4 percentage points since the beginning of June as investors are “comfortable with higher leverage ahead of expected Fed easing.”