Getty Images

Getty Images Stock buybacks may be the subject of criticism by people ranging from Sen. Bernie Sanders to BlackRock CEO Larry Fink for depressing investment and causing income inequality.

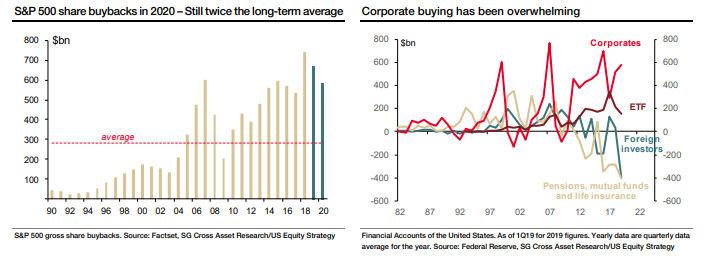

But that hasn’t been made them noticeably less popular, and there could still be $570 billion of repurchases of S&P 500 index SPX, +0.07% companies next year, according to a new report. That’s down from a forecasted $670 billion in 2019 and $748 billion in 2018.

Research published by the French bank Societe Generale shows that S&P 500 companies have bought back the equivalent of 22% of the index’s market capitalization since 2010, with more than 80% of the companies having a program in place.

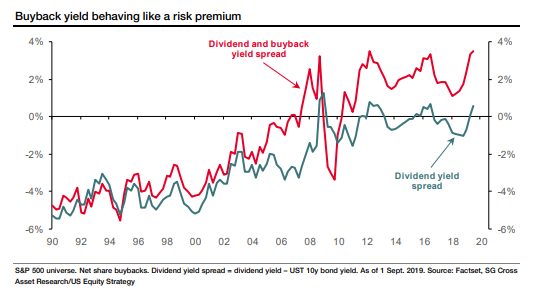

In the second quarter, there was the equivalent of what SocGen called a 3.2% buyback yield, on top of the 2.2% dividend yield.

The low cost of debt is one reason for the surge, with interest rates not that far above zero, and President Trump’s package of tax cuts in 2017 further triggered a big repatriation of cash held abroad. Since the passage of the Tax Cuts and Jobs Act, non-financial U.S. companies have reduced their foreign earnings held abroad by $601 billion.

This repatriation may have run its course, and stock buybacks should decline from here, but they will still be substantial. “We think corporate buying will remain at double the long-term average, which would act as a cushion for equity price action in our U.S. mild-recession scenario,” the report says.

Tech companies including Apple AAPL, +0.96% , Oracle ORCL, -0.67% , Qualcomm QCOM, -0.55% , Microsoft MSFT, +0.16% , Broadcom AVGO, -0.59% , Alphabet GOOG, -0.06% and Intel INTC, -0.53% are driving the buyback wave, followed not too far behind by financials including Wells Fargo WFC, -1.72% , Bank of America BAC, -0.91% , JPMorgan Chase JPM, -0.53% and Citi C, -1.55% .

SocGen estimates tech companies will buy $160 billion of their own stock next year, financials will buy $140 billion, and the rest of the S&P 500 will buy $270 billion.

Add Comment