The battle over growth versus value in stocks isn’t over. But investors increasingly have been browsing with their fingertips to learn more about responsible investing themes, according to DataTrek Research.

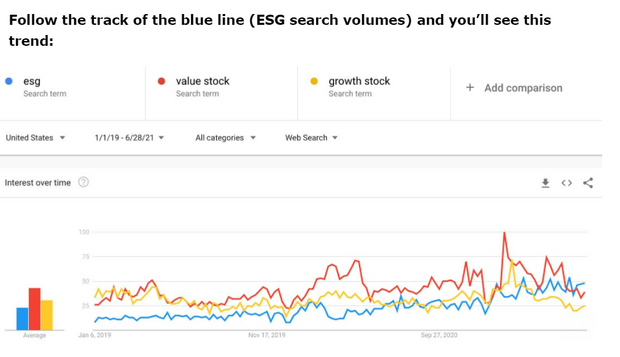

“We’ve reached the point where general investor interest in environmental, social and governance issues is stronger than the old growth/value paradigm,” DataTrek co-founder Nicholas Colas said in a note Tuesday. “‘ESG’ is now a more popular U.S. Google search than ‘value stock’ or ‘growth stock’ and, as this chart back to 2019 shows, that’s a brand-new phenomenon.”

While searches for value and growth stocks were more popular at the start of 2019, “ESG” searches now outnumber those for more traditional investment styles by 1.2 times to 1.9 times, Colas said in the note.

“If your livelihood involves convincing other people to allocate capital for you to manage, then ESG has to be part of your pitch,” he said. “It’s pretty much that simple.”

Investors have been flocking to sustainable funds in the U.S. as performance over the past three years shows they haven’t had to sacrifice returns when buying assets in line with their ESG criteria, Deutsche Bank said in a research report last month.

Companies that score well on ESG metrics tend to have less volatility and “rank better on quality measures” such as return on assets and debt levels relative to earnings, according to a Credit Suisse Group equity research note Monday. While “many assert that ESG’s outperformance, 3.9% annualized over the past five years, is the direct result of this quality tilt,” the bank’s research analysts said that ESG’s excess returns are “far more idiosyncratic.”

In the U.S., the “social” pillar of ESG has been the best performing over the past five years, a separate research note from Credit Suisse last month shows. “Product Liability (quality and safety) is of greatest importance within ‘S’,” the Credit Suisse analysts wrote in the May report. “Social’s leadership accelerated in 2018, with both “E” and “G” lagging since.”

On Tuesday, the S&P 500 Index SPX, +0.03% and the tech-heavy Nasdaq Composite Index COMP, +0.19% swept to another set of records, aided by a return of consumer confidence to pre-pandemic levels.

And for those keeping track, the Russell 1000 Value index RLV, -0.30% fell 0.3% Tuesday, while the Russell 1000 Growth RLG, +0.33% gained 0.3%, according to FactSet data.

Add Comment