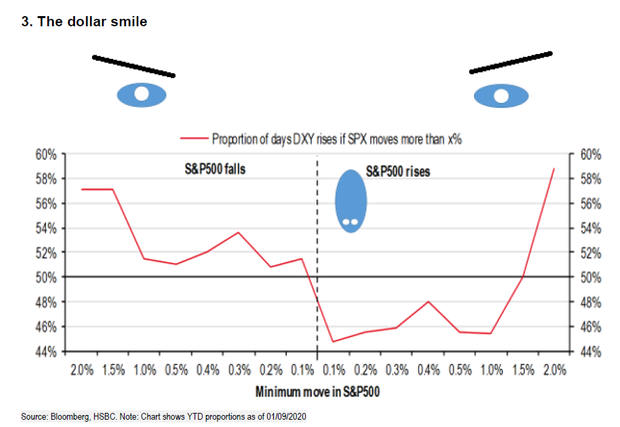

Analysts at HSBC tested what's called the "dollar smile theory" on this year's manic move in markets. What HSBC found was that the dollar rose both on days the S&P 500 fell sharply, and on days it posted big jumps.

Read More...

A happy currency?

federico parra/Agence France-Presse/Getty Images

Analysts at HSBC tested what’s called the “dollar smile theory” on this year’s manic move in markets. What HSBC found was that the dollar rose both on days the S&P 500 fell sharply, and on days it posted big jumps.

“What we do find is the dollar smile is not just a theoretical concept but does indeed work in practice,” said analysts Daragh Maher and Dominic Bunning.

Measured using the DXY DXY, +0.35% dollar index, the analysts said the dollar rose 51% on days when the S&P 500 SPX, -0.81% fell more than 0.5%. The dollar rose 57% on days the S&P 500 fell more than 1.5%.

The dollar is also sensitive to big S&P 500 rallies. The dollar rose 59% of the time when the S&P 500 rose at least 2%.