Against the backdrop of the biggest ground war and humanitarian disaster on European soil since World War II, major U.S. stock markets DJIA, -0.34% SPX, +0.09% COMP, +0.79% were on Friday set for their best weekly returns since November 2020.

Meanwhile, after soaring to more than seven year highs at the start of the Ukraine war, U.S. crude oil CL00, -1.04% and global benchmark Brent BRN00, -0.14% were facing their worst weekly slump since November and August 2021, respectively, amid hopes for negotiations progress between Russia and its smaller neighbor Ukraine.

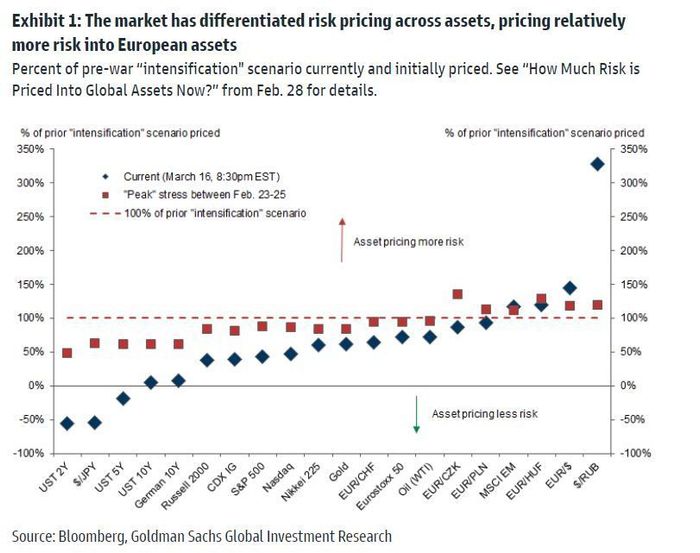

On the surface, the gains in equities and fall in commodity prices might seem unusual given that there is no sign of the Ukraine war ending and according to Goldman Sachs analysts, there are signs investors may have gotten too optimistic.

“This points to a significant relaxation in the market’s assessment of the global implications of the Ukraine invasion,” said strategists Dominic Wilson and Vickie Chang, in a note to clients on Thursday. “While many assets could shift further to our upside case, they are now more vulnerable if progress toward a resolution proves fleeting or if energy supplies are disruptedly more severely.”

Experts are warning of several more weeks or even months of fighting ahead and even the danger that Russian President Vladimir Putin may use tactical nuclear or chemical weapons in frustration at the slowness of his military campaign to oust the government of Ukraine.

“The presence of significant downside tails that are expensive to hedge has made it hard for investors to embrace the value that has emerged in assets at various points in the past few weeks,” said Wilson and Chang. “Volatility is still very high in many asset classes, but so are the potential moves in assets in the tail scenarios.”

With a recent relaxation in pricing, the pair said their own downside case is less reflected across several areas, and potential hedges are clearer than they’ve been for several weeks. Among those that stand out and adjusting for options volatility, oil remains the favored hedge as a recent reversal has appeared to reflect too little risk, while downside for European assets, the euro and bund yields are also showing up as better risk protection.

U.S. equity markets, meanwhile, are showing “less downside skew” than in Europe, with bank stocks on both sides of the Atlantic appearing to have reflected “relatively more downside risk and may still be appealing for those positioning for relief.” EM equities are pricing in a higher chance of bad outcomes, with fresh worries on China growth and regulatory risks also proving a drag.

Economists at Goldman see a worst-case scenario for Europe involving a complete stoppage of Russian gas flow to Europe, knocking 2.5 percentage points off growth for the region, while their base case involves a hit of 1.4 percentage points. For the U.S., a hit of 0.25 percentage points on growth this year is estimated.