With U.S. stocks up around 25% so far this year, it would appear to be have been a tough year for short sellers. But a breakdown of the most shorted large-cap stocks indicates Wall Street’s nabobs of negativity have enjoyed a somewhat more upbeat story.

In a Tuesday note, analysts at Bespoke Investment Group observed that Russell 1000 RUI, +0.17% stocks with more than 20% of their float sold short have seen total returns of 14.81% so far in 2019. That’s a solid gain, though it lags the returns of more than 25% posted by large-cap indexes, including the S&P 500 SPX, +0.06% , over the same time. That means shorts “have done OK on a relative basis,” the analysts wrote.

Compare that with the least-shorted stocks in the index, which are up 31.27% in 2019 to date, the analysts noted, more than double the return of the most heavily shorted stocks.

An investor can bet against a company by borrowing a stock and selling it on the open market, with the intention of buying it back later at a lower price. Heavy short interest is viewed by some investors as a potentially contrarian indicator. Moves to the upside by unpopular stocks can be accelerated when short sellers are forced to scramble and buy the shares to get out of a losing position.

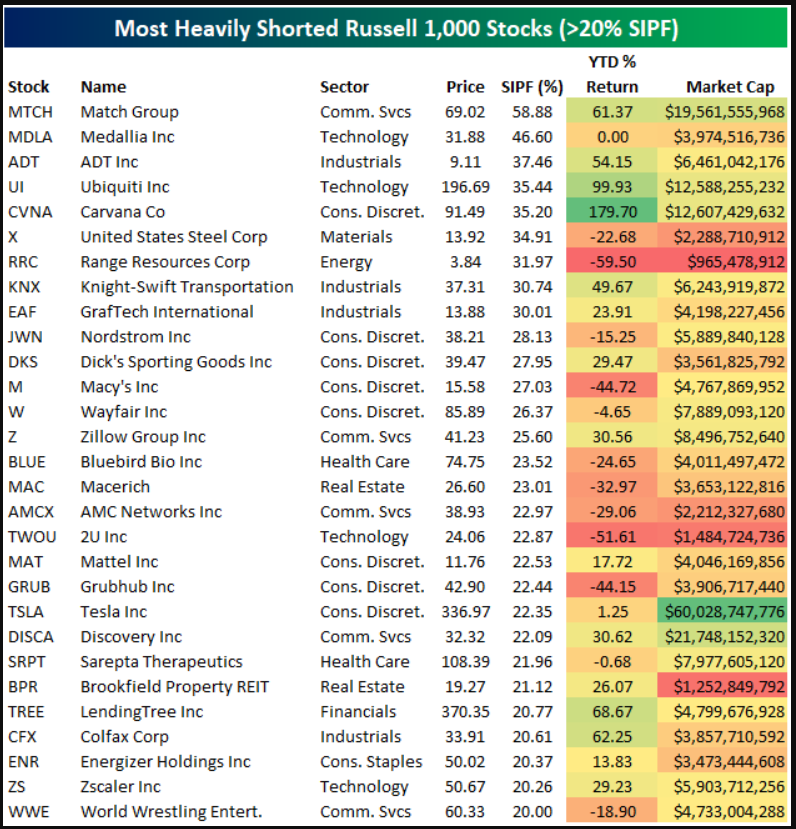

Bespoke lists the most heavily shorted stocks, sorted by percentage of their float sold short, in the table below:

Bespoke Investment Group

Bespoke Investment Group Online-dating company Match Group Inc. MTCH, +0.79% isn’t getting many investor love letters, with nearly 59% of its float sold short, topping the list. Shares have had a bumpy ride lately, declining 4.4% this month and nearly 19% over the last three months, but the stock has still run up a return of more than 60% in 2019.

Overall, 4.9% of the Russell 1000’s float is sold short, the analysts said, with communications services the most heavily shorted sector, at 7.5%. Utilities are the least targeted by short sellers, with 3% of that sector’s float sold short.

Among individual companies, shares of alcoholic-beverage producer Brown-Forman Corp. BF.A, +1.33% are the least shorted stock in the index. Just 0.2% of the company’s float is sold short, Bespoke said. Brown-Forman shares have enjoyed a 36.5% return so far this year.

Other prominent stocks on the least-shorted list include Nike Inc. NKE, +0.31% (0.6% of float sold short), Johnson & Johnson JNJ, -0.59% (0.64%), Philip Morris International Inc. PM, +0.01% (0.66%), PepsiCo Inc. PEP, +1.02% (0.69%), Altria Group Inc. MO, -0.40% (0.7%), Microsoft Corp. MSFT, +0.52% (0.82%) and Amazon.com Inc. AMZN, +0.91% (0.82%).

In an interesting wrinkle, the Bespoke analysts noted that, while tobacco companies like Altria and Philip Morris certainly aren’t popular among market participants focused on ESG investors — funds and individuals limiting their investments to companies that score acceptably on environmental, social and corporate-governance metrics — “their high dividend yields (which shorts have to pay) help keep the shorts away.”