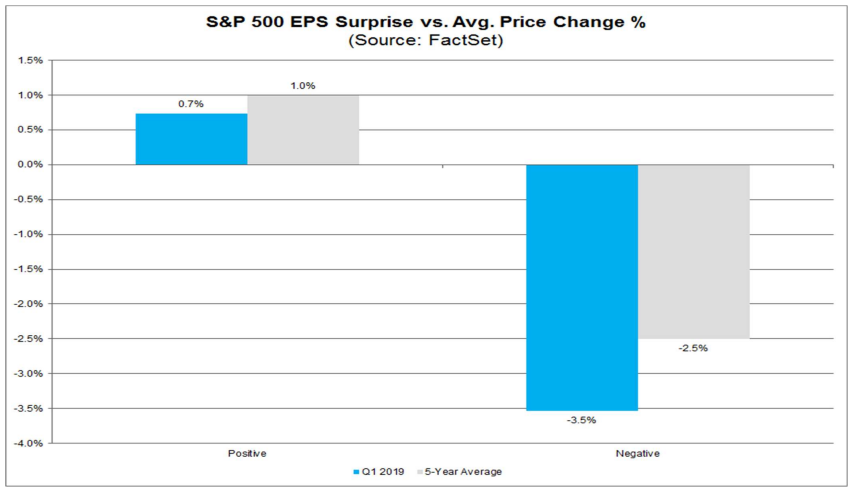

Stock-market investors were in a rare mood during first-quarter earnings season, ready to deliver outsize punishment to shares of companies that disappointed on earnings while providing relatively meager rewards to companies that topped expectations.

FactSet measured share price reaction over a four-day period beginning two days before a company reported results through the two days after. The numbers showed that companies in the S&P SPX, -0.58% that reported negative earnings surprises saw a 3.5% fall, on average, over the four-day period. That compares with a five-year average of a 2.5% fall over the window, said John Butters, senior earnings analyst at FactSet, in a Friday note.

Companies that topped earnings forecasts for the first quarter saw a 0.7% price rise over the four-day window, compared with the 1% gain seen on average over the past five years.

FactSet

FactSet

“Given this market reaction, it is interesting to note that companies and analysts have sent mixed signals to date on earnings expectations for the second quarter,” Butters said.

He noted that 80% of S&P 500 companies have issued negative guidance for the second quarter, compared with the five-year average of 70%. When it comes to revisions of earnings estimates by industry analysts, the 1% aggregate decline in estimated earnings over the first month of the second quarter was smaller than the 5-year (-1.7%), 10-year (-1.5%), and 15-year (-1.8%) average for the first month of a quarter.

While more S&P 500 companies have issued negative guidance for the second quarter than average, Wall Street analysts have made smaller cuts to second-quarter earnings pare share estimates than average, he said.

With 92% of S&P 500 companies having reported results, first-quarter earnings season is largely in the books. Butters said 76% of those companies reported earnings that topped estimates, topping the five-year average of 72%. In aggregate, companies reported earnings 5.4% above estimates, which topped the five-year average of 4.8%.

Meanwhile, 59% of companies reported actual sales above estimates, matching the five-year average, Butters wrote. In aggregate, companies topped sales forecasts by 0.4%, which was below the five-year average of 0.8%.