Stock market bulls have been arguing for months that muted stock market valuations and consistent equity-fund outflows are proof-positive that stock-market investors are not feeling the sort of euphoria that typically exists before the start of an economic recession or bear market.

But a longer-term view of equity valuations and allocations indicates “excessive optimism,” on the part of equity investors, according to Ned Davis, founder of Ned Davis Research.

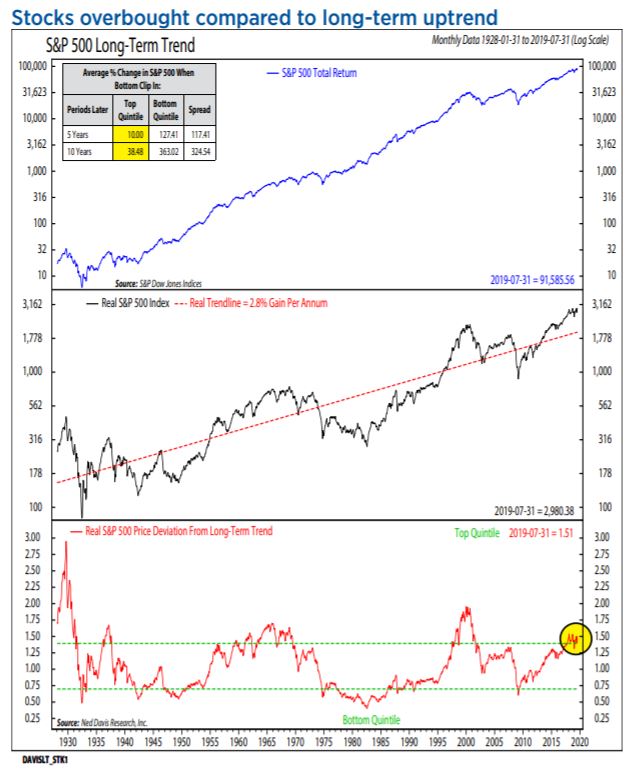

Davis created a linear regression that describes the average growth of the S&P 500 SPX, +1.46% over time, since 1928. Comparing this function against the actual performance of the S&P can be helpful in determining market sentiment (see below).

Ned Davis Research

Ned Davis Research

Davis, in a note, said that the value of the S&P is much higher today than the index’s average growth would predict. In fact, it’s higher relative to the average than it has been 80% of the time.

Davis cautions that this isn’t a foolproof measure of valuation, because stock market trends can change over time, “but one would be hard put to find many charts with a better record of [determining] risk/reward historically than this one.”

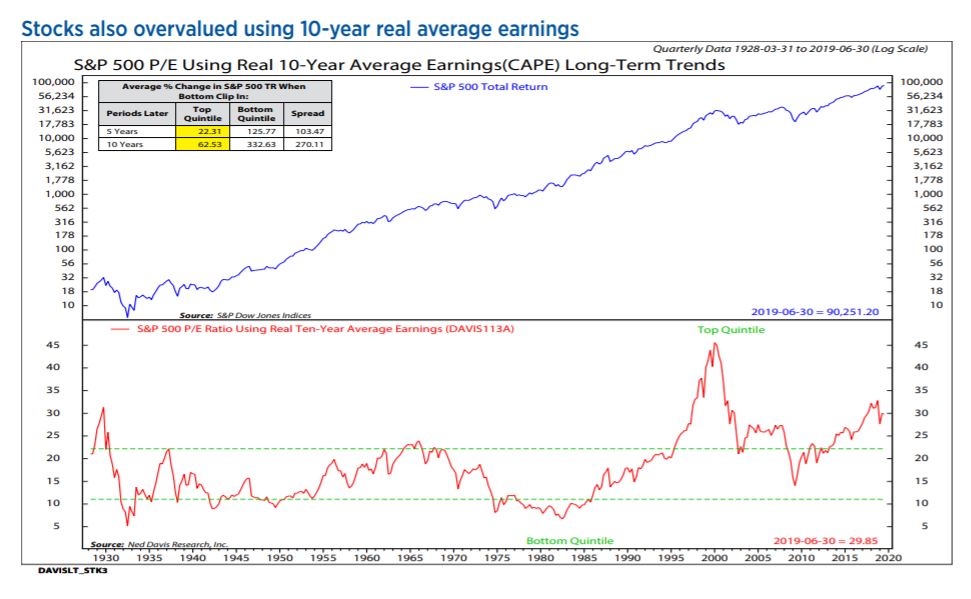

While S&P 500 valuations don’t look very rich by some measures — the index is trading at about 16.3 times forward earnings, below the average valuation during the past five years — they are higher than they’ve been 80% of the time going back to 1928. Stocks are also historically expensive relative to overall corporate profits, revenue and book value, Davis said.

Ned Davis Research

Ned Davis Research

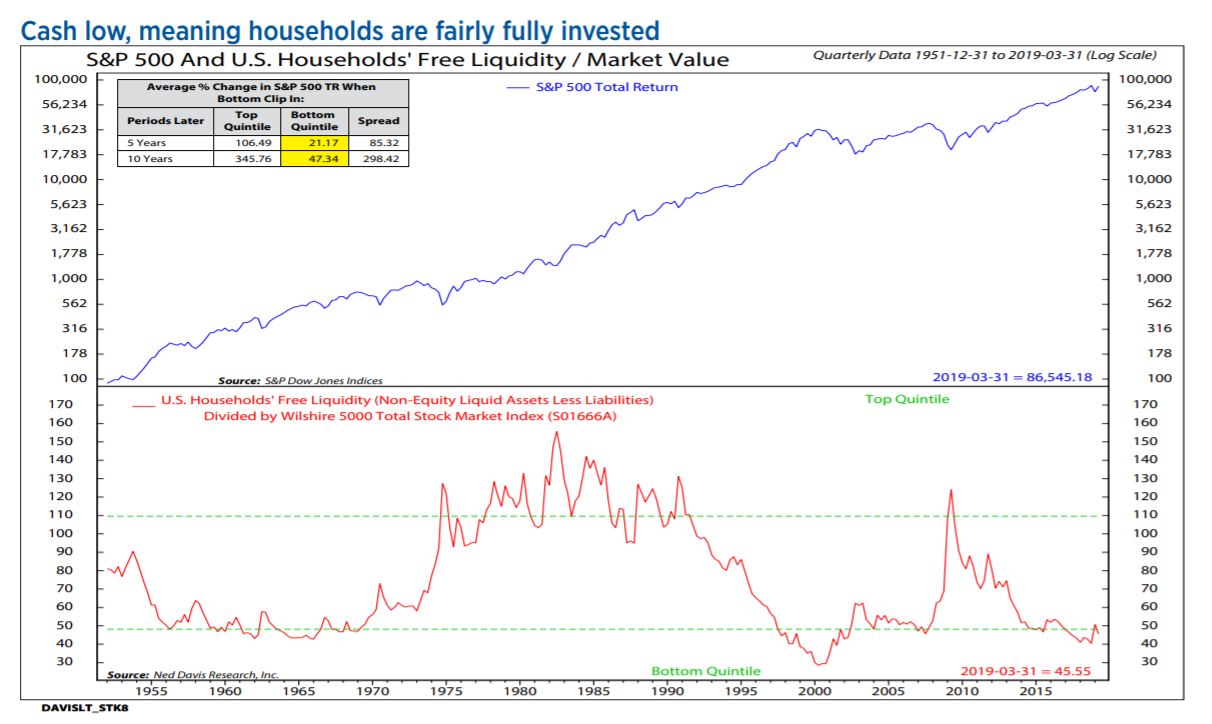

Another common refrain that bulls have repeated this year is that consistent equity-fund outflows throughout the year indicate that the average investor hadn’t participated in the market’s double-digit rally this year — the S&P 500 is up nearly 17% year-to-date, while the Dow Jones Industrial DJIA, +1.41% has gained 13% — and that when they decide to put that money to work, the market will march toward new highs. But analysts have pointed out that despite outflows, investors remain more invested in riskier assets than has historically been the case.

Meanwhile, household cash levels are also at historic lows.

Ned Davis Research

Ned Davis Research

“Cash is low,” Davis wrote. “Meaning households are fairly fully invested.”