The stock market has gotten off to a brutal start this month, with the S&P 500 SPX, -0.66% index down about 5% since it started unraveling last Thursday.

But while investors caught wrong-footed on the nasty pullback were busy licking their wounds, Crescat Capital founder Kevin Smith was happily crafting an update on his fund performance. Can’t really blame him, considering his Global Macro fund rallied almost 16% in a matter of days.

“Asset bubbles lead to busts that turn into economic recessions,” he wrote in his latest update. “In the last two decades, investors should have learned this lesson after the tech and housing busts, but people have short memories.”

With that in mind, Smith says that all three legs of his “macro trade of the century” are performing “remarkably well” during this rough stretch, and he’s confident more gains are on the way. The recipe: Long precious metals — gold GC.1, +0.06% , silver SI.1, +0.67% and related mining stocks — short Chinese yuan CNYUSD, +0.0001% and short equities.

“We believe this macro trade is only in its early stages,” Smith said. “It represents about 80% of the underlying exposure in our flagship global macro hedge fund. Our Chinese currency short exposure in that fund includes puts on the yuan as well as the Hong Kong dollar. We are seeking alpha above these macro benchmarks through individual security selection based on our equity models.”

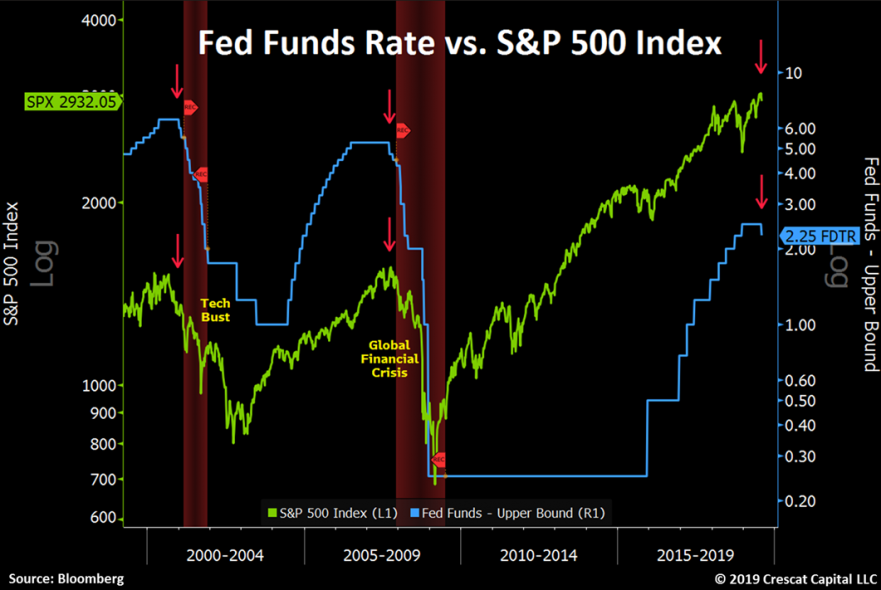

He used this chart to show what happened previously when the Federal Reserve cut interest rates after a period of tightening:

“Such a move, pressured by the bond market, is anything but bullish, and it’s certainly not acting like the ‘insurance cut’ advertised by Chairman Powell,” Smith said. “Instead, it’s a sign that our central bank is literally behind the curve. More ominously, it’s an indication that asset bubbles are poised to burst, just like the Fed’s first interest rate cut warned us directly ahead of both the tech bust and global financial crisis.”

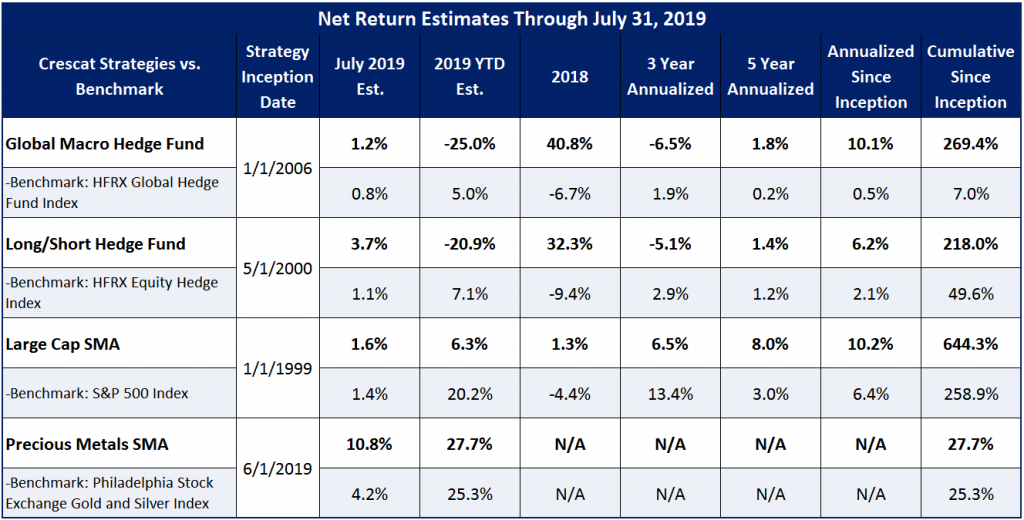

Crescat is coming off a year of fantastic performance, having turned in a 41% return for its flagship fund in 2018, which was good enough to make it one of the firm’s two entries on Bloomberg’s list of top performers.

But, August aside, it’s been a rocky 2019 for Crescat, which saw its main fund lose 25% through the end of July. Here’s the full performance table:

“We believe the smart money has already been selling stocks for a while now. It’s the big dumb money that we need to worry about as it inevitably tries to crowd out of its over-weighted, illiquid, long-term, bubble-priced investments into a liquidity vacuum,” Smith wrote. “Such is how markets crash and why we want to be fully positioned ahead of the crowd.”

The fund is likely enjoying another strong session on Wednesday, with the Dow DJIA, -0.34% down almost 400 points at last check.