Last week, Yin Luo warned money managers were vulnerable to a temporary but violent rotation from popular growth stocks to beaten-down value shares.

On Monday, Luo was answering calls until midnight from clients in the U.S., Australia, and Singapore on the very scenario he described, following Pfizer and BioNTech’s announcement that its COVID-19 vaccine candidate was more effective than many had anticipated.

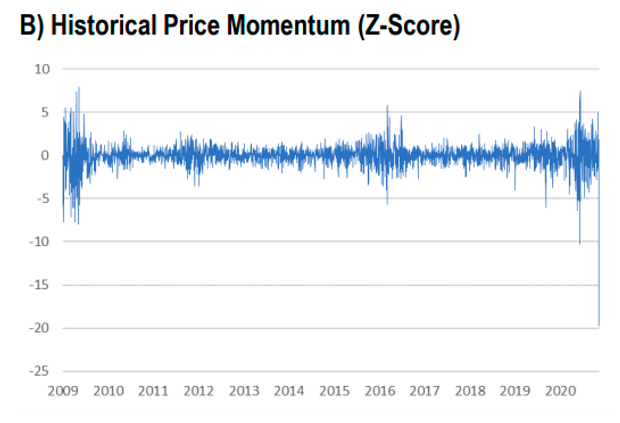

The news triggered sharp drawdowns in growth stocks to the benefit of value shares. Among the casualties, the selloff in “hot streak” momentum stocks, shares that have experienced sustained gains in their recent past usually based on earnings or revenue performance, was the worst ever, Luo, a quant strategist and vice chairman of Wolfe Research, told MarketWatch.

A former head quantitative analyst at Deutsche Bank, Luo had seen his fair share of market reversals, including the ‘quant quake’ of 2007, but even for him, the magnitude of Monday’s moves were astounding.

“We had to double check, and triple check the numbers,” he said.

By his analysts’ calculations, the decline in momentum stocks on Monday represented a near-20 standard deviation decline. In other words, the selloff was statistically “unprecedented.”

The broader market indexes saw more muted moves. That day, the S&P 500 SPX, +0.50% rose 1.2%, the Dow Jones Industrial Average DJIA, -0.31% surged 3%, and the Nasdaq Composite COMP, +1.70% tumbled 1.5%.

See: What is factor investing?

Opinion: Momentum is becoming a less-profitable strategy in the stock market

Investors who buy momentum shares are, in effect, betting that if they’ve already gained in price, they were likely to see further gains.

Like value and growth, momentum is a equity style factor that looks to strip out the essential qualities of stocks like book value, earnings-per-share, or rising market share, and focus on share price trends.

The sheer violence of Monday’s moves, said Luo, was a reflection of how the extreme bullish positioning around growth stocks and, therefore the muted appetite for value shares was vulnerable to reversal when investor sentiment shifted.

He said the good news was many money managers and hedge funds may have largely avoided the meltdown of momentum stocks, if only because they had been scalded by similar drawdowns in momentum shares that have increased in frequency since last September.

But the bad news was similar selloffs in momentum and growth stocks could still erupt as such rotations tended to have a knack of being “self-fulfilling prophecies,” with investors nursing losses forced to cut down the size of their bets, sparking further declines.

This was not the same as saying value would see a resurgence in Wall Street, said Luo, who had yet to see clear signs of a “regime shift.”

He, however, did warn the sudden bouts of intense volatility in the performance of equity style factors were likely to recur unless uncertainty around the U.S. economy dissipated entirely, perhaps driven by confirmation that the logistics of distributing and storing a COVID-19 vaccine were possible.

Though Pfizer’s announcement was promising, there still remained too many open questions on progress towards a viable vaccine, he said.

Stock-market quants had complained to him last year that market turbulence was limited, diminishing opportunities to take advantage of volatility. He expected these investors would be regretting their words.

“You have to be careful what you wish for,” said Luo.

Add Comment