There’s never been a worse time in history to be a value investor.

That’s according to an analysis by J.P. Morgan’s chief U.S. equity strategist, Dubravko Lakos-Bujas, who wrote in a Thursday note to clients that “value is currently trading at the biggest discount ever, and offers the largest premium over the last 30 years.”

Value investing is a strategy whereby investors look for stocks that are underpriced relative to a fundamental analysis of the companies worth, and one that was made famous by Berkshire Hathaway chief executive Warren Buffett.

While value investing helped make Buffett the third richest man in the world, it’s been a losing strategy since the financial crisis, when stock markets have been driven more by macroeconomic events than company fundamentals, and dominated by fast-growing, technologically innovative companies like Netflix Inc. NFLX, +1.05% and Amazon.com Inc. AMZN, +2.83% with sky-high valuations that value investors typically avoid.

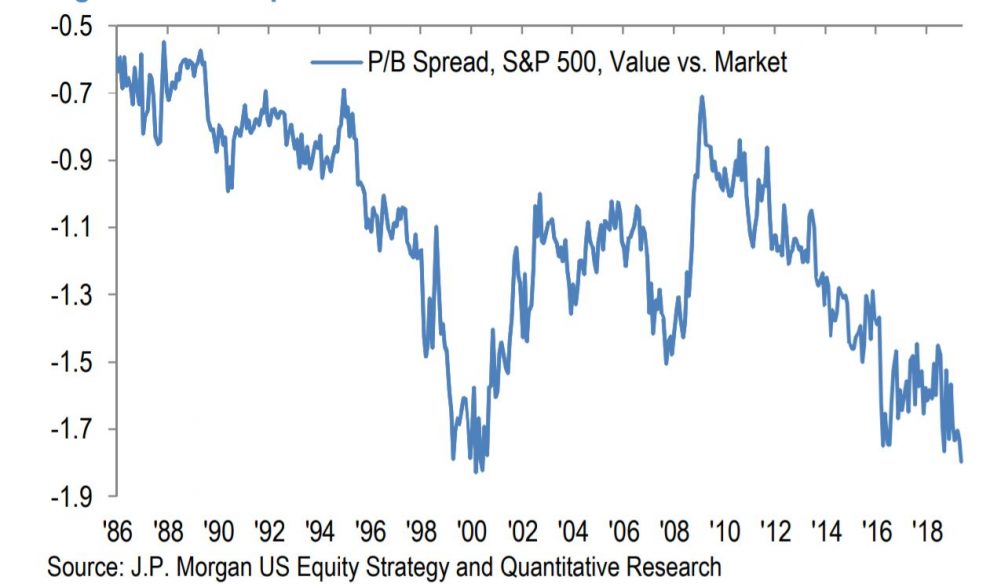

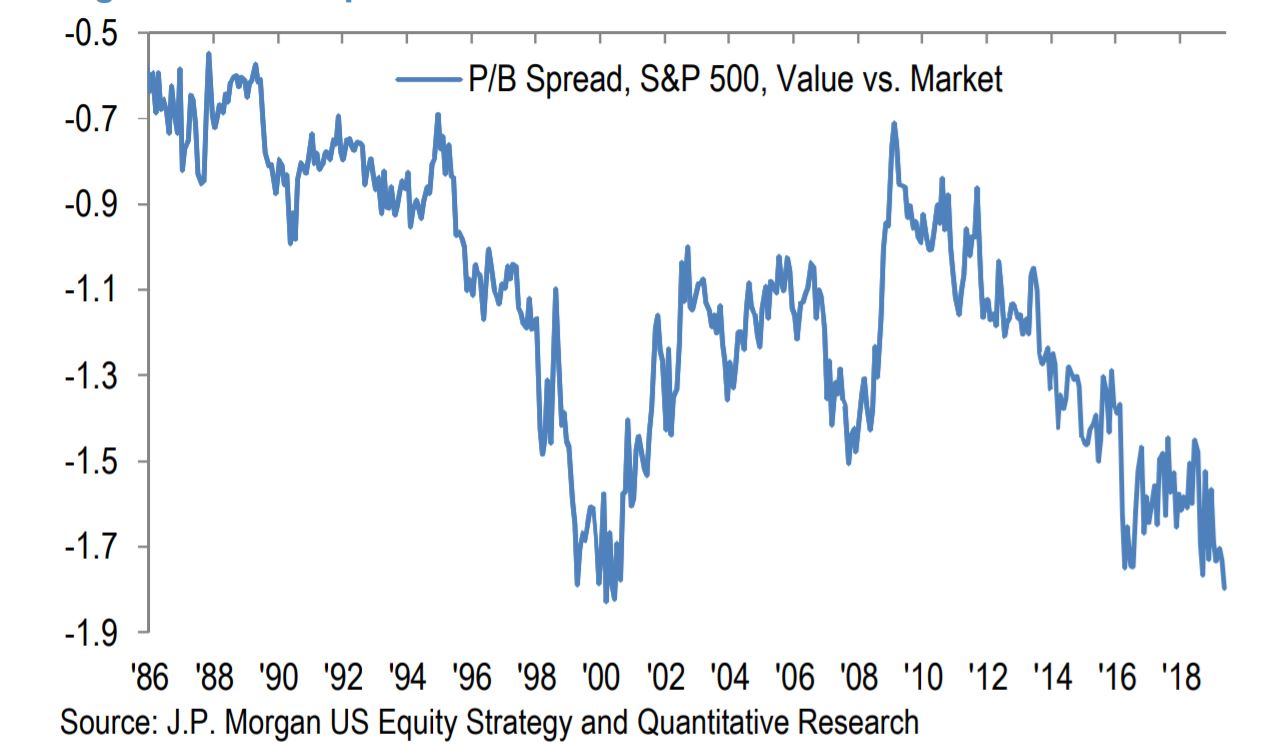

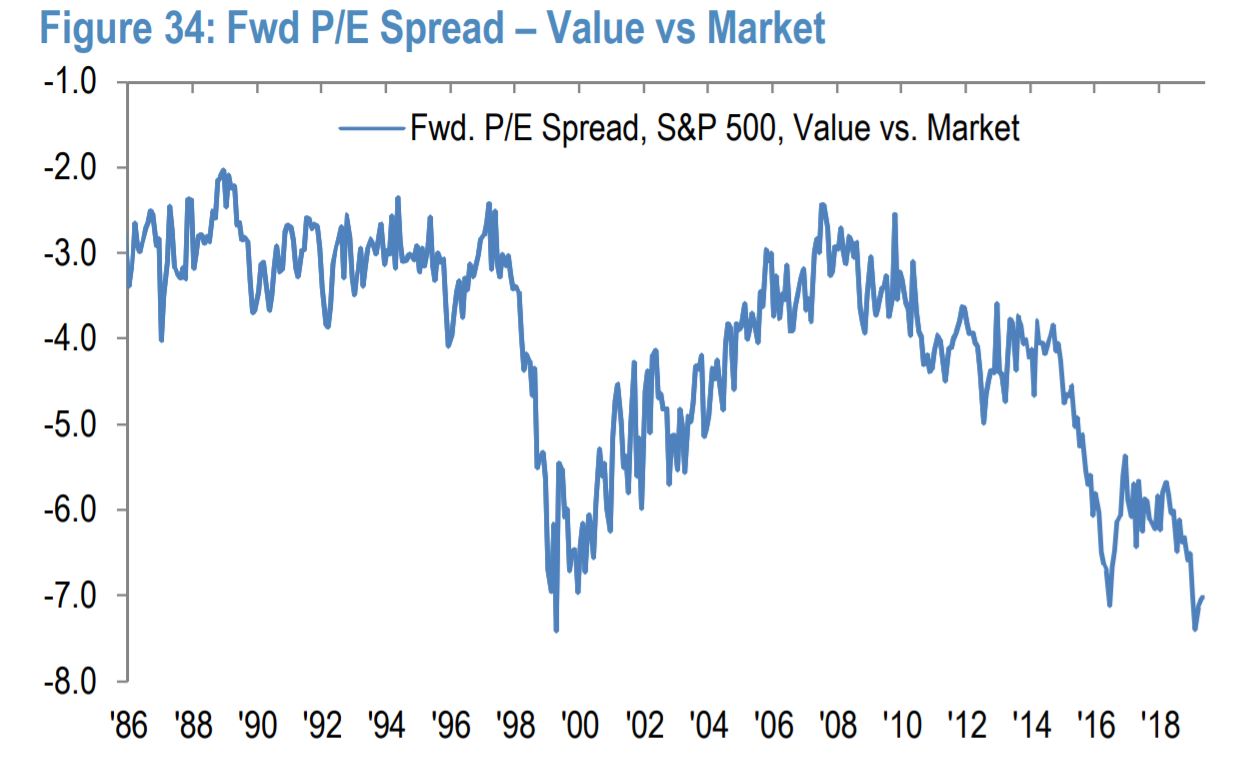

After a decade when such growth stocks have outperformed their cheaper rivals, the median forward price-to-earnings ratio of the cheapest portfolio of S&P 500 SPX, +1.05% stocks is now trading at 7 times less than the broader to the S&P 500. “Similarly the relative price-to-book spread of the cheapest vs. the most expensive portfolio is at 9 times,” Lakos-Bujas wrote. A price-to-book ratio is a comparison of a company’s market capitalization to its net assets.

J.P. Morgan

J.P. Morgan

J.P. Morgan

J.P. Morgan

The discrepancy between performance of growth stocks and value stocks has grown so much that even Buffett’s Berkshire Hathaway has been buying up shares of Amazon, a quintessential growth stock, while Buffett regrets not having bought shares himself sooner.

Value has made a bit of a comeback this week, however, with the Vanguard Value ETF rising VTV, +0.50% 4.2%, versus a 2.6% rise for the Vanguard Growth ETF VUG, +1.49% .

Lakos-Bujas argued, however, that this bounce will be short lived, due to structural factors, like the rise of disruptive technologies that have given many growth companies near-monopoly power in their markets, the rise of passive index investing, weak global growth and easy access to cheap capital globally.

“For Value to make a sustained comeback,” he wrote, “the following developments are likely needed”

- regulations that foster competition;

- a stabilization of active manager’s assets under management, relative to passive investing;

- less policy uncertainty;

- Either a reaccelerating of global growth, or a full-blow recession that forces a repricing of growth stocks.