Crude-oil prices for May carved out a dubious place in history on Monday, plunging the most on record and notching the first settlement ever in negative territory.

The unprecedented move in the oil contract now has investors wondering if one or more big energy players, or speculators, has been left holding on to sizable losses as the May West Texas Intermediate crude contract CL.1, +103.77% CLK20, +103.77% closed Monday trade at negative-$37.63 a barrel, marking an eye-popping one-day drop of $55.90, or 306%, according to Dow Jones Market Data.

“The size of the move in May WTI implies one of two things: either forced PnL pain, or a massively negative forecast about the outlook for crude inventories,” wrote researchers at Bespoke Investment Group in a Monday research note, referring to financial statements that would show an investor’s profit and losses during a given period.

On Monday, traders with long positions scrambled to get out amid a fear that it would be difficult to find a place to park physical oil amid a rising glut of crude.

Deep Dive:These U.S. oil companies are most at risk in the danger zone

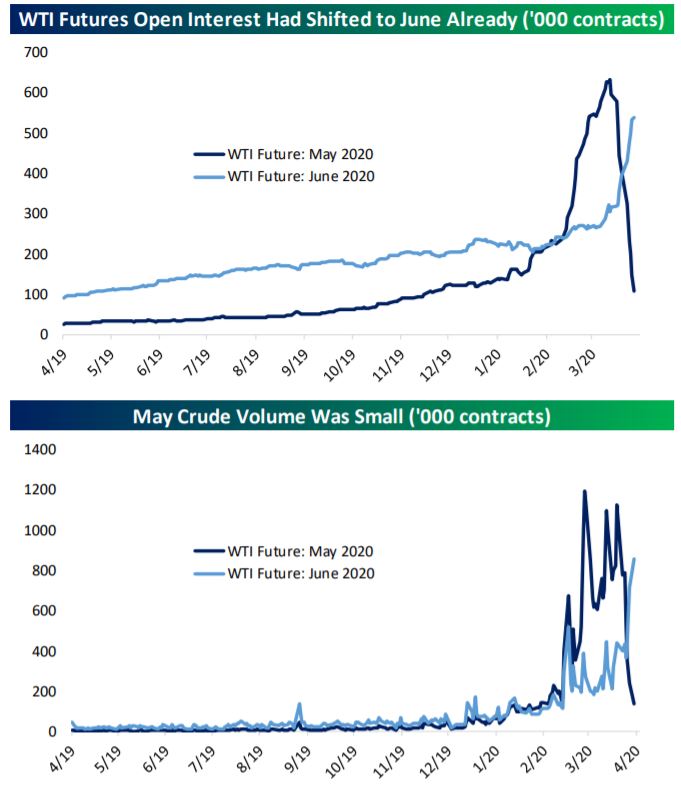

Idiosyncrasies in the price of the May contract, which expires at the end of trade on Tuesday, should come as no surprise because contracts that are about to roll off, or expire, tend to converge toward the prices for contracts for future months and therefore see volatile action near their expiration.

Read:Why oil prices just crashed into negative territory — 4 things investors need to know

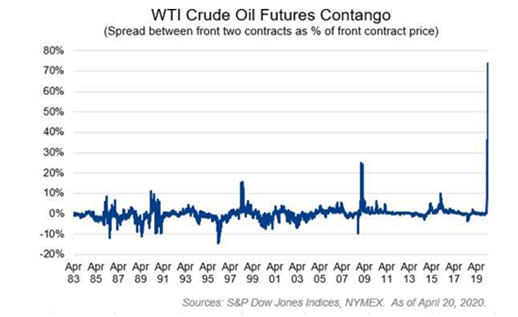

However, the yawning chasm between the May contract and those for future months this time around, due to rapidly decreasing places to store oil, resulting in a historic premium between the front-month contract and oil across coming months, amplified moves on Monday in the WTI contract for May delivery.

Some Investors speculated that the rapid descent in the final hour of trade may have been the result of a trader unwinding their May contract and rapidly rolling into the June contract CLM20, +4.89%, which finished Monday down a comparatively sedate $4.60, or 18%, to settle at $20.43 a barrel.

However, given that the decline was so close to the expiration for May contract, most of the pain — or benefits in the case of a short investor — was likely felt by a small number of speculative investors rather than a big player, experts estimate.

Bespoke put it this way: “We can’t be sure how much damage the >$40 slide in WTI did to leveraged players in the spot (physical) oil markets, but we can say with confidence that today’s price declines in June contracts (down 17.4%) caused more aggregate [profit-and-loss] pain than the May collapse into negative territory.”

Indeed, trading volumes for the May contract were relatively muted compared against the most-active June contract, based on volume, the number of contracts that changed hands and open interest, which reflects the number of active contracts.

Bespoke analysts said that more subdued action in Brent, the international benchmark for oil, suggests that the price tumble for WTI wasn’t indicative of a big portfolio being forced to liquidate a position. Brent crude for June delivery BRNM20, -0.70% finished down $2.51, or 8.94%, at $25.57 a barrel on Monday.

It is important to note that Brent, which originates from oil fields in the North Sea between the Shetland Islands and Norway, tends to be seaborne and is therefore less vulnerable, but not immune, to storage issues, which have punished landlocked WTI, because the international grade tends to be transported via pipelines.

Meanwhile, stockpiles of WTI at a key U.S. hub in Cushing, Okla., are up by nearly 50% at 55 million barrels, compared with terminal capacity at the hub of 76 million as of Sept. 30, according to data from the U.S. Energy Information Administration.

However, even though the damage to price isn’t likely the function of a “hedge-fund blowup,” and the June contracts are in comparatively good shape, the alternative reason for Monday’s oil collapse may be even less appetizing, as it suggests an oil market that may be unraveling.

“That’s why pointing to more measured declines in out-month futures is whistling past the graveyard; it doesn’t change the message from the overall crude market that the industry is breaking,” Bespoke analysts wrote.

However, Reuters on Monday reported that hedge funds were net purchasers of oil futures and options for the week ended April 14, marking the third straight week of bullish purchases for funds.

The news outlet wrote that purchases by hedge funds over the past three-week period have totaled 83 million barrels, as portfolio managers sold 688 million barrels over the previous 11 weeks.

Meanwhile, some investors going short — or betting that prices of crude would crater, even after a punishing March — could have profited from Monday’s decline.

Last month, London-based hedge funds, including Pierre Andurand, who runs the world’s largest oil fund, Andurand Capital, registered big gains as oil tumbled in March, according to a report by the Financial Times. Andurand Capital was up more than 50% as of mid-March after a bad start to the year, according to the FT.

Andurand via Twitter a month ago speculated that the coronavirus could deliver an 8-million-barrel-a-day hit to global demand in the second quarter of 2020, due to the pandemic’s impact on businesses and the economic slowdown wrought by the deadly contagion.

Add Comment