The chief executives of Exxon Mobil Corp. and Chevron Corp. spoke last year about combining the oil giants, according to people familiar with the talks, testing the waters for what could be one of the largest corporate mergers ever.

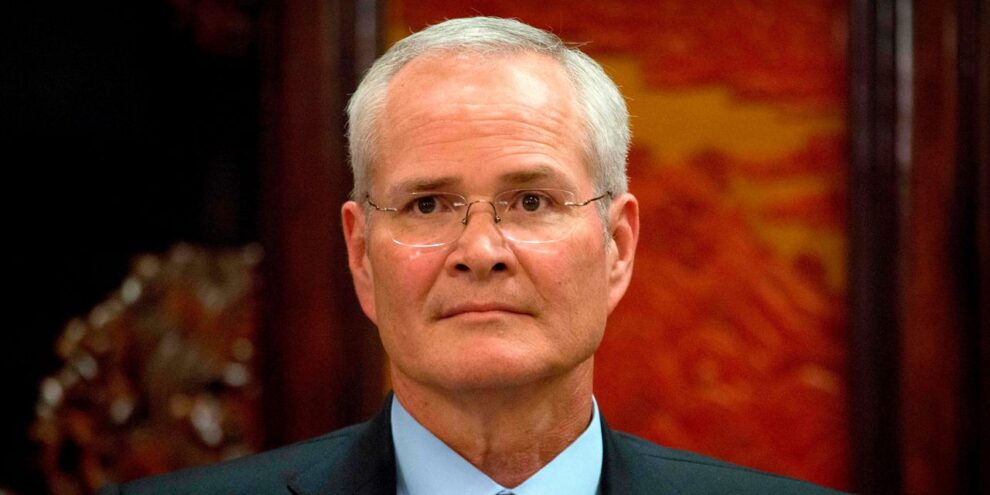

Chevron CVX, -4.29% Chief Executive Mike Wirth and Exxon XOM, -2.65% CEO Darren Woods spoke shortly after the coronavirus pandemic took hold, decimating oil and gas demand and putting enormous financial strain on both companies, the people said. The discussions were described as preliminary and aren’t ongoing but could come back in the future, the people said.

Such a deal would reunite the two largest descendants of John D. Rockefeller’s Standard Oil monopoly, which was broken up by U.S. regulators in 1911, and reshape the oil industry.

A combined company’s market value could top $350 billion. Exxon has a market value of $190 billion, while Chevron’s is $164 billion. Together, they would likely form the world’s second largest oil company by market capitalization and production, producing about 7 million barrels of oil and gas a day, based on pre-pandemic levels, second only in both measures to Saudi Aramco.

An expanded version of this report appears on WSJ.com.

Also popular on WSJ.com:

Jan. 6 rally funded by top Trump donor, helped by Alex Jones, organizers say.

Melvin Capital lost 53% in January, hurt by GameStop and other bets.

Add Comment