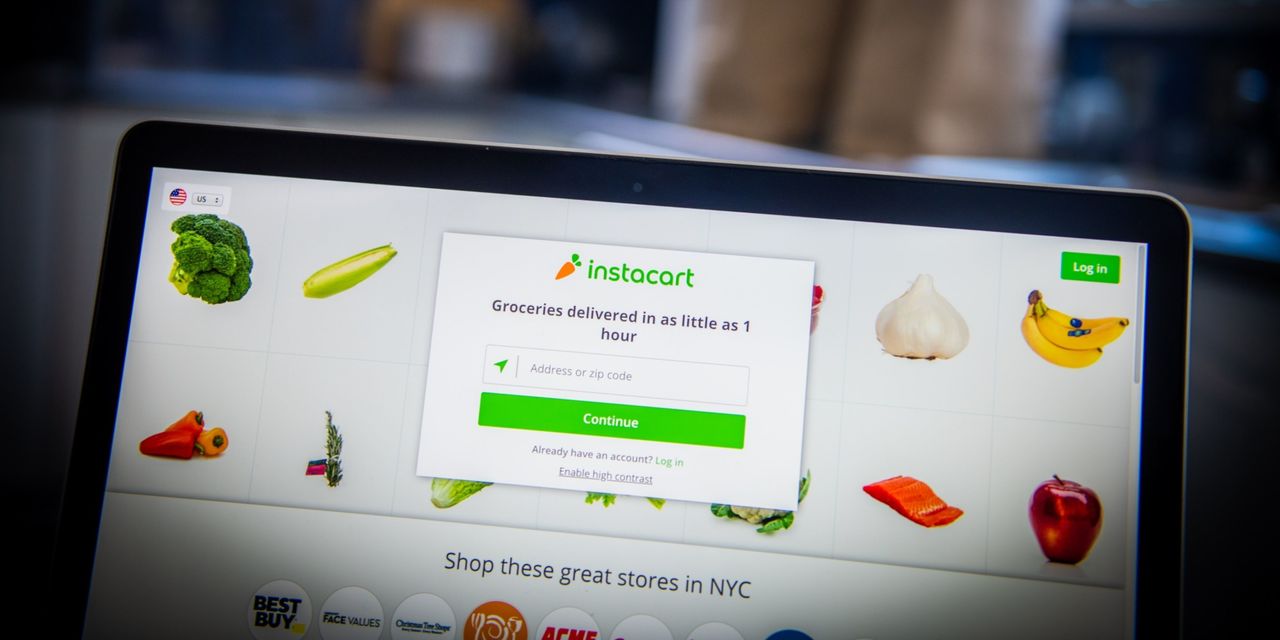

Instacart Inc. expects to go public before year’s end, according to people familiar with the matter, earlier than many on Wall Street had expected amid a frozen market for new listings.

An initial public offering this year would be a bold move in one of the slowest years for IPOs in more than a decade. Many bankers advising companies on going public have said they don’t expect large, unprofitable firms to launch IPOs until volatility subsides and other recent IPO stocks recover.

Instacart confidentially filed for an initial public offering with the Securities and Exchange Commission earlier this year during a broad stock-market selloff, and markets have remained volatile since. Instacart is in the process of responding to comments from the SEC on its IPO documents, some of the people said.

Instacart was profitable for the second quarter of this year under generally accepted accounting principles, according to a person familiar with the matter.

Instacart’s bankers have also started to approach investors for so-called testing-the-waters meetings, some of the people said. Such meetings allow investors to get to know the company’s management team better and allow the company to gauge the appetite for its stock.

An expanded version of this story appears on WSJ.com.

Popular stories from WSJ.com: