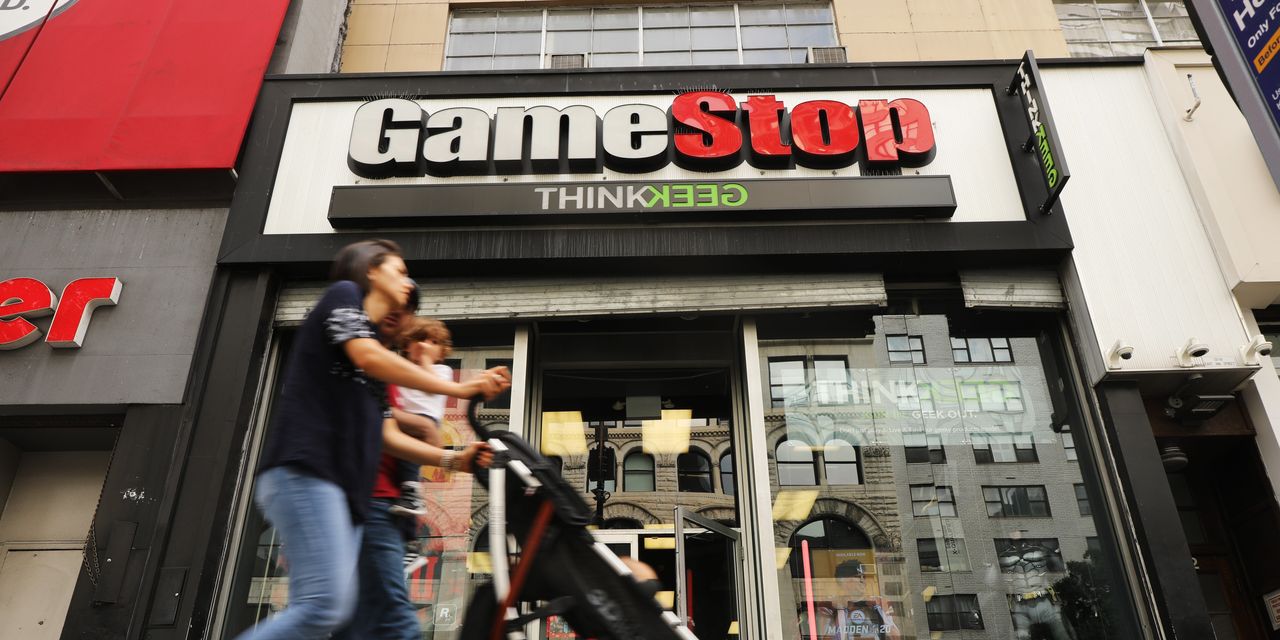

Richard Mashaal and Brian Gonick started buying GameStop Corp. shares in September.

They aren’t Reddit day traders or Discord users. They are hedge-fund managers in New York. And when the stock surged from less than $10 a share to above $400 and the dust had settled, they were sitting on a profit of nearly $700 million, one of the great fortunes of the January market mania.

The GameStop GME, +2.68% surge is often cast as a triumph of amateurs over professionals. Which it was, to a degree. But it also was a trade that pitted professionals against other professionals — and few have made more money than Senvest Management LLC, Mashaal’s and Gonick’s firm.

“When it started its march, we thought, something’s percolating here,” said Mashaal, 55. “But we had no idea how crazy this thing was going to get.”

Senvest’s interest in the videogame retailer was piqued by a presentation from the new GameStop chief executive at a consumer investment conference last January.

GameStop is now Senvest’s most profitable investment by dollars earned and by its internal rate of return — a performance metric that takes into account the length of an investment. It has propelled the firm’s flagship stock-picking fund from running $1.6 billion at the end of 2020 to $2.4 billion. For the month of January, the fund returned 38.4% after fees.

An expanded version of this report appears om WSJ.com.

Also popular on WSJ.com:

Biden wants a $15 minimum wage. Here’s what people say it would do to the economy.

For one GameStop trader, the wild ride was almost as good as the enormous payoff.

Add Comment