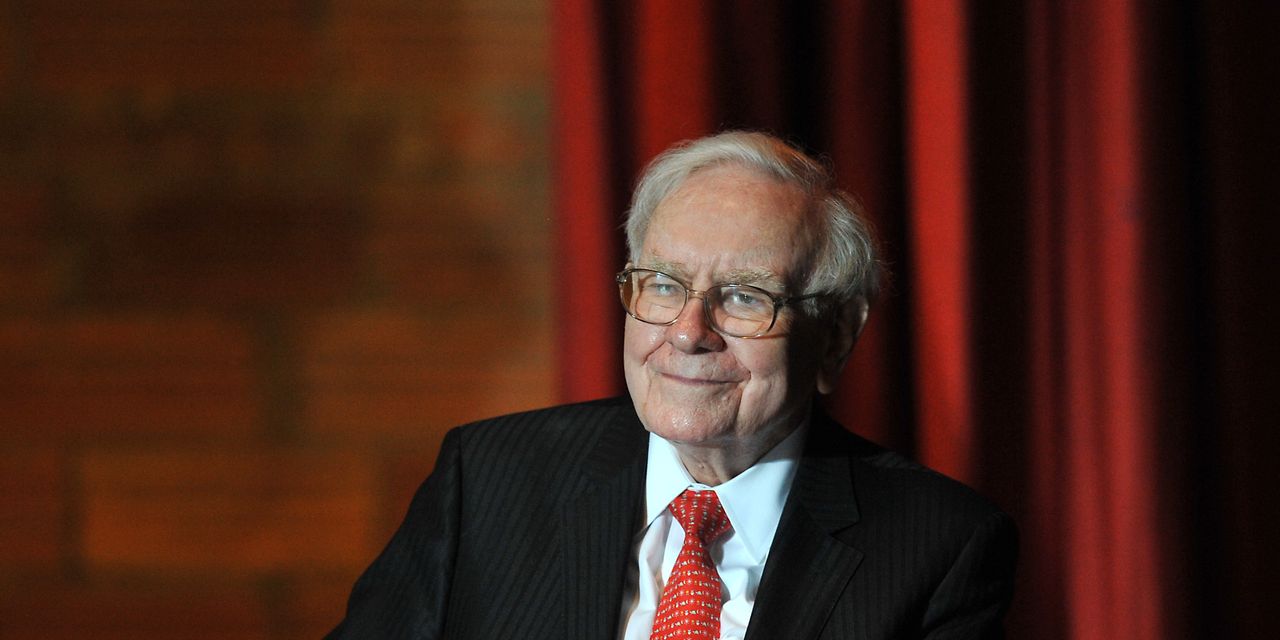

Berkshire Hathaway Inc. Chairman and Chief Executive Warren Buffett on Saturday defended the company’s investments over the past year as the coronavirus pandemic initially drove a plummet in stocks, before the market turned around and surged to record highs.

A year ago, as the pandemic took hold, Buffett sold all of his holdings in major airlines. He also lowered his stakes in several banking firms and didn’t make any large acquisitions even as markets were falling sharply. Since then, the airline industry has been one of the largest to bounce back and the broader market has surged. Shareholders have questioned whether Buffett was active enough during a potentially opportunistic time.

“I don’t consider it a great moment in Berkshire’s history but we have more net worth than any company on Earth,” he said. “And I still don’t want to own the airline business.”

Buffett said the decision to cut back on airlines reflects a broader belief about the future of the industry, particularly when it comes to what is likely to happen to business travel.

Buffett also addressed several other questions Saturday, including the decision to hold the meeting in Los Angeles and commented on the company’s quarterly earnings.

As the 90-year-old Buffett and his 97-year-old business partner Charlie Munger advance in age, succession has become a more important topic for shareholders. Some investors have asked to hear more from Buffett’s potential successors and vice chairmen Ajit Jain and Greg Abel, who respectively oversee the firm’s insurance business and operations. Both men joined Buffett and Munger in Los Angeles.

With millions of Americans unemployed, Buffett spent much of the 2020 meeting emphasizing the economy’s ability to bounce back from adversity. A year later, Buffett is speaking as the U.S. economy has broadly improved and 30% of Americans are fully vaccinated against the coronavirus.

Still, Berkshire BRK.B, -0.95% faces some heightened pressure this year. Some of its shareholders want the conglomerate to bring in new directors and disclose more information on climate risks and executive pay. The company’s returns have trailed the S&P 500 for the past five-year period.

Berkshire’s Class A BRK.A, -1.29% s hares closed Friday at $412,500, a decline of 1.3%.