Although these companies’ upside may not be as high as Nvidia’s, they could present a less stressful path for investors.

There isn’t a stock on the market that has been talked about more in the past two years than Nvidia (NVDA -4.08%). The rise of artificial intelligence (AI) has made Nvidia’s graphics processing units (GPUs) one of the most sought-after products because of their role in training AI.

It has also made Nvidia one of the hottest stocks on the market. From September 2022 to the start of September 2024, its stock rose over 750% — 18 times more than the S&P 500‘s gains over that span. That’s not an easy feat for a company whose market cap was around $300 million at the time.

Nvidia has also posted financial results to back this hype, increasing revenue and operating income by 122% and 174%, respectively. The praise is well deserved. That said, there are two companies that I’d be more likely to invest in at this point because there seems to be more long-term certainty around their businesses.

1. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Company (TSM -4.20%) (TSMC) is one of the world’s most-important tech companies despite not being a household name like some other big tech companies. It operates the world’s largest semiconductor (chip) foundry, manufacturing chips for companies’ specific needs.

Companies come to TSMC with a chip design, and it produces the chip according to the company’s request. It may seem simple enough, but manufacturing chips with that level of precision and at that scale requires complex processes (putting it lightly) and advanced technology that no other company has been able to match.

One company that relies heavily on TSMC is Nvidia. TSMC manufactures Nvidia’s chips for its GPUs, data-center processors, and other AI-related chips. Without TSMC’s manufacturing capabilities, there’s a strong case that Nvidia’s products would take a quality hit. That’s largely why Nvidia hasn’t embraced other chip manufacturers and is comfortable relying on TSMC.

Nvidia’s dependence on TSMC is why I prefer it at this stage. Much of Nvidia’s high valuation is built on expectations of what it should become, and its ability to deliver on that will depend on TSMC’s production capacity. The ceiling may not be nearly as high for TSMC, but its trajectory is seemingly more reliable.

TSMC also has an attractive dividend that reduces some of the investing risk. Its dividend yield is currently above the S&P 500’s average, making it easier for investors to remain patient during rocky times and trust its long-term potential.

2. Apple

Apple (AAPL -0.70%) didn’t reach the point of being the world’s most valuable public company by mistake; it has taken decades of non-complacency and disciplined execution. With Apple’s track record of discipline, it was puzzling why so many Wall Street investors were seemingly shocked as Apple remained relatively quiet during recent AI mania.

Apple has a history of letting other companies create something and then venturing into that area with a much better design and making it more user friendly. We’ve seen it with smartphones (iPhone), tablets (iPad), smartwatches (Apple Watch), virtual reality (Apple Vision Pro), and handfuls of other tech hardware.

Of course, Apple isn’t just going around copying others; rather, the tech giant does a great job of letting others be the guinea pigs and then learning perhaps from their missteps before releasing its own products and services to the market. That seems to be the same approach it’s taking with AI, too.

Apple hasn’t rushed into AI like most other big tech companies. In fact, it doesn’t even refer to its coming AI capabilities as “artificial intelligence”; it’s “Apple Intelligence.” (It’s just clever enough to work.) Nvidia is in a volatile position; just as fast as it rose, it can fall if it fails to meet expectations. Apple doesn’t quite have that same risk, though it’s not exempt from volatility.

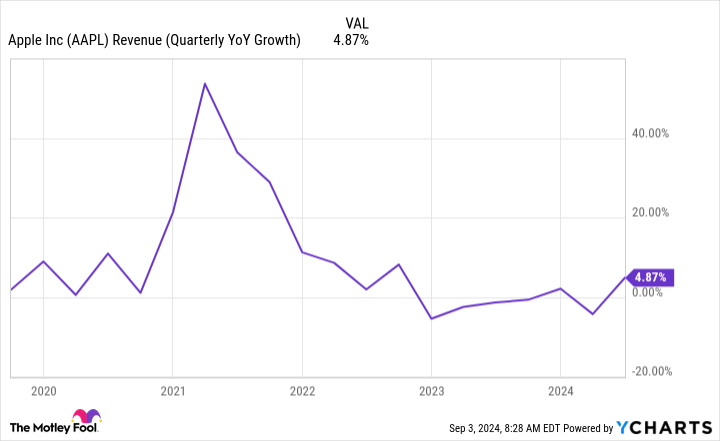

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Ideally, Apple Intelligence will give Apple an immediate financial boost, with consumers rushing to buy its next-gen products since it’ll only be accessible on newer hardware models. After a slump in Apple’s smartphone market over the past few years, I’m sure the company wouldn’t mind an extra lift from somewhere.

Short-term boost aside, there aren’t too many companies I trust more long term than Apple. The upside always seems to outweigh the potential downside.

Stefon Walters has positions in Apple. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.