Exciting shifts are happening among AI companies. See why a couple of top-notch AI stocks are must-buy investment opportunities right now.

Artificial intelligence (AI) stocks were on a roll for a while, but they have run into some skeptical market makers lately. As a result, some top-notch AI experts are on fire sale right now, and I expect them to come back strong in the long run.

Read on to see why semiconductor company Intel (INTC 4.08%) and voice-recognition expert SoundHound AI (SOUN 0.87%) look like no-brainer buys right now.

Intel’s several key roles in AI

You would think Intel would be a market darling right now, but it’s not.

- Its Xeon processors play a vital role in managing the data flows into AI accelerator chips, so there are lots of Xeons in many AI-training supercomputers.

- Intel also offers its own AI accelerator chips with bang-for-your-buck performance comparable to the best from Nvidia (NVDA 5.14%).

- At the same time, the company manufactures AI chips for other companies, including longtime computing partner Microsoft (MSFT 1.58%).

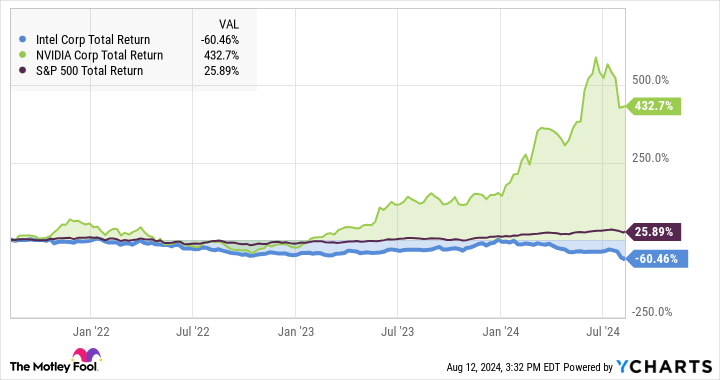

So Intel has its finger on the AI pulse from several different angles. Yet, the stock has been swooning instead of soaring in the AI boom. While Nvidia’s stock more than quintupled over the last three years and the S&P 500 (^GSPC 1.27%) market index gained 26%, Intel investors were stuck with a decline of 60%.

INTC total return level data by YCharts.

The bearish pressure on Intel’s stock is getting lighter, however. The company fell short of Wall Street’s consensus targets in the recent second-quarter report but announced ambitious cost-cutting and timely progress in the next leading-edge manufacturing node, code-named Intel 18A.

Intel’s stock was already affordable before this report but still fell another 26% the next day. The company is going through an unprofitable period of expensive investment in manufacturing equipment, setting it up for fantastic business results in the long run. With $120 billion of stockholder equity (also known as book value), the stock trades at a price-to-book ratio of 0.69.

That’s an all-time low and a valuation usually reserved for companies on the brink of bankruptcy. Meanwhile, Intel has plenty of growth catalysts in play, often related to the AI revolution. Thanks to this imbalance between robust business prospects and falling market value, I see a great buying opportunity in Intel’s current price dip.

SoundHound AI’s mass-market transition

SoundHound AI is an early-stage growth story, not a turnaround effort. The company is only getting started on a moneymaking business plan after running a popular but not very profitable song-identification service for nearly two decades.

The stock soared earlier this year as investors caught wind of Nvidia buying $3.7 million of SoundHound AI stock, but the elevated price didn’t last. Shares have traded sideways for three months, following a steep price drop in March and April.

So the stock looks sleepy, but there’s nothing boring about the underlying business story. Last week’s second-quarter report edged out analysts’ average expectations across the board. After the buyout of conversational AI specialist Amelia, SoundHound AI raised its full-year revenue guidance from roughly $71 million to at least $80 million, followed by a jump to over $150 million in 2025.

The company is starting to convert its enormous order backlog into cash-based sales. If that’s not exciting enough, it keeps adding household names to its customer list. Recent examples include sports grill chain Beef O’Brady’s and sandwich vendor Jersey Mike’s.

Automotive partners range from mass-market brands Honda and Hyundai to exclusive top-end names like the Stellantis (STLA 0.43%) marque Alfa Romeo. SoundHound AI’s advanced voice controls are rolling out across Stellantis’ many brands right now, starting in overseas markets such as Europe and Japan. You’ll see that wave reach American shores soon enough.

Long story short, I expect big things from management’s promising business plans. I’ll admit that the stock looks a bit pricey at the moment, but it’s one of those high-octane growth stories that might take off in a hurry. I’m talking about both the business results and the stock chart.

That’s why I recommend picking up a few SoundHound AI shares at this brief lull in its growth story. This little company is going places, and I don’t think it will stay small much longer.

Anders Bylund has positions in Intel, Nvidia, and SoundHound AI. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends Intel and Stellantis and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.