Many investors are familiar with price targets, as they represent analysts’ expectations of a stock’s future price.

Of course, analysts interpret many factors, including fundamental and technical, when calculating these levels.

In addition, price targets can be helpful for investors, helping to provide a more structured trade with pre-determined exit levels. However, it’s critical to remember that not all stocks reach analysts’ forecasted levels.

Two stocks – Exxon Mobil XOM and Netflix NFLX – have recently received price target upgrades. Below is a chart illustrating the performance of both stocks in 2023, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, both stocks have underperformed relative to the S&P 500 in 2023. It raises a valid question – how do they currently stack up? Let’s take a closer look.

Exxon Mobil

Exxon Mobil is a U.S.-based oil and gas entity, one of the world’s largest publicly traded energy companies. Just recently, UBS upgraded XOM shares to Buy from Neutral, with a new $144 per share price target.

The energy titan posted somewhat mixed results in its latest release, exceeding EPS expectations by roughly 2.4% but posting a negative 5.6% revenue surprise.

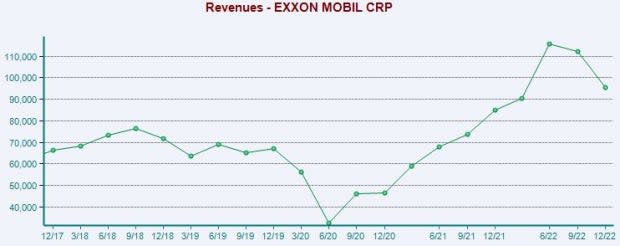

Still, the company’s revenue growth has undoubtedly been strong amid increased energy prices, as we can see in the chart below.

Image Source: Zacks Investment Research

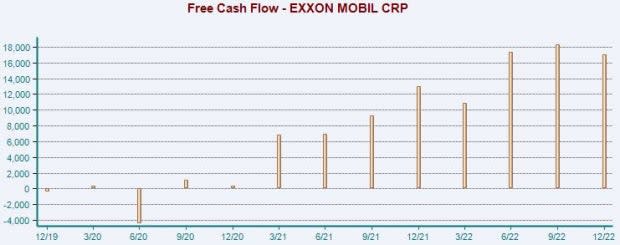

In addition, Exxon Mobil’s cash-generating abilities have been amplified; XOM generated $17.1 billion in free cash flow throughout its latest quarter, up more than 30% compared to the year-ago quarter.

Image Source: Zacks Investment Research

Netflix

UBS raised its PT for Netflix shares to $390 per share from $350 per share. The streaming titan reported Q1 results yesterday on April 18th; results came in somewhat mixed, with the company posting a modest EPS beat but falling marginally short of revenue expectations. In addition, paid net subscriber adds totaled +1.8 million, well above the year-ago quarter’s results of -200k.

NFLX shares aren’t necessarily cheap, with the company’s 4.3X forward price-to-sales residing on the higher end of the spectrum. Still, on a relative basis, the value is well below the steep 7.6X five-year median and highs of 8.9X in 2022.

Image Source: Zacks Investment Research

The company’s earnings outlook has inched higher across multiple timeframes as of late, indicating bullish sentiment from analysts.

Image Source: Zacks Investment Research

Bottom Line

Price targets are commonly discussed in the market, giving investors a gauge of current sentiment surrounding the stock.

And recently, both stocks above – Exxon Mobil XOM and Netflix NFLX – have received price target upgrades.

As mentioned previously, it’s critical to remember that not all stocks reach analysts’ forecasted levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.