This cloud-computing leader may have more room to run.

Shares of International Business Machines (IBM -0.29%) are trading at a record high amid a spectacular 68% rally over the past year. Some investors, seeing that performance, may assume the stock is now too expensive or overvalued.

That thinking risks overlooking an ongoing transformation for this storied technology giant as it shifts its business away from legacy infrastructure hardware toward a software and hybrid cloud focus. This year, IBM is benefiting from the strong demand for its artificial intelligence (AI) capabilities, which is driving a growth resurgence. The result is sharply higher earnings and free cash flow with an improved long-term outlook.

Considering those fundamental tailwinds, IBM stock may still be attractively priced.

IBM offers good tech sector value

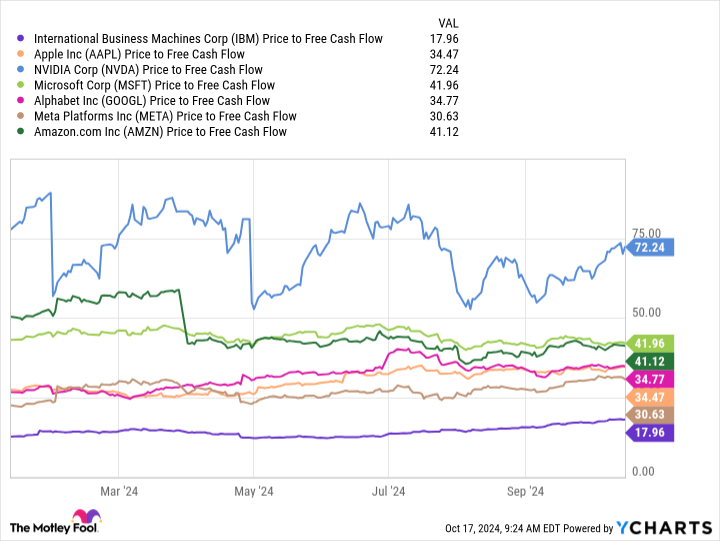

When looking at IBM stock, the valuation metric that stands out to me is its price-to-free-cash-flow ratio of 18, which measures the company’s $215.2 billion market capitalization against the $12.3 billion in cash it’s generated over the past year.

In this context, IBM appears downright cheap with a deep discount next to the group of “Magnificent Seven” stocks like Amazon or Microsoft, which have an average multiple above 40. One interpretation is that IBM stock still offers good value, further supported by its generous 2.9% dividend yield.

Data by YCharts.

What’s next for IBM stock?

There isn’t a single data point or valuation metric that alone determines whether a stock is cheap or expensive. Often, the more important factor for a stock’s future performance is how well the company executes its strategy and delivers profitable growth.

The good news is that IBM is well positioned to sustain its recent operating and financial momentum. Beyond the regular bouts of stock market volatility, IBM has regained its status as a high-quality tech leader that can reward shareholders over the long run.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.