Nvidia’s post-earnings stumble could be a buying opportunity.

Nvidia (NVDA 1.51%) has become the market’s most visible and influential battleground stock. The artificial intelligence (AI) leader posted second-quarter results after the market closed on Aug. 28 and posted performance that crushed Wall Street’s targets. The business recorded non-GAAP (adjusted) earnings per share of $0.68 on sales of $30 billion in the period, cruising past the average analyst estimate for per-share earnings of $0.64 on revenue of $28.7 billion.

But despite substantial sales and earnings beats in the quarter, Nvidia stock still lost ground following the report. With the company’s share price losing ground on the heels of a blockbuster Q2 report, it’s not unreasonable to wonder whether the red-hot AI leader may have finally hit its valuation peak.

While the stock could continue to see some post-earnings valuation volatility, there’s a good reason to think the stock can bounce back and continue climbing higher.

Nvidia’s gross margins are holding up well and have a positive catalyst on the horizon

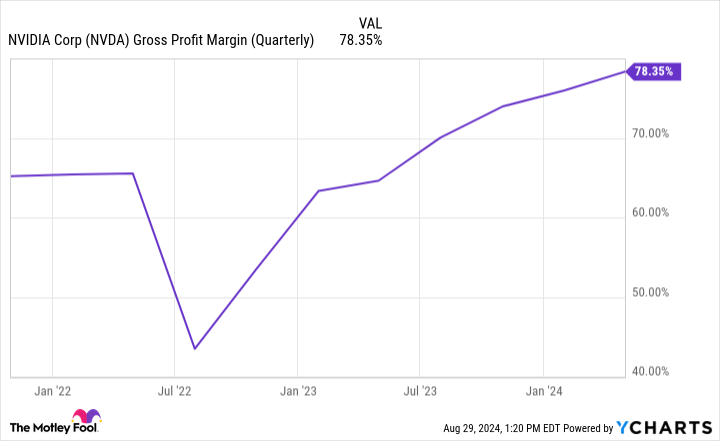

Thanks to AI-driven demand for the company’s most advanced processors, Nvidia has been posting fantastic gross margins. The chart below tracks the business’ gross margin over a three-year period concluding at the first quarter of the company’s 2025 fiscal year, which ended April 28, 2024.

NVDA Gross Profit Margin (Quarterly) data by YCharts

With its recent report, Nvidia showed that it had recorded a gross margin of 75.1% in Q2 and also guided for a margin of 74.4% in fiscal Q3. For the full-year period, the company expects its gross margin percentage to be in the mid-70s. Based on the company’s recent results and forecast, it looks like prices for its AI processors are coming down — but not by much.

Nvidia’s current top-of-the-line graphics processing units (GPUs) and accelerators are still showing very strong pricing power, and large tech companies are still buying hardware to improve their AI infrastructure. Selling prices for the company’s current GPUs for advanced data center applications will likely continue to decline, but the AI frontrunner is gearing up to release its next major chip platform.

Nvidia has said that manufacturing of its next-generation Blackwell chips will ramp up in the fourth quarter, and it appears that the new processors are poised for release late in 2024 or early in 2025. With the company’s current processors demonstrating resilient pricing power and a major leap forward in GPU technology on the horizon, the bull case for the stock remains intact.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.