Investors who know how to value a stock properly always have an eye on the future.

Is Nvidia (NVDA 1.69%) stock overvalued? This question, while simple on the surface, is extraordinarily hard to answer.

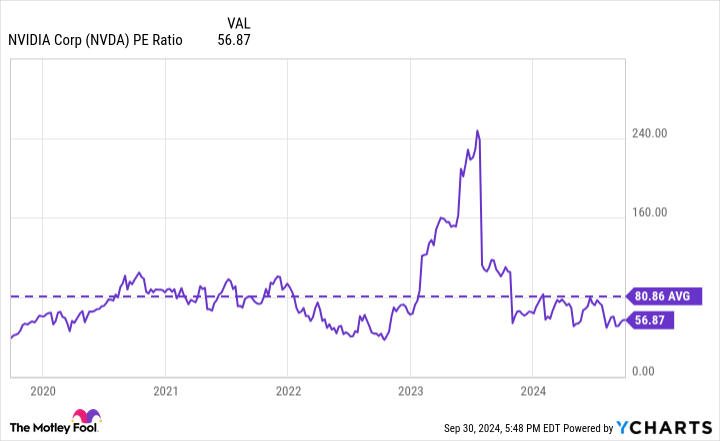

Many investors use a valuation metric called a price-to-earnings (P/E) ratio. This popular metric is useful because it measures the stock price against a company’s profits. And in Nvidia’s case, its P/E ratio of 57 certainly looks expensive, considering it’s roughly double the P/E ratio for the S&P 500.

Then again, context is important. Nvidia stock might look expensive now. But it actually trades at a steep discount to its average P/E ratio valuation over the last five years, as the chart below shows.

NVDA PE Ratio data by YCharts.

Many say to avoid stocks with a high P/E ratio. But Nvidia’s high P/E over the last five years didn’t prevent the stock from rising over 2,700%.

Nvidia stock is now cheaper than its five-year average valuation. Moreover, it’s not even the most expensive constituent of the S&P 500. In fact, Axon Enterprise (AXON 1.63%) and CrowdStrike (CRWD 2.99%) trade at higher P/E ratios, as of this writing. And even Costco Wholesale (COST 0.85%) has been more expensive than Nvidia at times in recent weeks.

Axon provides hardware and software to law enforcement agencies. CrowdStrike is a cybersecurity specialist. And Costco is a grocery and home-goods retail chain known for its membership-business model and low prices. As the chart below shows, none of these companies are necessarily cheap when looking at the P/E ratio.

NVDA PE Ratio data by YCharts.

Should investors sell stocks when their valuations are high? Should they only buy stocks that trade with below-average valuations?

If the path to long-term wealth were this simple, all investors would be rich. The entire investing process could be automated to sell when a P/E ratio was high and buy when a P/E ratio was low. But it’s not that simple. As I said at the start, it’s extraordinarily hard to say when a stock is actually overvalued.

Famous investor Bill Miller succinctly explains why valuing a stock is difficult. Miller has said, “100% of the information you have about a company represents the past, and 100% of the value depends on the future.”

Imagine for a moment a company valued at $10 billion and that has only made $1 million in profit. That stock would look extremely overvalued using the information we have from the past. But Miller reminds us that value has to do with the future. If this same $10 billion company earns $100 billion in profit over the next five years or so, then the stock is a screaming value stock.

In my opinion, whether Nvidia is overvalued or undervalued today largely depends on how sustainable its profit margins are. As the chart below shows, its margin has soared as artificial intelligence has fueled demand for its hardware products.

NVDA Profit Margin data by YCharts.

I believe it’s reasonable to expect more growth from Nvidia in coming years. And if the company can defend its current profit margins, then the stock likely has more upside. But if its margins drop back down to more normalized levels, the stock might not fare as well. That’s a question that every Nvidia investor needs to answer.

But what about the other three companies that are as expensive or more expensive than Nvidia when looking at the P/E ratios? Well, here’s how I think about their valuations.

Two stocks I’m not so sure about today

Costco is a fantastic business, enjoying stability from 137 million membership card holders with a greater-than 90% renewal rate. But one thing it’s not is high growth. It only had 5% top-line growth in its fiscal 2024, which ended Sept. 1. This led to 14% growth for operating income, which is respectable. But investors shouldn’t expect these growth metrics to materially improve in its fiscal 2025.

That’s why I’m not a fan of the valuation of Costco stock today. Its valuation implies better-than-average long-term growth with the business whereas it’s more likely to be modest.

Turning to Axon, its growth is far superior to Costco, and it should stay robust for quite some time. The company has a competitive advantage because it sells its hardware in a package with its cloud-software services. Agencies are eager to renew their contracts with Axon because they don’t want to find a new solution for all their data. And there are still plenty of places that aren’t using Axon yet that could in the future.

However, I still think there’s room for caution with Axon stock today. Its growth rate has been higher at times in the past. But by contrast, its price-to-sales valuation is almost double its 10-year average.

AXON PS Ratio data by YCharts.

A clear winner?

CrowdStrike stock is by no means the cheapest stock on this list when using various valuation metrics. But once again, value is about the future. And CrowdStrike’s potential is still so large because of its market. Management projects that the market for its security platform will skyrocket from $100 billion in 2024 to $225 billion in 2028.

For perspective, CrowdStrike only has $3.5 billion in trailing-12-month revenue. In other words, it doesn’t even need to grab a significant portion of this market to have significant growth. Moreover, it has an easy path to growth. Only 29% of its customers use seven or more of its software products, whereas it has more than 20 options to chose from.

Cross-selling to existing customers is an easy path for growth for CrowdStrike. And what’s stunning is that its pipeline for new deals has completely recovered from its catastrophe earlier this year when a software defect caused a massive IT outage. The speed of its rebound strongly implies that its customers love its cybersecurity platform and products.

CrowdStrike stock is quite expensive when looking at the valuation metrics that measure its past results. But when considering its path for future growth, I believe the stock could still be a good value today and perhaps the best value of the four stocks mentioned here.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Axon Enterprise, Costco Wholesale, CrowdStrike, and Nvidia. The Motley Fool has a disclosure policy.