A report from Jefferies analyst Brent Thill, which was released over the weekend, has made some investors nervous about Amazon (AMZN) stock.

Now before getting to the details, it bears emphasizing: Thill actually likes Amazon stock. Indeed, he recommends buying the stock, and thinks the shares, which cost less than $103 apiece today, are actually worth more like $163 — and will hit that price within a year.

However, according to Thill, online traffic to the Amazon.com website declined 6% year-over-year in both April and May, which represented “a substantial slowdown” from the 15% web traffic growth Amazon enjoyed back in 2020 for example. And as Thill observes — unsurprisingly — there’s “a strong historical correlation” between how much web traffic Amazon gets, and how much money gets spent on Amazon.com.

It’s not a one-to-one correlation, fortunately, but in Thill’s view, these continued 6% declines in web traffic are probably going to work out to no better than flat sales at Amazon in its next quarterly earnings report. This could disappoint investors because, currently, Wall Street consensus estimates have Amazon growing its sales 4% year over year in the year’s second quarter.

Granted, it’s true that Amazon is not alone in experiencing weakened traffic. As Thill notes, “a return to in person shopping, difficult comps, and a shift in consumption to other discretionary spending buckets (travel/dining) has contributed to declining traffic across the largest ecommerce sites, including Walmart.com and Target.com.” In Thill’s view, this is evidence that Amazon is not losing market shares to its rivals (i.e. Walmart and Target), but rather just suffering beside them from “shifting consumer behavior.”

That will be small comfort to Amazon shareholders, however, if their shares get hit after reporting a sales miss next month.

Nor are sales Amazon’s only problem. Thill notes that wage inflation is at a 15-year high, which is likely to take a bite out of Amazon’s profits this quarter. Indeed, according to the analyst, Amazon’s operating income could remain “muted” throughout this year, as Amazon’s profits will be doubly hit — first, by higher wages for its employees, and second, by the fact that the number those Amazon employees collecting those higher wages has doubled since the pandemic.

Long story short, Thill still likes Amazon for the long term, and indeed he believes conditions could start improving for the company as early as H2 2022. The remainder of Q2, however, could still be a rough ride for Amazon. (To watch Thill’s track record, click here)

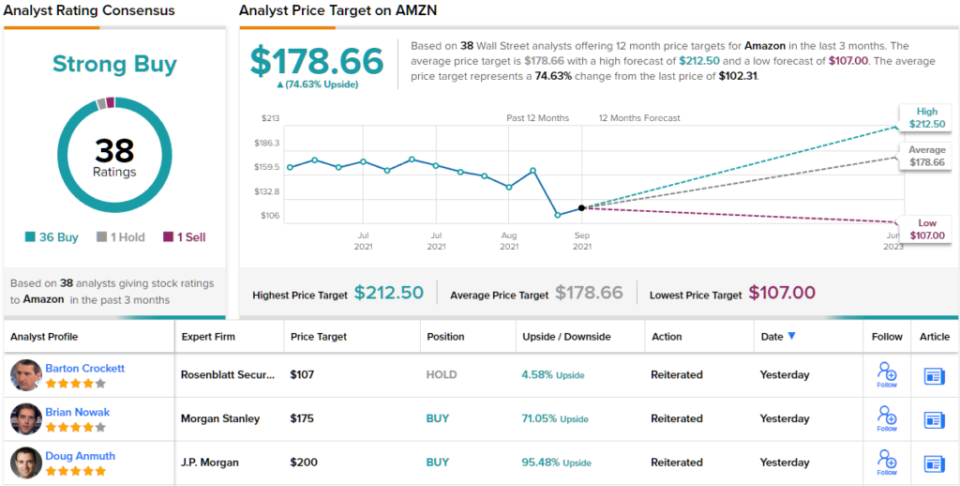

Overall, AMZN has a rare bullish outlook according to the Street. TipRanks reveals that in the last three months, the stock has received 36 Buy ratings vs. just 1 Hold and Sell each — giving it a Strong Buy analyst consensus. Meanwhile, the $178.66 average analyst price target translate into ~75% upside potential from the current share price. (See AMZN stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.