Investors looking for a hot AI stock that’s reasonably valued right now should take a closer look at this company, as it seems set for more upside.

The proliferation of artificial intelligence (AI) has given shares of many companies a big lift in the past year or so, and Dell Technologies (DELL 4.30%) is one of them. Shares of Dell have more than tripled in the past year as investors have been buying the stock hand over fist in the belief that it could benefit big time from the growing adoption of AI.

That’s not surprising, as Dell can take advantage of two lucrative AI-related growth opportunities — servers and personal computers (PCs). And recent developments indicate that the company is taking steps to capitalize on both these markets. Let’s take a closer look at the reasons why Dell’s red-hot stock market rally could continue thanks to AI.

The booming demand for AI servers is giving Dell Technologies a nice boost

When Dell reported its fiscal 2024 fourth-quarter results (for the three months ended Feb. 2), management pointed out that it is witnessing robust demand for its AI-optimized servers. More specifically, orders for Dell’s AI-focused servers were up 40% quarter over quarter. As a result, Dell’s order backlog of AI servers almost doubled from the previous quarter to $2.9 billion.

The company shipped $800 million worth of AI servers in fiscal Q4, and its solid backlog indicates that this figure could keep heading higher in future quarters. More importantly, Dell is scratching the surface of a massive growth opportunity in AI servers, as this market is expected to generate $33 billion in revenue in 2024, according to market research firm IDC.

Another estimate from contract electronics manufacturer Foxconn puts the size of the AI server market at a whopping $150 billion in 2027. As such, it wouldn’t be surprising to see demand for Dell’s AI servers boom in the long run, especially considering that it is optimizing its offerings for Nvidia.

Dell recently announced that it has extended its partnership with AI chip leader Nvidia to offer server solutions optimized for the latter’s next-generation Blackwell AI graphics processing units (GPUs). It is worth noting that Dell is offering liquid-cooled servers for mounting Nvidia’s Blackwell processors. That’s a smart thing to do considering that the market for liquid-cooled data centers is forecasted to clock annual growth of almost 25% over the next decade.

It is worth noting that the demand for Nvidia’s upcoming Blackwell AI chips is expected to remain extremely healthy in 2025. John Vinh of KeyBanc estimates that Nvidia’s data center revenue could jump to a whopping $200 billion in 2025 thanks to the Blackwell processors, which would be a huge increase from $47.5 billion last year.

So Dell is doing the right thing by bringing Blackwell-focused AI server solutions to the market, as it should be able to cash in on the huge demand for Nvidia’s chips. More importantly, the long-term opportunity in the AI server market bodes well for Dell, as it is among the leading players in this market.

The PC business seems set for a turnaround

The soft demand for PCs over the past couple of years has weighed on Dell’s financial performance. Its revenue in the previous fiscal year fell 14% year over year to $88.4 billion. The company’s revenue from the client solutions group (CSG), which includes sales of commercial and consumer PCs, was down 16% year over year to $48.9 billion in fiscal 2024.

That wasn’t surprising as PC shipments were down 14% in 2023, according to IDC. However, the arrival of AI-enabled PCs is likely to trigger a turnaround in this market for Dell, as it is the third-largest seller of PCs, with a market share of just over 15%. According to market research firm Canalys, AI PC shipments are forecasted to increase at an impressive annual rate of 44% through 2028.

Dell has set its sights on this market, and recently announced a new portfolio of PCs with on-device AI features, such as allowing users to generate images locally with the help of text inputs, translate “any live or pre-recorded audio from 44 languages to English,” and use AI to increase the resolution of games and videos in real time for a more immersive experience.

Dell remains “bullish on the coming PC refresh cycle and the longer-term impact of AI on the PC market,” and its product development moves should allow the company to dig into this opportunity and bring its CSG business out of the slump it is in.

Buying the stock is a no-brainer right now

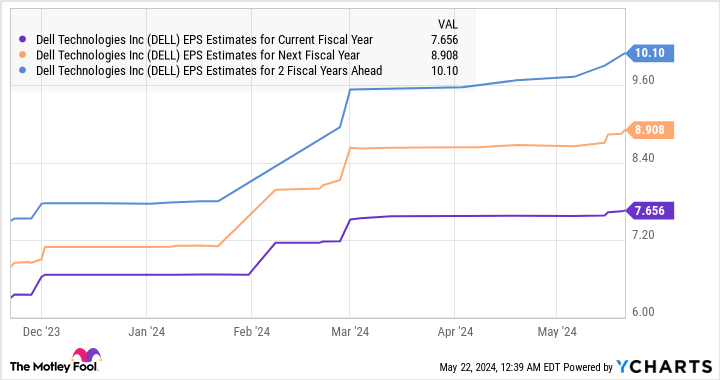

Dell’s earnings fell 6% in fiscal 2024 to $7.13 per share. However, analysts are expecting its bottom line to return to growth in the current fiscal year, followed by healthier growth over the next couple of fiscal years.

DELL EPS Estimates for Current Fiscal Year data by YCharts

Also, as the above chart tells us, analysts have been raising their earnings growth expectations from Dell. With the stock trading at 20 times forward earnings right now, which is a discount to the Nasdaq-100’s forward earnings multiple of 27 (using the index as a proxy for tech stocks), investors are getting a good deal on this AI stock right now despite the outstanding gains it has delivered in the past year.

Buying Dell at this valuation looks like a smart thing to do in light of the potential growth that AI could drive for the company, as the market could continue rewarding the stock with more gains given the accelerated bottom-line growth it is expected to deliver.