(Bloomberg Opinion) — Take Hong Kong protests, add a dash of Brexit and then stir in the death of brick-and-mortar shopping. It’s hardly surprising that a savvy investor would want to bail from its stake in A.S. Watson Group, a retailer based in the former British colony with a big U.K. footprint.

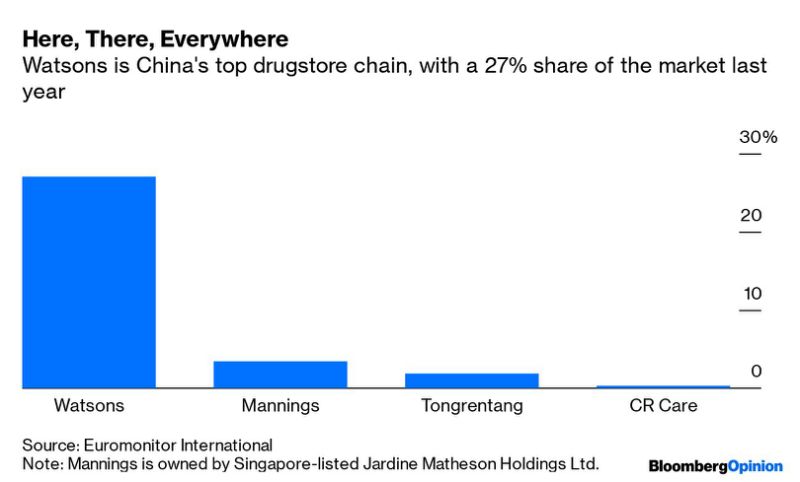

These latest geopolitical flash points have been cited for Temasek Holdings Pte’s decision to table the sale of its $3 billion interest in A.S. Watson, Bloomberg reporters Manuel Baigorri, Joyce Koh and Vinicy Chan wrote Wednesday. The company has a sprawling operation in Hong Kong that includes the ubiquitous Watsons drugstore chain, supermarkets and electronics stores. Pro-democracy protests in the city, which have choked main commercial areas over the past several weekends, have become a problem. The city’s retail sales could plunge to a decade low in August, after an 11.4% drop in July, Bloomberg Intelligence says. Tourist arrivals in July fell 4.8% from a year earlier, the Immigration Department said.

Meanwhile, A.S. Watson owns Superdrug, a pharmacy and beauty retailer with hundreds of stores in the U.K. As Brexit uncertainty rocks the pound, revenue coming in looks weaker for a parent that reports earnings in Hong Kong dollars (which trace the greenback).

But offloading A.S. Watson would be a hard sell even without the background noise of these political dramas. Temasek forked out HK$44 billion ($5.6 billion) in 2014 to buy a 25% stake in the retailer from Hong Kong billionaire Li Ka-shing’s CK Hutchison Holdings Ltd., which remains the controlling shareholder. The global ports-to-telecom conglomerate said it planned to list the business within three years. In a world where the likes of Amazon.com Inc. and Alibaba Group Holding Ltd.’s Taobao have decimated traditional drugstores, finding a willing buyer has been an uphill task.

The Singapore investment firm’s asking price also looks quite rich. The $3 billion tag for a 10% stake amounts to a valuation of $7.5 billion for the 25% currently owned by Temasek. In March, Citigroup Inc. analysts said that the target price implies a valuation of 16.5 times forward Ebitda – well above the 9 times the broker had assigned to A.S. Watson. While the stake had once piqued the interest of Mubadala Investment Co., the Abu Dhabi sovereign fund, and even Tencent Holdings Ltd., ultimately it wasn’t tempting enough for an interest with no management control.

These unfortunate turns come just as things were starting to look up for A.S. Watson. The company was making headway into online groceries, including a tie-up for its ParknShop supermarket chain in Guangdong with mainland rival Yonghui Superstores Co. and Tencent. During the first half of the year, excluding a one-time HK$633 million gain from its mainland venture, Watson’s retail earnings before interest, tax and depreciation rose 6% in local currencies, driven by its health and beauty-product sales in Asia. Its Chinese operations also saw a turnaround, with same-store sales up 2.2% after declining 1.6% in 2018.

Temasek, sitting in stable Singapore, has every reason to want to distance itself from political upheaval in Hong Kong and London. Given A.S. Watson’s troublesome mix, the retailer may need to go at a deeper discount.

To contact the author of this story: Nisha Gopalan at [email protected]

To contact the editor responsible for this story: Rachel Rosenthal at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nisha Gopalan is a Bloomberg Opinion columnist covering deals and banking. She previously worked for the Wall Street Journal and Dow Jones as an editor and a reporter.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”51″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.