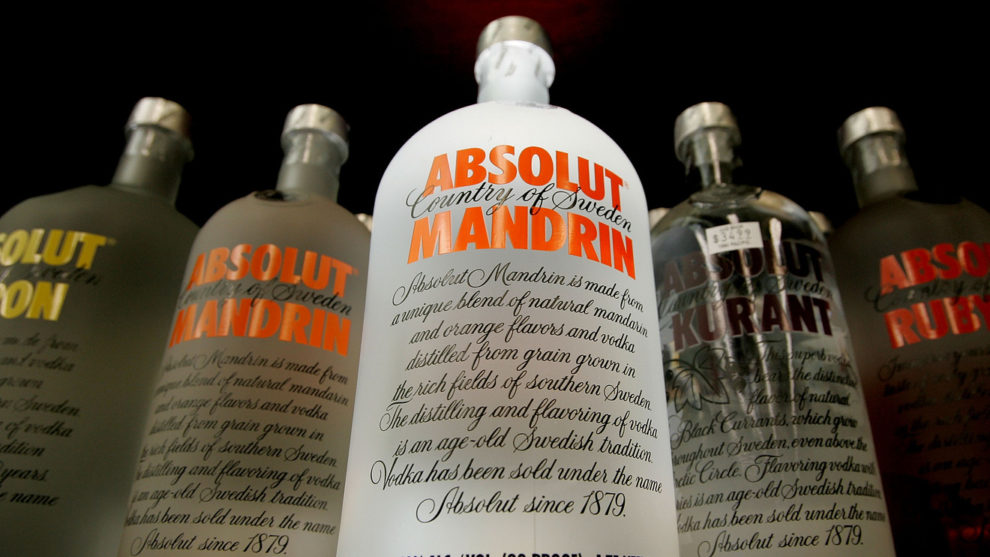

Pernod Ricard, the maker of Jameson whiskey and Absolut vodka, cut its annual profit growth outlook for 2019-2020 on Thursday, as it said China’s coronavirus epidemic was likely to have a “severe” impact on its third-quarter performance.

The French spirits maker, which generates 10% of its global sales in China, said it couldn’t predict the “duration and extent of the impact,” but stressed it remained confident on overall strategy.

“In our view Pernod Ricard deserves credit for attempting to quantify the impact, which few other companies we follow have done,” said James Edwardes Jones, analyst at RBC Capital Markets.

He added: “We don’t believe that this should weigh heavily on the shares, albeit China is an important market for Pernod Ricard (we estimate 14% of sales and 20% of EBIT [earnings before interest and taxes]) if the lack of reaction for others in the sector is any guide.”

Shares in Pernod RI, +3.80% closed up 3.8% on Thursday.

Pernod’s warning came as the European Union cautioned on Thursday that the coronavirus outbreak had emerged as a “new downside risk” for the eurozone’s growth prospects.

In its winter 2019 economic forecast, the European Commission said: “The longer it lasts, however, the higher the likelihood of knock-on effects on economic sentiment and global financing conditions.”

Paolo Gentiloni, European Commissioner for the Economy, added: “We still face significant policy uncertainty, which casts a shadow over manufacturing. As for the coronavirus, it is too soon to evaluate the extent of its negative economic impact.”

Pernod, the world’s second-biggest spirits group after the U.K.’s Diageo DGE, -0.87%, said operating profit from recurring operations would grow between 2% to 4% this year, down from the 5% to 7% it previously predicted, because of the impact of the coronavirus outbreak.

The French spirits maker reported a net profit of €1.03 billion ($1.12 billion), up 1% from a year earlier, while profit from recurring operations was €1.78 billion, up 4.3% on an organic basis. Sales reached €5.47 billion in the six months to Dec. 31, a 5.6% gain on the year earlier, and 2.7% higher on an organic basis.

The company came under pressure to boost its margins and improve its corporate governance in December 2018, after U.S. activist investor Elliot Management built a 2.5% stake in the company.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>