Betting on AI isn’t the only way to beat the market.

The big story in the stock market over the past few years has been artificial intelligence (AI). Generative AI, which can create text, images, videos, and audio, looks likely to be a transformative technology. Tech leaders like Microsoft, Alphabet, and Advanced Micro Devices are betting heavily on AI to drive growth.

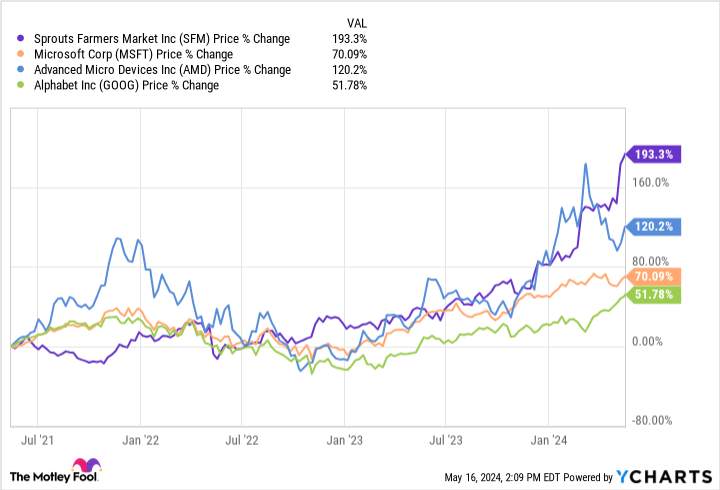

While the stocks of all three of those AI-centric companies have surged over the past year, they have been beaten handily by a stock that has absolutely nothing to do with AI. Investing is about more than chasing buzzwords. The tried-and-true method of finding unappreciated companies with solid growth prospects trading at pessimistic valuations still works.

This mystery stock has more than doubled over the past year, beating all three of the aforementioned tech companies by large margins. It has also trounced Microsoft, Alphabet, and AMD over the past three years, nearly tripling in that time.

The stock is Sprouts Farmers Market (SFM 1.54%), a small chain of grocery stores that does things differently from the major supermarket chains. That strategy has been paying off, and Sprouts still has plenty of growth ahead as it expands its footprint.

Small, curated stores

Sprouts operated 414 stores in 23 states as of March 31. Each store is relatively small. Its older stores are around 30,000 square feet, while its newer stores are even smaller at approximately 23,000 square feet. While the size of traditional supermarkets varies, they’re often substantially larger.

Keeping its stores small reduces the cost of building new stores, lowers the ongoing operating costs, and allows Sprouts to build in locations where larger supermarkets wouldn’t make sense. The average new store costs just $3.8 million. First-year sales average $13 million, with 20% to 25% annual growth over the following four years.

Sprouts focuses on two things: produce and attribute-based items. Each store features a large produce section with affordable prices. It makes a point to beat competitors on price.

About 70% of the products Sprouts sells are attribute-based — meaning gluten-free, organic, vegan, non-GMO, and the like. It doesn’t try to compete with the big supermarket chains on selection, instead curating a differentiated assortment of products. This works well with the company’s customer base, which skews toward the wealthy and college-educated.

Hundreds of new stores could be on the way

The Sprouts model is working. Comparable-store sales (comps) were up 4% in the first quarter of this year, and the company expects 3% to 4% comps growth for the full year. Adjusted earnings per share will top $3 this year, according to the company’s guidance, up from just $1.25 in 2019.

Sprouts will open 35 new stores this year. In 2025 and beyond, the company plans to increase its store count by about 10% annually. It sees opportunities to open more than 300 new stores in its expansion markets, which include Texas, California, Florida, and portions of the East Coast.

Based on the company’s guidance, the stock trades for about 25 times forward earnings even after the multiyear rally that has propelled shares to market-trouncing gains. With the company expecting 10% store growth, low single-digit comps growth, and stable profit margins, double-digit annual earnings growth is in the cards.

That valuation looks reasonable given the chain’s growth potential. It could also be an acquisition target. Amazon snagged Whole Foods, another differentiated grocery chain, in 2017. Sprouts could be an attractive acquisition for a larger chain hunting for growth.

The grocery industry is tough, and consumer behavior can shift unexpectedly. Sprouts is navigating the post-pandemic environment well so far, and the company looks poised to greatly expand its footprint in the coming years. While the stock might not repeat its performance from the past few years, it looks like a solid long-term investment.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Timothy Green has positions in Sprouts Farmers Market. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, and Microsoft. The Motley Fool recommends Sprouts Farmers Market and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.