Leave it to a roster of “American-made” cars to best illustrate how globalization touches U.S. consumers.

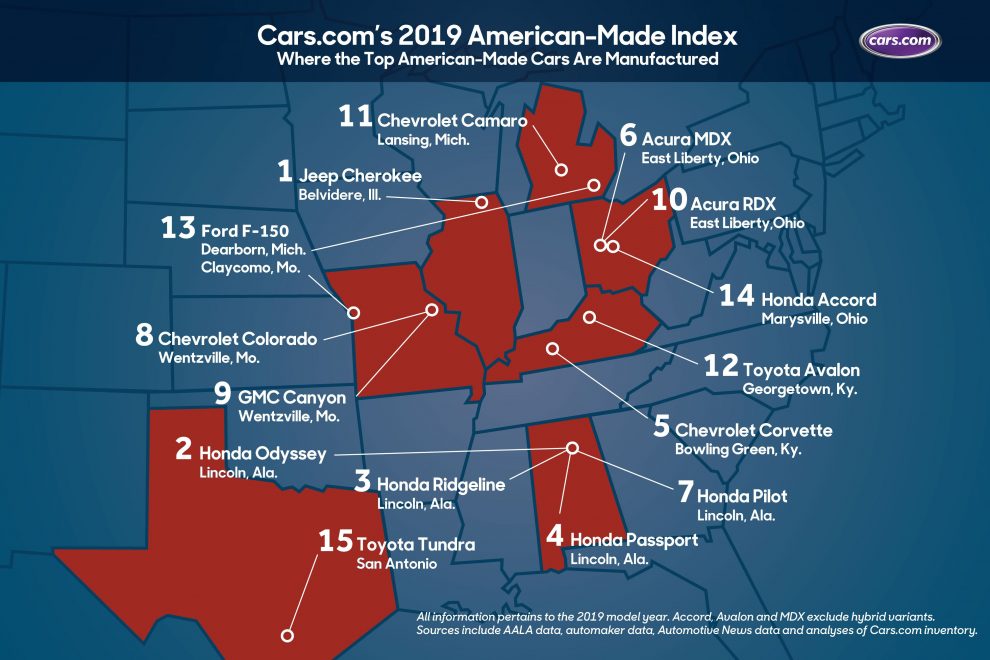

The top model in the Cars.com annual American-Made Index is a longtime U.S. brand that falls under shared international ownership: Fiat Chrysler’s FCAU, -1.57% FCA, -0.05% Jeep Cherokee. It rolls off the line in Belvidere, Ill.

The runner-up is a Japanese make put together in Alabama: the Honda HMC, -0.35% 7267, -0.24% Odyssey minivan.

The auto index tracks vehicles with the most domestically sourced major parts and labor, but increasingly so-called American made vehicles have some international connection.

In fact, nine of the top 15 “American-made” autos came from Honda or Toyota TM, -0.69% 7203, -0.57% Among the top 10 vehicles, the Honda Passport, the Chevrolet Colorado and GMC Canyon, both from U.S.-based General Motors GM, +1.95% and the higher-end Honda brand Acura RDX are new to the AMI or have returned in 2019 after an absence.

Ford Motor Co.’s F, -1.11% F-150 pickup comes in at No. 13, the U.S.-based vehicle maker’s only offering to crack the list.

Cars.com

Cars.com

Automobiles were ranked based on five factors: assembly location, parts sourcing (as determined by the American Automobile Labeling Act), U.S. factory employment relative to sales, and engine and transmission origins.

The fate of the U.S. auto industry, of the shrinking high-paying jobs assembling vehicles, and the pressure of nailing the changing demand of environmentally conscious, yet-still SUV-loving, Americans who shuttle pets, kids and do-it-yourself materials remain hot topics. That’s particularly true as import duties and U.S.-first labor issues feature in a Trump White House.

Cars.com asked industry sources and consumers how much trade factors, notably, the threat of tariffs, are impacting their decision-making.

“Despite a lot of talk around new tariffs and the looming U.S.-Mexico-Canada Agreement [the updated North American Free Trade Agreement, or Nafta], few of the automakers in the top 15 indicated major manufacturing changes as a result,” said Kelsey Mays, senior editor at Cars.com.

Auto makers still assembled around 120 models in the U.S. for the 2019 model year, with U.S.-built sales accounting for just over half of all new vehicles bought by consumers. That’s little changed from a year ago, Cars.com data shows.

Read: Lobbying on trade issues could set record as companies sound off on tariffs, USMCA

Taste changes mean that several sedans and hatchbacks have met their demise, but that stems from consumers’ preference for SUVs, which began before current trade pressures, Mays said.

‘Despite a lot of talk around new tariffs. few of the automakers in the top 15 indicated major manufacturing changes as a result.’

Still, trade-related concerns can’t be entirely dismissed.

“Tariffs or other changes in trade policy could have a major impact on consumers and the auto industry, including rising costs,” Mays said. “It’s no small task to move supply chains, much less alter where a car or its major components are built – both factors that influence AMI rankings. Such actions take years to plan, negotiate and implement.”

President Trump, in May, said he’d put off applying tariffs to Japanese and European Union car imports for at least six months. Trump had been considering tariffs of 25% on imported cars and auto parts.

Cars.com

Cars.com

A Cars.com consumer survey revealed that half of all respondents are concerned about the possibility of tariffs on automotive imports. If tariffs are passed, consumers could see increases in vehicle prices or manufacturers may be forced to eat those costs. About 41% of those polled are unsure if the levies would make them more likely to consider buying domestic.

The query revealed some sensitivity to the health of the U.S. auto market overall.

The poll found that two-out-of-three respondents want to buy a car that contributes substantially to the U.S. economy, but the sentiment varies by age. Among respondents age 18-34 — a group that includes millennials and GenZ consumers — just 61% indicated that it matters that the car they buy contributes substantially to the U.S. economy. Compare that with the share of respondents age 35-54 (at 71%) who indicated the same concern.

Cars.com

Cars.com

Younger generations are also least likely (14%) to think it’s unpatriotic to buy non-American, compared with 27% of respondents 55 and older. Perhaps their parents’ buying habits play a part: only about half of respondents age 18-34 said their parents owned American-made cars, significantly lower than the percentage of respondents age 55+ (at 88%) who indicated the same.

Watch: How computer simulation can make autonomous cars a reality

Consumers are generally pretty savvy about the industry it turns out. Asked which state produces the most cars in the U.S., 47% correctly answered Michigan.

The home state of the “Motor City” makes almost 18% of all new cars in the U.S. — the largest share of any state — followed closely by Indiana, Kentucky and Ohio.

Opinion: The road to riches is this simple: Drive a crappy car