Two tech giants highlighting this week’s busy earnings lineup are Alphabet GOOGL and International Business Machines IBM which are set to report their Q2 results on Tuesday, July 24, and Wednesday, July 25 respectively.

Belonging to the high-performing Magnificent Seven-themed stocks, GOOGL has soared +30% this year to edge the S&P 500 and Nasdaq while IBM’s +12% has slightly trailed the broader indexes. Still, both have outperformed the broader market over the last three years.

That said, let’s see if it’s time to buy Alphabet or IBM’s stock with each trading at just over $180 a share.

Image Source: Zacks Investment Research

Alphabet Q2 Expectations

Making up the majority of its search engine revenue from Google, Alphabet’s Advertising segment sales are thought to have increased 10% during Q2 to $64.27 billion based on Zacks estimates. Another catalyst to Alphabet’s growth has been its Cloud segment revenue which is projected to soar 25% to $10.08 billion.

Overall, Alphabet’s Q2 sales are expected to increase 13% to $70.55 billion versus $62.07 billion in the comparative quarter. Furthermore, earnings are projected to climb 28% to $1.84 per share compared to EPS of $1.44 in Q2 2023.

Notably, Alphabet has surpassed earnings expectations for five consecutive quarters posting an average earnings surprise of 11.34% in its last four quarterly reports.

Image Source: Zacks Investment Research

IBM Q2 Expectations

While Alphabet has been one of the most innovative tech companies in the modern age, IBM has begun to evolve itself as a provider of cloud and data platforms.

Known for its hardware and integrated computer offerings, IBM’s Q2 sales are expected to be slightly up to $15.58 billion versus $15.48 billion in the prior-year quarter. However, Q2 EPS is projected to dip by roughly -1% to $2.16.

IBM has also surpassed earnings expectations for five straight quarters posting an average earnings surprise of 5.2% in its last four quarterly reports.

Image Source: Zacks Investment Research

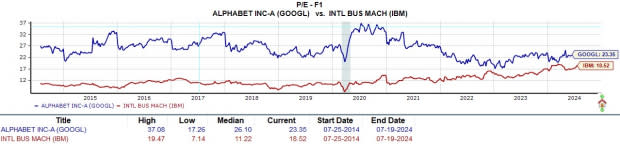

Valuation Comparison

With their stocks edging toward $200 and trading at similar price tags, it’s noteworthy that IBM has an 18.5X forward earnings multiple which is a nice discount to the S&P 500’s 23.2X with GOOGL at 23.3X.

In terms of price to sales, IBM’s P/S ratio is also more reasonable at 2.7X which is beneath the benchmark’s 5.4X, and GOOGL at 7.5X.

Image Source: Zacks Investment Research

Bottom Line

Ahead of their Q2 reports, Alphabet and IBM’s stock both land a Zacks Rank #3 (Hold). While the anticipation of Alphabet’s quarterly growth certainly stands out, IBM’s valuation is very attractive with both companies being sound long-term investments in the tech sector.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.