Several big tech giants will highlight this week’s earnings lineup with Microsoft (MSFT) and Amazon (AMZN) scheduled to release their quarterly results on April 25 and 27 respectively.

While Amazon and Microsoft have very different business operations, cloud services are still key points for their future growth and diversity.

Let’s see if investors should consider buying either tech giant with earnings approaching.

Recent Cloud Growth

Going into their quarterly reports, Wall Street will certainly monitor if Amazon and Microsoft can sustain their market share and growth in cloud services.

As of now Amazon Web Services (AWS) is thought to control the majority of the cloud market share at about 32% followed by Microsoft Azure at 23%, with Alphabet’s (GOOGL) Google Cloud third at around 10%.

Amazon’s AWS revenue increased 20% year over year in its most recent fiscal fourth quarter at $21.4 billion. AWS accounted for 14% of Amazon’s total revenue during Q4 and increased 4% from third-quarter cloud revenue of $20.5 billion. However, this was slower than many analysts expected and a notable decline from the 27% YoY growth rate in the third quarter.

Image Source: Zacks Investment Research

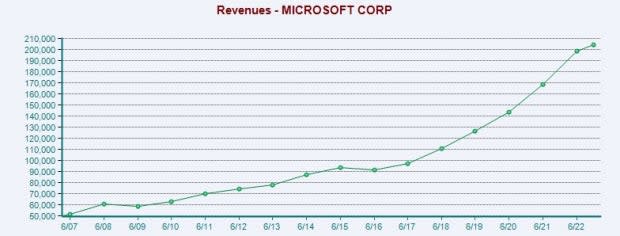

Microsoft’s cloud revenue grew by 22% year over year during its most recent fiscal second quarter at $27.1 billion. This accounted for 51% of the company’s total revenue and represented 5% growth from $25.7 billion in Q1 cloud revenue but below the 24% YoY growth rate for the first quarter.

Image Source: Zacks Investment Research

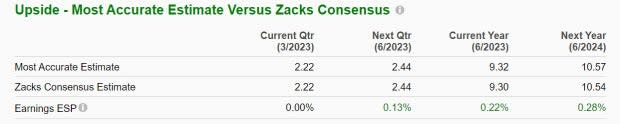

Microsoft Q3 Preview

Microsoft’s fiscal third-quarter earnings on April 25 are expected to be virtually flat YoY at $2.22 per share. Sales for Q3 are projected to rise 3% to $50.95 billion. The Zacks Expected Surprise Prediction (ESP) indicates that Microsoft should reach its Q3 earnings expectations with the Most Accurate Estimate also having third-quarter earnings at $2.22 per share.

Image Source: Zacks Investment Research

Overall, Microsoft earnings are now expected to be up 1% this year and jump 13% in FY24 at $10.54 per share. Total sales are forecasted to rise 5% in FY23 and edge up another 10% in FY24 to $229.88 billion.

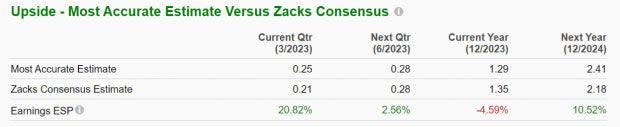

Amazon Q1 Preview

Amazon’s fiscal first-quarter earnings on April 27 are also expected to be flat YoY at $0.21 per share with sales projected to rise 7% to $124.77 billion. Notably, the Zacks ESP indicates Amazon could beat its Q1 earnings expectations with the Most Accurate Estimate having first quarter EPS at $0.25.

Image Source: Zacks Investment Research

Annual earnings are anticipated to rebound and soar 90% in FY23 at $1.35 per share compared to EPS of $0.71 in 2022. Fiscal 2024 earnings are expected to climb another 61% at $2.18 per share. On the top line, sales are forecasted to rise 8% this year and jump another 12% in FY24 to $625.41 billion.

Performance & Valuation

Year to date Amazon is up +26% to beat Microsoft’s +17% with both topping the S&P 500’s +8% and the Nasdaq’s +15%. Even better, over the last decade, Microsoft’s +787% and Amazon’s +733% have easily topped the broader indexes.

Image Source: Zacks Investment Research

At $281 per share, Microsoft stock trades at 30.7X forward earnings which is not far above the industry average of 27.4X. Furthermore, Microsoft is an industry leader and trades nicely beneath its decade high of 37.4X but above the median of 24.5X.

In comparison, Amazon trades at $106 per share and 79.3X forward earnings which is well below its extreme decade-long high and a 37% discount to the median of 126.5X.

However, Amazon still trades much higher than its own industry average of 21.6X but is the leader in its space and Wall Street has historically been ok with paying a premium for the company due to its growth and expansion.

Takeaway

Going into their quarterly reports, Microsoft and Amazon stock land a Zacks Rank #3 (Hold). There may be more upside for both tech giants’ stocks this year but this could largely depend on their quarterly results showing they can sustain cloud growth along with expansion in other business areas.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.