Apple’s AAPL stock spiked +7% today to fresh 52-week highs after the renowned iPhone maker announced a partnership with OpenAI to integrate ChatGPT into its iconic product line and services.

With that being said, investors may certainly be wondering if it’s time to buy Apple’s stock with its operating system getting an innovative makeover.

Apple Intelligence Overview

Joining the lineup of big tech companies that are accelerating and utilizing the capabilities of artificial intelligence through generative AI chatbots, Apple joins Alphabet GOOGL, Meta Platforms META, and Microsoft MSFT in this regard.

Siri, Apple’s iconic voice-embedded virtual assistant will be upgraded with AI chatbot features as part of Apple Intelligence, the company’s AI platform that will be integrated into the iOS 18 which is the next-generation operating system that will power its iconic devices including the iPhone, iPad, MacBook, and smartwatch.

Recent Performance & Valuation

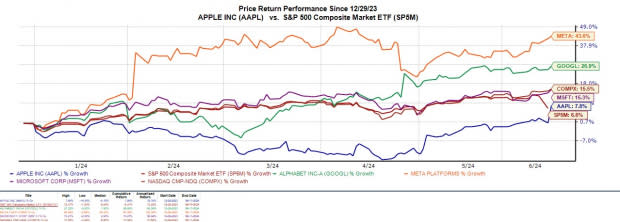

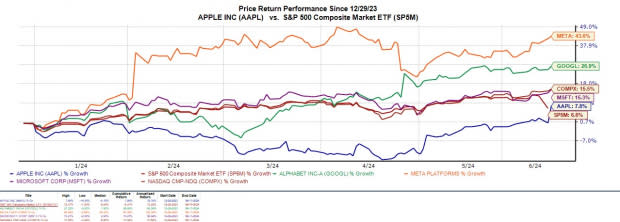

Soaring to over $200 a share on Tuesday, Apple’s stock is now in positive territory for the year and sitting on +7% gains. Although this has slightly edged the benchmark S&P 500, Apple has underperformed Alphabet, Meta Platforms, and Microsoft’s stock with the tech-centric Nasdaq up +15% for the year.

Image Source: Zacks Investment Research

At current levels, Apple’s 29.3X forward earnings multiple is a slight premium to the P/E valuation of Meta Platforms and Alphabet along with the benchmark’s 21.7X but is beneath Microsoft’s 36.3X.

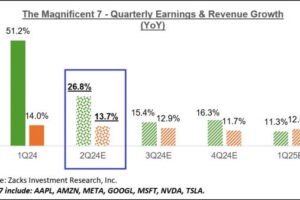

Image Source: Zacks Investment Research

Growth Trajectory

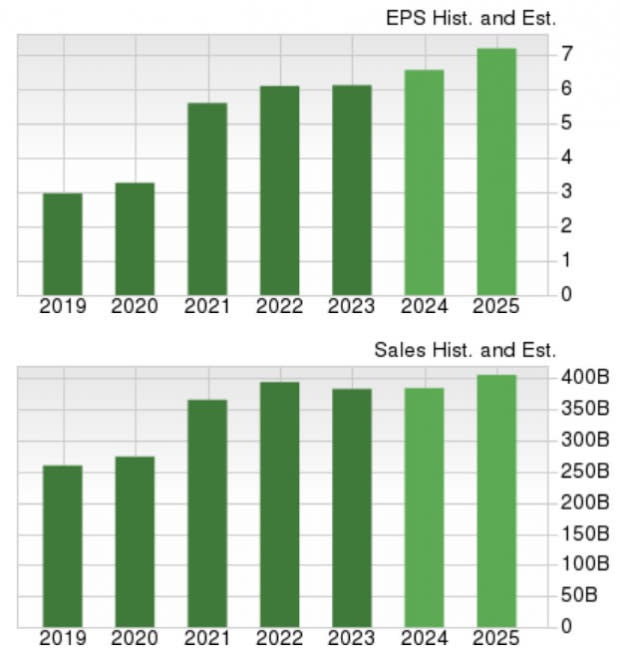

Based on Zacks estimates, Apple’s total sales are now expected to be virtually flat in fiscal 2024 but are projected to rise 5% in FY25 to $405.81 billion. Notably, Apple’s top line is more robust than any of its aforementioned big tech peers with the closest being Alphabet whose total sales are expected to cross $300 billion next year.

On the bottom line, Apple’s annual earnings are projected to be up 7% this year and are forecasted to rise another 9% in FY25 to $7.21 per share.

Image Source: Zacks Investment Research

Takeaway

While it’s far too soon to say Apple may be at another inflection point due to its artificial intelligence offerings, AAPL does land a Zacks Rank #3 (Hold). However, there could be better buying opportunities after the smoke clears from the recent rally atttribued to the announcement of Apple Intelligence and the collaboration with OpenAI.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment