Trading just over $120 a share, Nvidia’s NVDA 10-1 stock split went into effect today making shares more accessible to a broader range of investors. This comes as the chip giant’s stock price tripled in 2023 and had already more than doubled this year.

Although stock splits don’t change a company’s overall market value, the lowered share price certainly prompts the discussion of if it’s time to buy NVDA after previously trading near all-time highs of over $1,000.

Image Source: Zacks Investment Research

Market Value

Nvidia’s dominance as the leader in semiconductor chips that power artificial intelligence had recently led to its market capatilization surpassing Apple AAPL at over $3 trillion to be the second highest-valued company in the United States behind Microsoft MSFT.

Indicative of Nvidia’s dominance, this towers over other noteworthy chip leaders in AMD AMD and Intel INTC which have market caps of $271 billion and $130 billion respectively.

Image Source: Zacks Investment Research

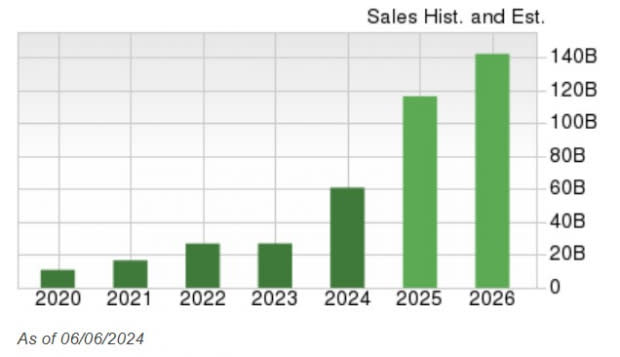

Post-Split Growth Trajectory

Certainly, Nvidia’s market cap and industry leadership make the case for investing in its stock and It’s noteworthy that stock splits have no bearing on a company’s underlying fundamentals or earnings although earnings per share (EPS) are diluted to reflect the increased number of shares.

In this regard, Nvidia’s annual earnings are now forecasted at $2.65 per share ($26.54 per share/10) for its current fiscal 2025 with FY26 EPS projected to expand 22% to $3.25. Of course, sales are not affected by a stock split either and Nvidia’s top line is expected to soar 91% in FY25 to $116.4 billion versus $60.92 billion in FY24. Better still, FY26 sales are projected to climb another 22% to $142.29 billion.

Image Source: Zacks Investment Research

Takeaway

Optimistically, Nvidia’s stock split does look like an opportunity to get in on the tech behemoth’s expansive growth at a more reasonable price with NVDA boasting a Zacks Rank #1 (Strong Buy).

The forward stock split also comes at an ideal time for investors as Nvidia’s Blackwell series of GPUs are expected to officially launch later in the year and are thought to be the most powerful AI chips on the market ahead of its current H200 series and AMD’s MI300 series.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.