Salesforce CRM continued its transformation efforts to provide stronger financial figures after beating Q2 expectations on Wednesday and raising its profit guidance.

This also helped to quiet fears of increasing competition from Microsoft MSFT and Oracle ORCL which have popular customer relationship managment software brands of their own.

Salesforce’s Q2 Results

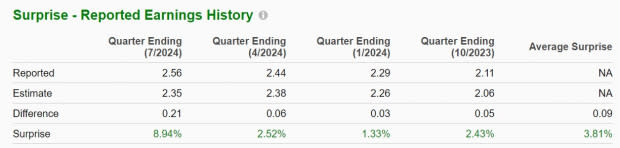

Driven by subscription and support revenue, Salesforce posted Q2 sales of $9.32 billion which rose 8% year over year and surpassed estimates of $9.22 billion by 1%. On the bottom line, Q2 EPS of $2.56 spiked 21% from $2.12 per share in the comparative quarter and beat estimates of $2.35 a share by 9%.

Notably, Salesforce delivered Q2 operating cash flow of $892 million which increased 10% YoY with free cash flow of $755 million spiking 20%.

Image Source: Zacks Investment Research

AI Updates

Salesforce highlighted the acceleration of artificial intelligence across its product portfolio stating new bookings for its AI products more than doubled quarter-over-quarter. Salesforce said it signed 1,500 AI deals in Q2 with some of the world’s largest brands including Alliant Energy LNT.

Guidance & Growth Trajectory

For its current fiscal 2025, Salesforce still expects total sales at $37.7 billion-$38 billion which falls in line with the Zacks Consensus of $37.85 billion or 8% growth. Based on Zacks estimates, Salesforce’s top line is expected to expand another 9% in FY26 to $41.23 billion.

Image Source: Zacks Investment Research

Salesforce raised its EPS guidance for FY25 to $10.03-$10.11 compared to previous guidance of $9.86-$9.94 per share. This came in above the current Zacks Consensus of $9.91 per share or 20% growth. Salesforce’s EPS is projected to rise another 10% in FY26, based on Zacks estimates.

Image Source: Zacks Investment Research

Experiencing record cash flow this year, Salesforce also raised its operating cash flow guidance to 23%-25% growth compared to previous forecast of 21%-24% growth. Salesforce now expects free cash flow growth of 25%-27%, up from forecasts of 23%-26%.

Image Source: Zacks Investment Research

Price Performance & Valuation Comparison

Aforementioned, Salesforce is experiencing increased competition from Microsoft’s Dynamic 365 CRM and Oracle CRM. Attributed to fears of such, Salesforce’s stock is down -4% year to date which has trailed the broader indexes with Microsoft and Oracle shares up +9% and +33% respectively.

Image Source: Zacks Investment Research

At current levels, Salesforce’s stock trades at 25.9X forward earnings and at a slight premium to the S&P 500’s 23.6X. Salesforce does trades below Microsoft’s 31.6X forward earnings multiple but above Oracle’s 22.5X.

Image Source: Zacks Investment Research

Takeaway

For now, Salesforce lands a Zacks Rank #3 (Hold). More upside in Salesforce’s stock will depend on the trend of earnings estimate revisions following its Q2 report which should be positive considering the company raised its profit guidance.

This could lead to a buy rating for Salesforce’s stock as fears of increased competition from Microsoft and Oracle do appear to be overdone when looking at the company’s attractive growth trajectory.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.