After reporting Q1 results after market hours last Thursday and falling -18% on Friday for what was its worst trading day since 2018, the post-earnings dip in Dell Technologies DELL stock is starting to look like a buying opportunity.

To that point, Dell was added to the Zacks Rank #1 (Strong Buy) list today as Q1 EPS of $1.27 still topped expectations by 1% despite falling -4% from $1.31 a share in the comparative quarter. This comes as investors have had lofty hopes for Dell’s ability to increase profits as a critical player in the landscape of artificial intelligence with the company having a partnership with Nvidia NVDA in this regard and providing servers that propel AI solutions.

Given that Dell’s stock has soared to well over $100 a share, its Q1 EPS may have been somewhat underwhelming but earnings estimate revisions have trended higher in the last week which suggests it’s an ideal time to buy.

Image Source: Zacks Investment Research

Healthy Correction

Corrections can be healthy and despite the recent dip, DELL has still soared +72% year to date and is now sitting on +200% gains over the last year which has slightly edged Nvidia’s impeccable price performance while largely outperforming the broader indexes.

Image Source: Zacks Investment Research

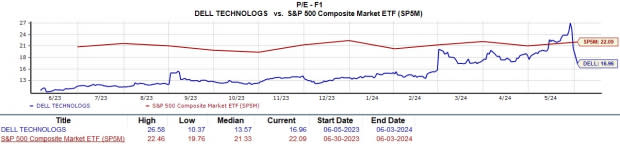

More tempting is that Dell’s stock is back at a very reasonable 16.9X forward earnings multiple which is well below its high of 25.5X over the last year and closer to the median of 13.5X. With rising EPS estimates offering support to the notion that DELL trades at a discount to its Zacks Computers-IT Services Market’s forward P/E average of 25.2X, it’s also noteworthy that this is pleasantly below the S&P 500’s 22X and Nvidia’s 42.8X.

Image Source: Zacks Investment Research

Checking Dell’s Growth & Outlook

Based on Zacks estimates, Dell’s total sales are projected to be up 9% in its current fiscal 2025 and are forecasted to rise another 8% in FY26 to $104.23 billion. Plus, annual earnings are slated to increase 9% in FY25 as well and are forecasted to climb another 23% in FY26 to $9.61 per share.

Furthermore, FY25 and FY26 EPS estimates have continued to trend higher over the last month and are up 2% and 1% in the last seven days respectively.

Image Source: Zacks Investment Research

Bottom Line

Buying the post-earnings dip in Dell’s stock looks advantageous considering its attractive P/E valuation and the positive trend of earnings estimate revisions. Notably, the average Zacks Price Target of $151.07 a share suggests 14% upside in Dell’s stock from current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.