(Bloomberg Opinion) — Ever since the trade war broke out last year, economists have been scribbling up extensive lists of winners and losers.

The common refrain has been that China will suffer the most, followed by economies dependent on its demand, such as South Korea. The likes of Indonesia and its Southeast Asian neighbors should be spared, because the products they send to China don’t end up assembled and repackaged on the mainland, and then resold to the U.S.

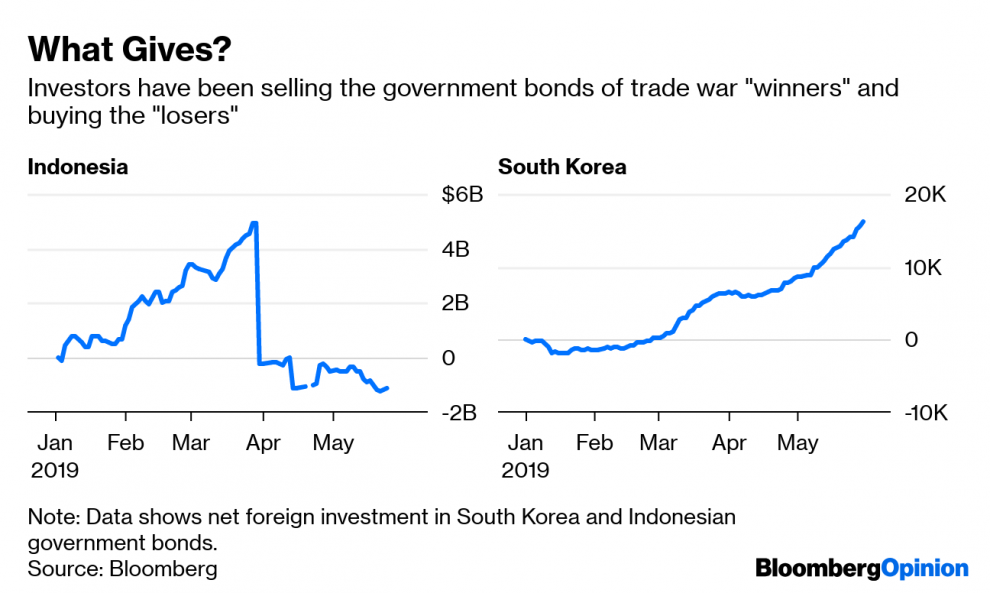

The bond market, however, sees things very differently.

Foreigners are gobbling up U.S. dollar bonds from risky, first-time issuers in Chinese cities so remote you’d need Google Maps to find them. The strong demand even prompted China’s state planner to curb issuance. This is a sharp reversal from the past, when market watchers speculated that the debt of so-called local government financing vehicles would precipitate the country’s “Minsky Moment,” a sudden collapse that follows a period of heavy borrowing.

In May, investors from abroad also accelerated their purchases of South Korean debt, despite the economy’s recent downturn. In the first quarter, South Korea’s grew only 1.8%, sharply below last year’s 2.7%; yet its central bank refuses to cut interest rates, stubbornly holding on to its unrealistic growth forecast of 2.5% GDP for the year.

In Jakarta, meanwhile, optimism is in the air. Reform-minded Joko Widodo was recently re-elected and is promising to spend more than $400 billion on infrastructure. Its real interest rate is the highest in the region, giving Bank Indonesia room to cut rates, a catalyst for bonds to rally. Yet foreigners are bailing.

On the surface, this is perplexing: Bond investors tend to run for safety during turbulent times. In the U.S., for instance, junk-rated bonds suffered their first month of negative returns this year, while investment-grade notes are still churning along. This isn’t happening in Asia.

That’s partly because, two decades after the Asian financial crisis, the greenback still rules supreme. During times of distress, protecting against sudden movements in certain currencies can get expensive quickly – particularly for nations that run fiscal and current-account deficits. In May, hedging the Indonesian rupiah with a one-year forward could set you back as much as 7%, eroding whatever capital gain you could earn from high-yielding Indonesian bonds. In that light, LGFV bonds look pretty appealing to dollar-based portfolio managers eager to beat benchmark returns.

Unlike economists and stock investors, bond traders don’t look at growth numbers, but rather exposure to credit risk. And China’s Ministry of Finance needs the bond market on its side this year – if only to finance $1 trillion worth of infrastructure projects. While we might see a few “technical” defaults every once in a while – most of which are repaid in a matter of days – Beijing hasn’t allowed any government-affiliated bonds to go under. Corporate bond yields with sovereign support? What a good deal!

The truth is, local governments in China are dirt poor. On average, one-third of their fiscal income comes from central-government handouts, according to Moody’s Investors Service. What we have in Asia right now is a bear rally. Traders are investing on faith, not facts.

Lately U.S. investors have gotten pickier. Having already sold off their junk bonds, they’ve started pulling out of investment-grade credit, too. Asian investors may want to take a cue, before the choice is made for them.

To contact the author of this story: Shuli Ren at [email protected]

To contact the editor responsible for this story: Rachel Rosenthal at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. She previously wrote on markets for Barron’s, following a career as an investment banker, and is a CFA charterholder.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”60″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.