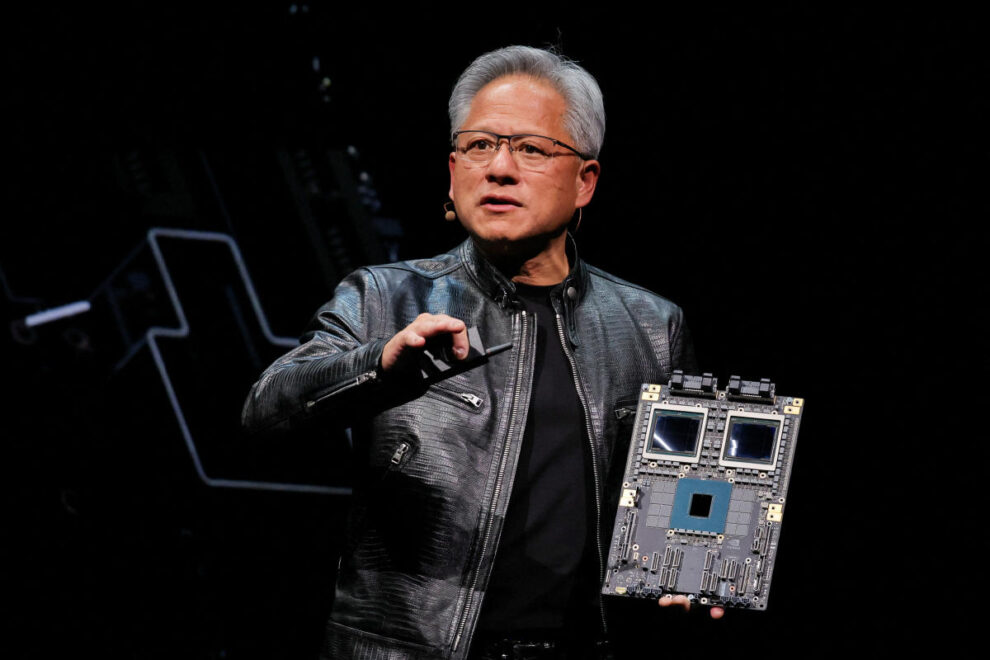

Shares in chipmaker Nvidia were down 3% in pre-market trading on Thursday following the release of the company’s highly anticipated third-quarter results.

While key metrics topped expectations, investors appeared disappointed by a decline gross margins and the company’s guidance on revenue.

Nvidia, the world’s largest company by market capitalisation, posted revenue of $35.1bn (£27.8bn) for the third quarter, which was well ahead of analysts estimates of $33.2bn. Earnings per share came in at $0.81, compared with expectations of $0.74.

Read more: FTSE 100 LIVE: Stocks muted as UK government borrowing jumps to £17.4bn in October

However, gross margins were lower quarter-on-quarter from 75.1% to 74.6% and Nvidia guided to revenue of $37.5bn for the final quarter, plus or minus 2%, which would be just ahead of Wall Street expectations of $37bn.

Dan Coatsworth, investment analyst at AJ Bell, said: “At face value, Nvidia has once again generated the kind of growth that most companies will never achieve in their lifespan.

“What’s troubled investors this time was a quarter-on-quarter decline in gross margins, with guidance for them to fall further in the coming quarter, and weaker than expected forward guidance for revenue.

“Investors have enjoyed stellar share price gains from Nvidia over the past two years and that’s made them think it is invincible,” he added. “In reality, a small decline in margins is not a reason to panic, particularly when they are still over 70% which many companies could only dream of.”

Shares in companies under India’s Adani Group plunged on Thursday after US prosecutors charged its billionaire owner Gautam Adani over an alleged $250m bribery scheme.

US federal prosecutors alleged that Adani and seven other defendants were involved in a scheme to bribe Indian officials to win contracts in relation to a solar power project.

Shares in the Adani Group’s flagship company, Adani Enterprises, had dropped nearly 23% by the end of the trading session in India. Meanwhile, energy company Adani Power (ADANIPOWER.NS) closed 9% lower, renewable energy firm Adani Green Energy (ADANIGREEN.NS) was down 19% and logistics company Adani Ports and Special Economic Zone (ADANIPORTS.NS) was 14% in the red.

Read more: Pound, gold and oil prices in focus: commodity and currency check, 21 November

These falls in the Adani Group companies weighed on India’s Nifty 50 (^NSEI), which closed the session 0.7% in the red.

In a statement on Thursday, Adani Group said that the allegations were “baseless”.

“The Adani Group has always upheld and is steadfastly committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions of its operations,” the conglomerate said.

US retail giant Target’s stock closed Wednesday’s session 21% in the red, after the company reported earnings that missed on forecasts, as well as slashing its full-year guidance.

Target posted earnings per share of $1.85 for the third quarter, which was nearly 12% down compared with last year. Total revenue of $25.7bn was just 1.1% higher than the same period last year.

For the fourth quarter, Target said it expected approximately flat comparable sales and adjusted earnings per share of $1.85 to $2.45. It said this translated to adjusted earnings per share in the range of $8.30 to $8.90 for the full year.

Read more: Stocks that are trending today

These results came a day after fellow retail giant Walmart (WMT) released another strong earnings report and raised its guidance.

On the back of both results, R5 Capital founder and CEO Scott Mushkin spoke to Yahoo Finance about why Target’s results told a different story than those from Walmart.

He said that Target’s shortcomings in execution create “a pretty big disconnect” between “what’s going on in the physical stores and what’s going on with the rest of the company, and we think that’s a sizable issue for Target.”

Chinese technology company Baidu also released disappointing quarterly results, reporting a 3% fall in third-quarter revenue on Thursday.

Baidu’s New York-listed shares were down 2% in pre-market trading on Thursday morning.

The company logged revenue of 33.6 billion yuan (£3.7bn) for the third quarter, which was 3% lower than the same period last year. Meanwhile, net income was up 14% to 7.6 billion yuan.

Read more: Rise in UK borrowing shows Reeves has ‘little wiggle room’ on spending

Robin Li, co-founder and CEO of Baidu, said: “Baidu core’s flattish third quarter top line reflected the ongoing weakness in our online marketing business, offset by the growth of our AI Cloud business.

“Despite the near-term pressures, we remain steadfast in our AI-focused strategy and are confident in our long-term trajectory,” he added. “As we further scale AI, we are emboldened to find how it can drive innovations and create value for consumers, enterprises and society at large.”

Shares in JD Sports slumped 13% on Thursday morning, after the UK sportswear retailer warned on profits.

The company said that given the “volatile trading environment” following October trading, it expected profit before tax and adjusted items to be at the lower end of its original guidance range of £955m ($1.2bn) to £1.04bn for the year.

In its trading update on Thursday, JD Sports said that third quarter revenue for the group was down 0.3% like-for-like.

Read more: December UK interest rate cut unlikely despite GDP slowdown

Régis Schultz, CEO of JD Sports Fashion Plc, said October’s volatile trading activity reflected “elevated promotional activity and mild weather”.

AJ Bell’s Coatsworth said: “JD Sports’ goal of scoring £1 billion in annual profits has been kicked down the road for the second year in a row.”

However, he added that “even if JD Sports does fall short of the £1 billion target again, there is no denying it is one of the biggest retail success stories of the past decade.”

Britvic (BVIC.L)

Grainger (GRI.L)

Jet2 (JET2.L)

Intuit (INTU)

Warner Music (WMG)

Gap (GAP)

Read more:

Download the Yahoo Finance app, available for Apple and Android.