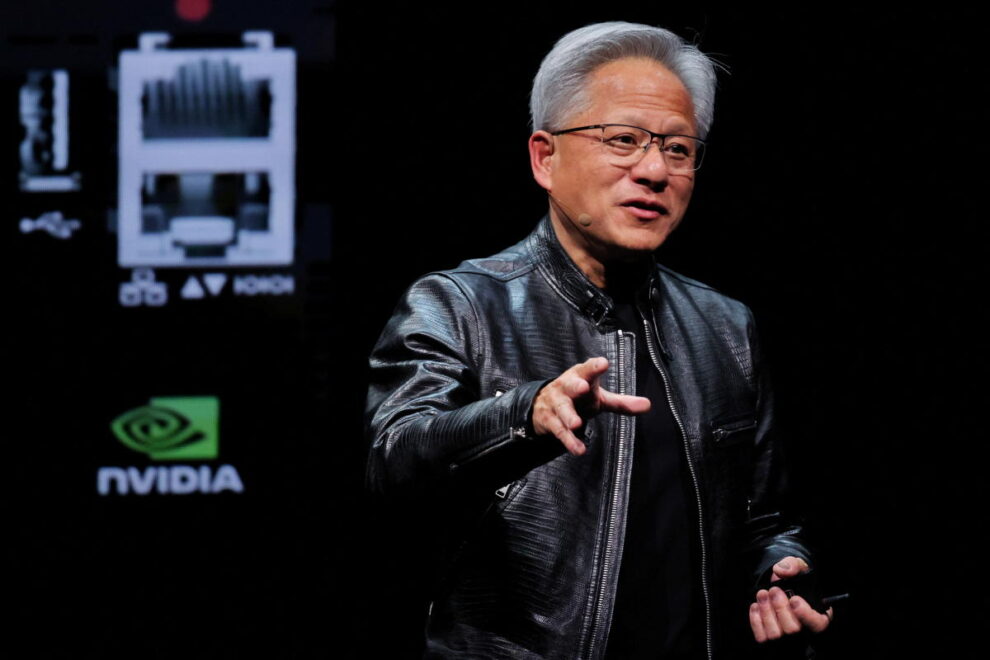

Nvidia (NVDA)

Shares in Nvidia bounced back in pre-market trading, recouping from Friday losses which were sparked by fears the AI darling’s rally might be losing steam.

New Street Research recently downgraded the stock to Neutral from Buy and set the stock’s price target at $135 (£104.41).

“We downgrade the stock to Neutral today, as upside will only materialise in a bull case, in which the outlook beyond 2025 increases materially, and we do not have the conviction on this scenario playing out yet.” New Street analyst Pierre Ferragu said.

Read more: Dollar slides as Biden quits US election race

ADVERTISEMENT

A recent report from Goldman Sachs suggested that AI might not be quite as game changing as the headlines suggest. And that investing big into AI stocks at today’s prices might disappoint.

“Do you know what this all reminds me of? Yes, the internet revolution, and the dot com bubble that it created. I lived, and invested, through it,” John Mackey, former CEO of Whole Foods Market, said.

Still, the chip manufacturer is moving markets, with Serve Robotics (SERV) seeing its stock price skyrocket by 140% on Friday following the announcement that Nvidia had acquired a substantial stake in the company, which specialises in low-emissions sidewalk delivery robots.

SAP’s Q2 2024 earnings will be a barometer for the tech sector, reflecting on enterprise software demand and digital transformation and so far, shares were lower in pre-market trading.

Analysts expect SAP SE to post quarterly earnings at $1.16 per share on revenue of $8.84bn. The company will release earnings after the markets close.

SAP delivered first-quarter 2024 non-IFRS earnings per share (EPS) of €0.81, which increased 8% year over year. The company reported total revenues on a non-IFRS basis of €8.04bn, which increased 8% year over year.

Our estimate for cloud revenues (on a non-IFRS basis) for the second quarter is pegged at €4.04bn, up 21.7% from the year-ago quarter,” analysts at Zacks Equity Research, wrote.

“Rise with SAP solution continues to gain significant traction and will aid the company in expanding its market share in the cloud enterprise resource planning (ERP) solutions space. In the last reported quarter, Cloud ERP Suite revenues were up 31% year over year,” they added.

Starbucks (SBUX)

Starbucks shares continue to surge – now in pre-market trading – after a report in the Wall Street Journal that activist investor Elliot bought a sizable stake in the company.

The activist hedge fund and coffee chain have been holding private discussions in the last weeks on ways to move the chain’s stock price higher.

The Journal could not learn the size of Elliott’s position nor its specific demands, but noted it was possible a settlement could be reached.

Elliott is one of the most prolific activist investors and one of the largest hedge funds in the world. The firm has taken up a number of sizable positions in recent months, including stakes at Southwest (LUV), SoftBank (9434.T), Johnson Controls (JCI) and Texas Instruments (TXN).

Starbucks’ stock price took a hit in April when the chain, the world’s biggest coffee company by location and sales, reported a drop in same-store sales for the first time in nearly three years.

Ocado jumped to top the FTSE 250 (^FTMC) after it announced a new deal with US partner Kroger.

The online supermarket and technology group was up more than 7pc after the American retailer placed an order for a “wide range of new automated technologies”.

The technologies include proprietary Ocado innovations such as On-Grid Robotic Pick, a robotic arm installed directly onto the warehouse’s grid that packs customer bags using advanced machine vision and sensing capabilities.

Ocado said its On-Grid Robotic Pick technology, which it is already rolling out in UK warehouses, is able to pick up and carry 70% more items than previous robots.

This means retailers can stock up to 50,000 different products each that can be dealt with by robot arms, which have the sensitivity to cope with both delicate and heavy items.

Chief executive Tim Steiner said: “We are delivering a step-change in warehouse automation and new levels of efficiency to our partners as global supply chains are under significant pressure to manage higher volumes and greater complexity, as well as challenges in labour cost and availability.

“Today marks another exciting milestone in our partnership with Kroger. Our current Customer Fulfilment Centres (CFCs) are already helping to deliver a game-changing quality of service to their customers across the USA.”

Download the Yahoo Finance app, available for Apple and Android.