Palantir (PLTR)

Shares in data-analytics company Palantir have more than doubled so far this year, and Bank of America (BofA) believes the stock will head even higher, Fortune reported.

BofA has maintained a buy rating on Palantir and raised its price target on the stock to $50 from $30, according to a note released last week. Pre-market open on Monday, Palantir was trading at over $35 per share.

BofA analysts reportedly said the bank believed Palantir’s “capabilities, technology and path forward” were facing a misunderstanding on Wall Street.

Read more: FTSE 100 LIVE: European markets cautious ahead of busy week for interest rate decisions

“The upcoming S&P 500 inclusion provides a watershed moment for institutional investors to revisit what they ‘know’ about PLTR,” they said.

Palantir shares jumped earlier this month following the news that it, along with server-maker Dell (DELL) and insurer Erie Indemnity (ERIE) are set to join the S&P 500 (^GSPC) before market open on 23 September.

Gambling software company Playtech has said it expects adjusted profits for 2024 to be slightly ahead of market expectations, mainly driven by strong performance in its business-to-business (B2B) division.

Playtech shares jumped nearly 8% on Monday on the back of the company’s trading update.

The company said its B2B division had performed well in the first half of the year, “driven by a combination of revenue growth in the Americas and a focus on tighter cost control”.

Playtech also announced that it had reached an agreement with Mexican sports betting company Caliente, to hold a 30.8% stake in Caliente Interactive, which will be the new holding company for their joint venture Caliplay.

The deal follows a legal dispute in which Caliplay stopped paying software and service fees to Playtech. However, Playtech said Caliplay had resumed paying the fees, with it having received more than €150m (£127m), or over 80%, of the unpaid amount.

Read more: Top fund picks for self-invested pensions

In the business-to-consumer side of the company, Playtech said it was in discussions with Flutter (FLTR.L) around the potential sale of its Italian division Snaitech.

Russ Mould, investment director at AJ Bell, said: “You can see why gambling software firm Playtech is considering getting shot of its consumer facing Snaitech business, based on today’s trading update.

“The business-to-business arm is the one driving earnings to be slightly above expectations for 2024 — supported by good growth across the Atlantic and tight cost control.”

Playtech is due to release its half-year results on 30 September.

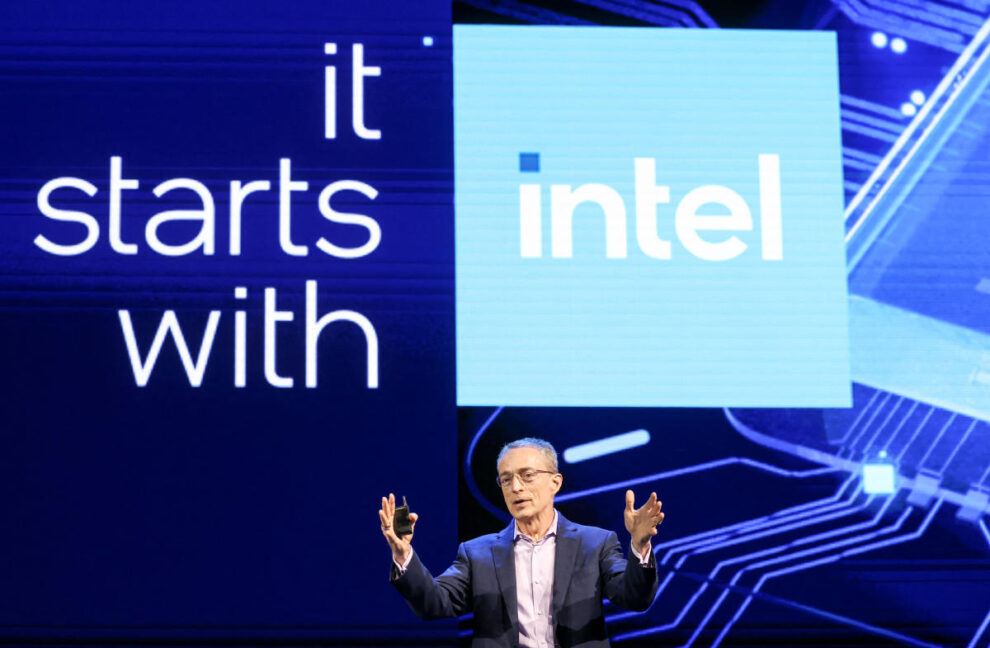

Shares in chipmaker Intel were up nearly 4% in pre-market trading. This followed news on Friday that the European Commission had given Poland the green light to grant the company more than $1.9bn in state aid to support its chip assembly and testing plant.

However, Intel has experienced challenges this year, with the stock slumping 61% year-to-date. The company recently announced it was planning to layoff more than 15% of its workforce, around 15,000 employees, as part of cost cutting measures.

“This is the biggest restructuring of Intel I’d say since the memory microprocessor decision four decades ago,” Intel CEO Pat Gelsinger told Yahoo Finance in early August.

Separately, Goldman Sachs analyst Toshiya Hari told Yahoo Finance that Intel faces an “uphill battle” to turn itself around and compete with the likes of Nvidia (NVDA), AMD (AMD), and Taiwan Semiconductor (TSM).

Read more: Stocks that are trending today

Hari rated the stock as a sell, as he believed the company needed to some time to get its technology on par with rivals.

Intel missed second-quarter estimates on sales, gross profit margins and earnings, citing more challenging market conditions and higher-than-expected costs to increase production of its artificial intelligence (AI) chips. The company also decided to suspend its dividend, which will come into effect in the fourth quarter of the year.

India’s biggest shadow bank Bajaj Finance floated its housing finance arm last week, with shares being oversubscribed by nearly 64 times in the initial public offering (IPO).

Bajaj Housing Finance raised $782m in its first day of bidding last Monday, making it the most sought-after IPO in India this year, as investors looked to tap into the country’s growing real estate market.

Shares in Bajaj Housing Finance more than doubled on Monday. The stock jumped 136% to 165 rupees (£1.49), compared with an offer price of 70 rupees.

In addition to sector demand, it also the reputation of its parent Bajaj Group that has bolstered the stock in its debut.

“The group has a proven track record of wealth creation,” said Pranav Bhavsar, co-founder of Trudence Capital Advisors Pvt, according to Bloomberg.

Download the Yahoo Finance app, available for Apple and Android.