One reason German hotel price-comparison site Trivago invested $10 million in Holisto is to resolve the “irritation” Trivago users feel when they get bounced around to many other sites to make a booking.

“The product gap is basically that we see user irritation with leaving our site and landing on dozens of different sites,” Trivago CEO Johannes Thomas told analysts Wednesday during the company’s second quarter earnings call.

That’s a flaw that Trivago is trying to address in the metasearch model.

When Trivago offers a hotel deal and users navigate to third-party advertiser sites to book, they encounter landing pages of varying quality, he said, adding that’s an especially acute problem on a mobile phone.

To address the issue before the pandemic, Trivago had a product called Express Booking, which gave customers — and advertisers — a landing page with a consistent users experience. Express Booking was a casualty of the pandemic, however, and discontinued.

But Trivago partnered with Holisto in 2022 to create a new user experience.

Thomas said Trivago can now offer advertisers, which are seeking to attract bookers, a co-branded “funnel,” which would lift their conversion rates i.e. turning lookers into bookers.

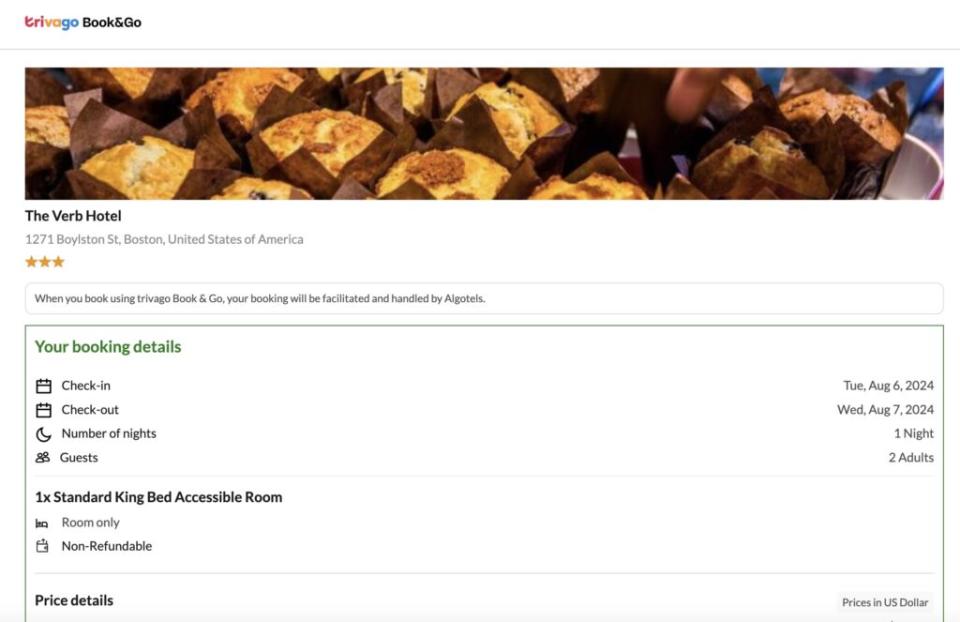

In a Skift interview after the earnings call, Thomas explained that Express Booking was “Trivago hosted, advertiser branded.” He said the new product for advertisers, Trivago Book&Go, provides a standardized booking experience, is Trivago branded, and is more integrated into Trivago than was Express Booking.

Holisto, which created the Trivago Book&Go product, is the only advertiser using it now, but Trivago will reach out to other advertisers, Thomas said.

The following screenshot is an example: It is branded Trivago Book&Go, but powered by the advertiser, Algotels, which is a Holisto brand. Algotels facilitates the booking, and will send the email conformation.

“So you have the less-known booking sites like Priceline that might be known in the U.S., but it’s not known in Europe,” Thomas said during the earnings call. “And then we would have a co-branded booking funnel that gives Priceline more trust and would also be part of lifting conversion.”

So the goal is to make the booking more fluid and consistent for users, turn them into repeat customers, and increase conversions for advertisers.

Google Provides Headwinds

Trivago officials said Google started making changes to Google Hotels and advertising formats a year ago, and they took a toll on Trivago’s performance marketing and revenue in the second quarter of 2024, particularly in Europe. However, Trivago officials expressed satisfaction with the progress of its branded advertising campaigns.

In the Skift interview, Thomas said Google Hotels took more market share, and Google’s Property Promotion Ads downplayed text ads, which were a source of Trivago revenue. Thomas said because of Trivago’s renewed push into branded TV ads and video, Google is a declining factor in Trivago’s revenue mix, and the company should be done with the worst of the Google impact in early 2025.

The Numbers and Outlook

In the second quarter, Trivago’s net loss, driven by higher expenses and Google headwinds, was $5.3 million, compared with net income of $6.28 million a year earlier. Revenue fell 5% to $128.6 million in the second quarter.

On the upside, officials forecast that revenue will increase in the second half of 2024, and the company will achieve adjusted EBITDA break even for the full year.

The company notched a $5.8 million adjusted EBITDA loss in the second quarter.

Get breaking travel news and exclusive hotel, airline, and tourism research and insights at Skift.com.