The Trump administration is revising its approach to regulating lenders who provide loans insured by the Federal Housing Administration in a bid to bring banks back into this market.

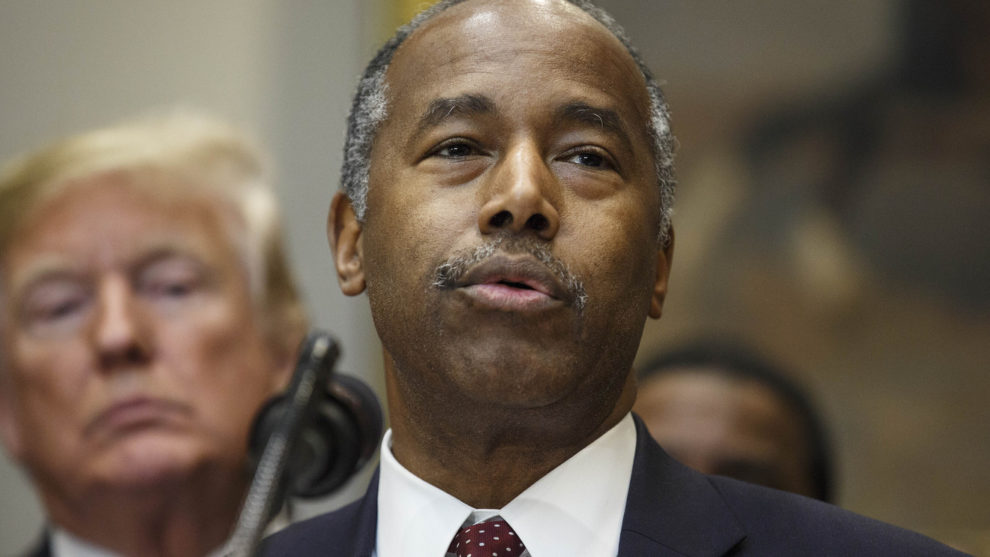

U.S. Secretary of Housing and Urban Development Ben Carson and Attorney General William Barr released a memorandum of understanding (MOU) outlining how their agencies will approach lenders who violate FHA regulations.

Specifically, HUD and the Justice Department will reduce how frequently they bring claims against companies based on the False Claims Act, a law that makes companies liable if their actions defraud the federal government.

“The market hates uncertainty,” Carson told attendees at a mortgage industry conference Monday while announcing the agreement with the Justice Department. “This MOU is part of a comprehensive plan to bring greater clarity to regulatory expectations within the FHA program.”

The FHA loan program is designed to serve low- to moderate-income Americans by offering them mortgages that require lower down payments and credit scores.

Moving forward, HUD will initially take administrative action against any lenders that violate financial regulations in an effort to avoid settlements under the False Claims Act. In some cases, HUD may still approach the Justice Department about a possible False Claims Act violation. And in instances where a third party alerts the Justice Department about possible violations, the two departments will coordinate their investigations.

Under the Obama administration, the Justice Department reached large settlements with many lenders including Bank of America BAC, +0.38% , Wells Fargo WFC, +0.16% and JPMorgan Chase JPM, +0.38% under the auspices of the False Claims Act. The settlements were intended to resolve issues related to FHA lending activity at these banks, such as underwriting loans that did not comply with federal rules. Quicken Loans previously sued the federal government after being threatened with a fine for a supposed False Claims Act violation.

All told the Justice Department collected around $7 billion through these settlements from lenders, FHA Commissioner Brian Montgomery said Monday, according to a report from housing industry news website HousingWire.

Banks have largely exited the FHA market

Banks previously comprised a significant share of the FHA market, but have pulled back in recent years. Back in 2010, nearly 44% of FHA mortgages were written by bank. As of 2018, depository banks only account for roughly 13% of the market.

The fear of being sued by the federal government for alleged violations of FHA regulations is what has steered banks and credit unions away from this market, Carson argued Monday. “We know that at least part of the reason for the decade-long decline in depository participation is because of uncertainty about how federal agencies apply the False Claim Act,” he said.

Banks themselves have echoed this sentiment. JPMorgan CEO Jamie Dimon criticized the FHA’s use of the False Claims Act (FCA) in levying fines against FHA lenders. “A first step to increasing participation in the FHA program could be the communication of support for only using the FCA, as originally intended, to penalize intentional fraud rather than immaterial or unintentional errors,” Dimon wrote in his annual letter back in 2017.

While non-bank lenders — meaning mortgage companies that don’t also hold consumers’ deposits — have risen up to fill some of that gap, government officials have argued that banks’ pull-back from this market may be hurting consumers. In particular, the pull-back has affected lower-income and first-time home-buyers who tend to seek FHA loans because they require lower down payments. It has also increased the risk to the FHA, because non-bank lenders aren’t always as well-capitalized as banks that hold deposits, meaning they are more likely to suffer losses in instances where a borrower forecloses.

“This trend impacts consumer access to credit and increases counterparty risk to FHA’s Single Family mortgage insurance programs,” the FHA said in its most recent annual report on the state of its mortgage insurance fund.