Getty Images

Getty Images

The Consumer Financial Protection Bureau will focus more on educating Americans to protect themselves, the agency’s new director said Wednesday, laying out a more conservative focus for a department founded to level the playing field between the financial services industry and ordinary Americans.

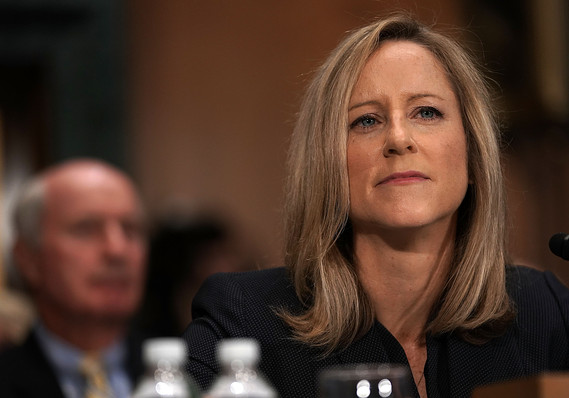

“Empowering consumers to help themselves protect their own interests and choose products and services that best fit their needs is vital to preventing consumer harm and building financial well-being,” Kathy Kraninger, who took over the agency in December, said at a panel discussion sponsored by the Bipartisan Policy Center think tank in Washington on Wednesday.

That contrasts with the vision of the CFPB’s first director, Richard Cordray. Under Cordray’s leadership, the agency, created in the wake of the 2008 financial crisis, went aggressively after wrongdoers, with fines in the billions of dollars. One of its biggest successes was uncovering the customer mistreatment at Wells Fargo WFC, -0.21% But that stance earned criticism from Republicans and industry participants.

When Kraninger was confirmed by the Senate in November to run the CFPB, she had little experience in financial services, and was working as a program associate director at the Office of Management and Budget under Mick Mulvaney, then the CFPB’s acting director.

On Wednesday, Kraninger dispelled one big idea. Based on her findings from an extensive “listening tour,” she believes there’s solid consensus that “the CFPB’s mission and the agency itself are critical to our economy and are not going away.”

She also acknowledged that “bad actors harm consumers and undermine the integrity of markets.”

Those comments came just one day after the New York Times published an extensive investigation into Mulvaney’s controversial 13-month tenure at the agency, titled “Mick Mulvaney’s Master Class in Destroying A Bureaucracy from Within.” Among other things, the Times article details Mulvaney’s belief that Americans should have access to some financial products most consumer advocates consider predatory, like payday loans.

Kraninger on Wednesday was more heartfelt in describing the mission of protecting consumers. But she stuck to a clearly conservative vision that stands in stark contrast to the progressives who helped establish the CFPB.

The CFPB wants to measure consumer well-being, she said. “Core to that is control over day-to-day and month-to-month personal finances, as well as the capacity to absorb financial shocks.” To do that, she suggested, “consumer skills and confidence in those skills” is important. “For example, fewer than half of Americans set aside money for their children’s college education. More and more people reach retirement with incomes and savings that simply won’t meet their needs.”

Kraninger spoke of being personally moved by a Federal Reserve study that found four in 10 Americans couldn’t cover an emergency expense of $400.

But it is unclear how more education about emergency savings can help Americans save more for retirement in an era of stagnant wage growth and high inflation for basic needs like shelter.

Read: Still too damn high: how can we address rising rents?

Kraninger did acknowledge a role for CFPB regulation, saying that “supervision is the heart of the industry,” while also speaking of the need to be more transparent and deliberate in rule-making. For example, she wants to update the Fair Debt Collection Practices Act to bring it in line with modern technology.

Many of the staff members with whom she’s spoken have told her that in the early days of the bureau so many people pressed so much on them, and they tried to be all things to all people. Under her leadership, Kraninger said, the CFPB will be more “deliberate.” She has no plans now to reduce staff, she said.