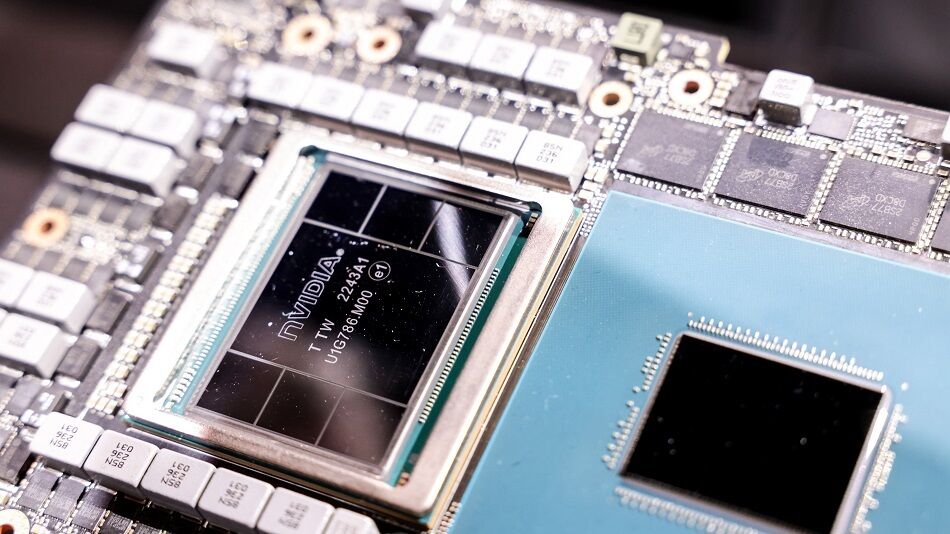

(Bloomberg) — Stocks in Asia slipped as Nvidia Corp. earnings lacked the wow factor to impress investors, while Chinese results helped extend a selloff in the country’s tech companies.

Most Read from Bloomberg

MSCI’s Asia-Pacific gauge declined as much as 0.6%, dragged by chipmakers Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc. Futures on the Nasdaq 100 Index were down 0.8% in Asia. Nvidia slumped more than 8% in post-market trading following a sales forecast that missed the highest analyst estimates.

The outlook threatens to cool an AI frenzy that has powered global tech stocks for much of this year. Nvidia is a key beneficiary of a race to upgrade data centers to handle AI software, and its sales forecasts have become a barometer for that spending boom. Chinese equity benchmarks fell as glum earnings underscored sluggish consumer demand in the world’s no. 2 economy.

“Nvidia had a good result yet share price was down on the back of big expectations for next year,” said Jun Bei Liu, a portfolio manager at Sydney-based Tribeca Investment Partners Pty Ltd. “It is expected to drag down performance of Asian AI stocks due to its close correlation, but its result actually demonstrated continued demand for the sector.”

Treasury 10-year yields steadied after rising one basis point to 3.84% in the previous session. The dollar edged lower after gaining broadly amid speculation investors were buying the US currency for portfolio re-balancing.

The New Zealand dollar strengthened after the country’s business confidence jumped to a 10-year high. In Japan, a sale of two-year sovereign notes saw the highest bid-cover ratio since 2019 after a recent increase in yields attracted investors.

Among major Chinese earnings, EV maker Li Auto Inc. missed estimates, spurring a near 15% slump in its share prices. Peer BYD Co. also fell despite delivering a 33% jump in profit. Meituan was an outlier, jumping after the delivery service provider beat estimates and unveiled a $1 billion buyback.

Adding to the sour mood, UBS Group AG downgraded its forecast for China’s growth for this year and the next, citing a deeper-than-expected property market slump.

Bar Too High?

While Nvidia’s guidance underwhelmed, revenue more than doubled to $30 billion in the fiscal second quarter, which ended July 28. And the Santa Clara, California-based company’s board approved an additional $50 billion in stock buybacks.

Later Thursday, investors will shift focus to key US data including a growth reading, personal consumption and weekly jobless claims to help firm bets the Federal Reserve will quickly ease policy this year. Fed Bank of Atlanta President Raphael Bostic said it “may be time to cut” but he’s still looking for additional data to support lowering interest rates next month.

In commodities, oil steadied after a two-day drop, with stock market losses offsetting a drawdown in US stockpiles and supply disruptions in Libya. Gold traded just below its record high, on course for a monthly gain.

Key events this week:

-

Eurozone consumer confidence, Thursday

-

US GDP, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

-

Eurozone CPI, unemployment, Friday

-

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.4% as of 12:57 p.m. Tokyo time

-

Nikkei 225 futures (OSE) fell 0.1%

-

Japan’s Topix was little changed

-

Australia’s S&P/ASX 200 fell 0.4%

-

Hong Kong’s Hang Seng fell 0.6%

-

The Shanghai Composite fell 0.5%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.7%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro rose 0.1% to $1.1136

-

The Japanese yen was little changed at 144.53 per dollar

-

The offshore yuan rose 0.2% to 7.1163 per dollar

-

The Australian dollar rose 0.2% to $0.6797

Cryptocurrencies

-

Bitcoin fell 0.4% to $59,138.22

-

Ether fell 0.6% to $2,522.41

Bonds

-

The yield on 10-year Treasuries was little changed at 3.83%

-

Japan’s 10-year yield was unchanged at 0.895%

-

Australia’s 10-year yield advanced three basis points to 3.96%

Commodities

-

West Texas Intermediate crude rose 0.2% to $74.69 a barrel

-

Spot gold rose 0.4% to $2,515.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess, Kurt Schussler and Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.