(Bloomberg) — Taiwan Semiconductor Manufacturing Co.’s revenue rose 33% last month, in a positive signal to investors betting on a smartphone market recovery and sustained demand for Nvidia Corp.’s AI chips.

Most Read from Bloomberg

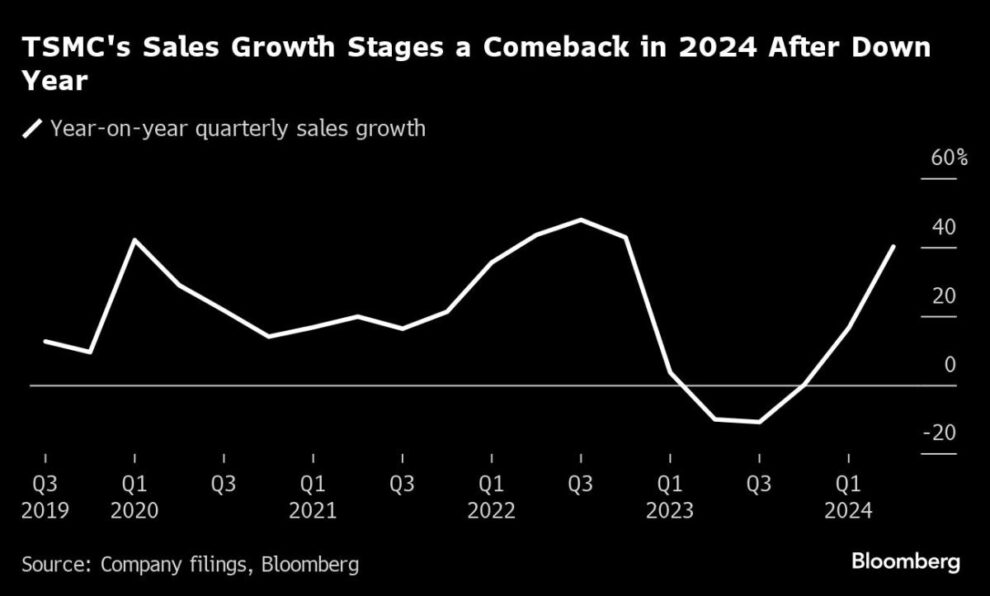

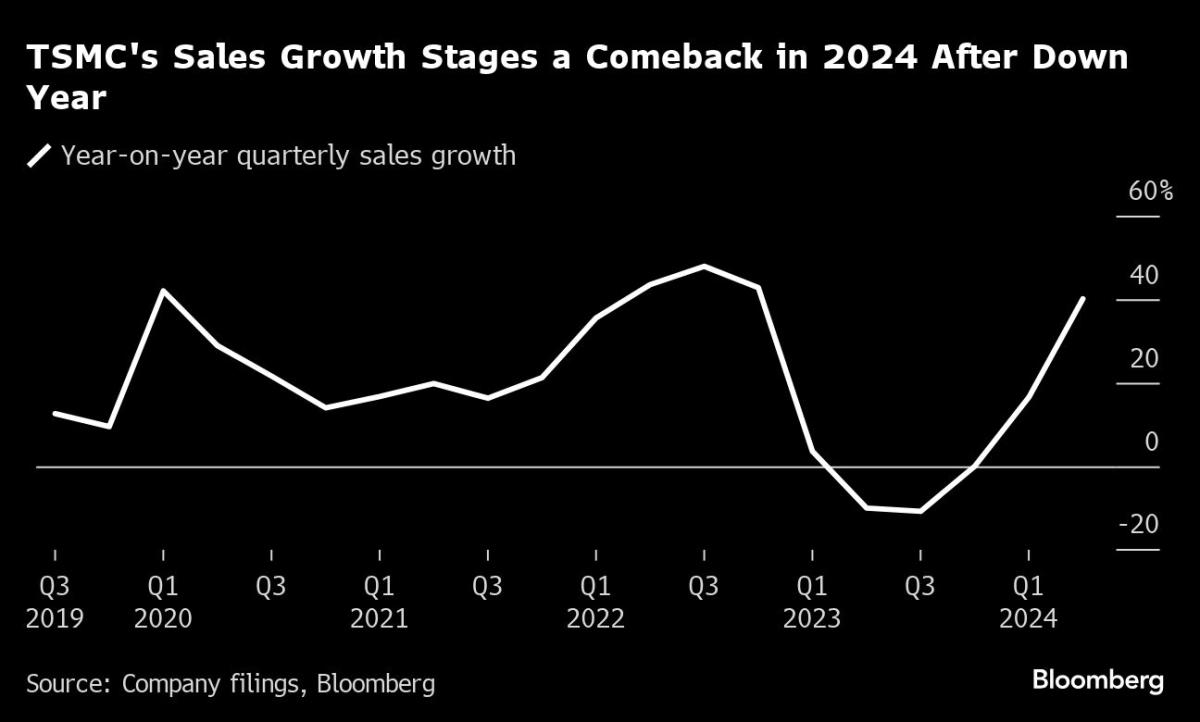

Sales reached NT$250.9 billion ($7.8 billion) in August, slowing from the previous month’s 45% growth pace. For the third quarter, analysts expect TSMC’s revenue to grow 37%, extending a recovery from the post-Covid depths of 2023.

While just a month’s snapshot, the results could assuage concerns about whether the market has over-estimated the durability of AI infrastructure spending. Nvidia’s shares shed some $279 billion on Sept. 3 in their biggest single-day loss of value, after reporting earnings that failed to live up to the loftiest expectations.

Taiwan’s largest company now makes more than half of its revenue from high-performance computing, the segment of its business driven by AI demand.

Nvidia’s go-to chipmaker is also the main manufacturer for the iPhone’s main processor. Apple Inc. on Monday unveiled the iPhone 16, built for AI “from the ground up” but with capabilities that will be gradually added to the device via software updates. Wall Street is betting on a bounce-back in demand for mobile devices.

What Bloomberg Intelligence Says

Apple’s adoption of Wi-Fi 7 on the iPhone 16 and 16 Pro should accelerate technology penetration and boost demand for TSMC’s N6 (7-nanometer) and N4 (5-nanometer) nodes already used by Broadcom and MediaTek and others for Wi-Fi 7 chip production. A18 and A18 Pro processor performance gains align with our expectations, reinforcing a positive outlook for TSMC’s N3E node sales growth.

– Charles Shum, analyst

Click here for the research.

TSMC offered an upbeat assessment of its business and prospects when it last reported earnings. In July, the world’s largest contract chipmaker raised its full-year growth outlook to beyond the maximum mid-20% it had guided toward previously.

As the market improves, Chief Executive Officer C.C. Wei is spearheading a major global expansion.

The company has flagged early progress in ramping up a project in Arizona, is considering a third fab in Japan, and broke ground a few weeks ago on a €10 billion German facility.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.