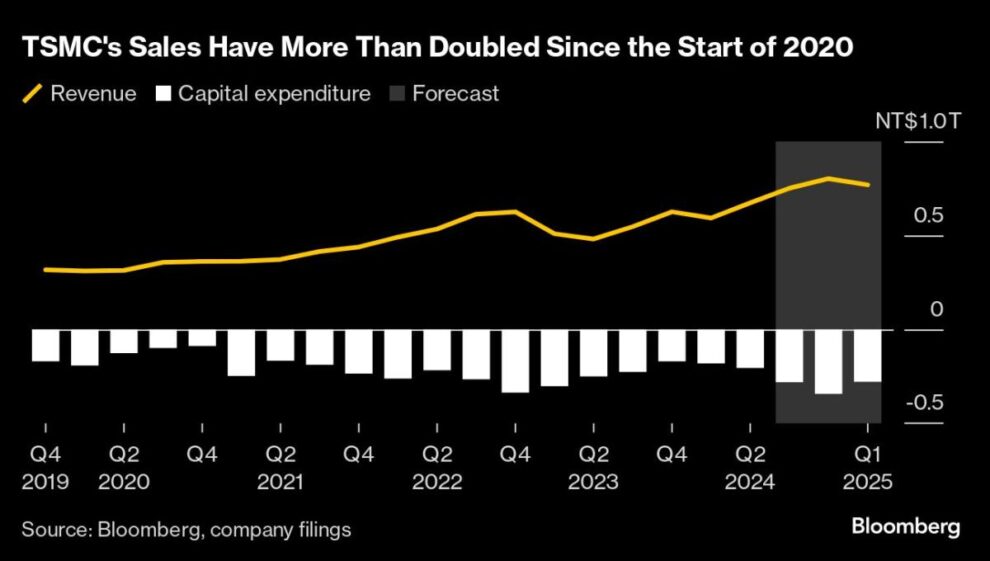

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. posted a better-than-projected 54% rise in quarterly earnings after strong sales of Nvidia Corp. AI chips offset a sagging mobile industry.

Most Read from Bloomberg

The main chipmaker to Nvidia Corp. and Apple Inc. reported September-quarter net profit of NT$325.3 billion ($10.1 billion), versus an average estimate for NT$299.3 billion. That followed a previously reported 39% climb in revenue during the period.

TSMC’s shares have surged more than 70% this year, outpacing many of Asia’s biggest tech firms in a reflection of outsized expectations around its AI business. Taiwan’s largest company raised its outlook for 2024 revenue in July, underscoring expectations for sustained spending on AI infrastructure from the likes of Microsoft Corp. and Amazon.com Inc. Steady adoption of artificial intelligence should also help fuel sales of iPhones and other gadgets.

While official trading of TSMC’s American depositary receipts won’t begin for a few hours, the ADRs are up about 4.5% on Robinhood’s overnight trading platform. TSMC is popular among US retail investors seeking to bet on the AI theme. Shares of Japanese chip gear makers including Lasertec Corp. pared losses in Tokyo after TSMC reported.

For a liveblog on TSMC’s earnings, click here.

Still, investors will be watching for deviations in outlook after major supplier ASML Holding NV reported only half the orders analysts estimated. The chipmaking gear maker blamed slower-than-expected recovery in the automotive, mobile and PC markets, impacting expansion plans for chip plants. AI remains a bright spot, executives said.

What Bloomberg Intelligence Says

TSMC’s short- to medium-term revenue outlook remains solid despite the potential slowdown in global fabrication-capacity growth implied by ASML — its largest tool supplier — reporting a 3Q book at half the expected level. Strong demand for TSMC’s 2- and 3-nanometer technologies from Nvidia, AMD, Apple and Qualcomm provide an offset. TSMC’s superior production yields, improving EUV machine productivity and leadership in 2.5D and 3D packaging offer further sales support.

– Charles Shum, analyst

Click here for the research.

Even before ASML, some investors have grown cautious about the sustainability of global AI spending. They question whether big tech firms like Meta Platforms Inc. and Alphabet Inc. will continue to splash out on AI chips and data centers without a truly killer AI application.

For now, TSMC appears to be pursuing a rapid international expansion.

It’s planning more plants in Europe with a focus on the market for artificial intelligence chips, according to a senior Taiwanese official. That’s on top of construction underway in Japan, Arizona and Germany.

–With assistance from Vlad Savov and Cindy Wang.

(Updates with share action in the fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.