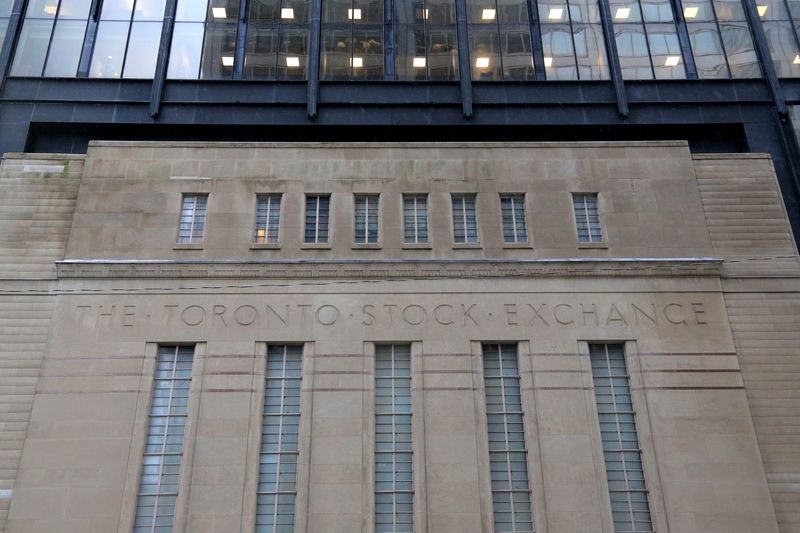

(Reuters) -Futures tied to Canada’s main stock index were subdued on Thursday, while TD Bank and CIBC became the latest domestic lenders to report a rise in third-quarter profit.

Futures on the S&P/TSX index fell 0.05% by 06:59 a.m. ET (1007 GMT) following the composite index’s record close on Wednesday, led by blockbuster earnings from Canada’s largest bank, Royal Bank of Canada.

TD Bank’s bottomline was helped by lower cash reserves for bad loans, while Canadian Imperial Bank of Commerce benefited from robust performance in its capital markets division.

Earlier this week, the country’s fourth- and fifth-biggest lenders, Bank of Montreal and Bank of Nova Scotia, also posted upbeat quarterly earnings and set aside smaller-than-expected sums of money to cover potential loan losses as trade-related risks between Canada and the United States eased.

In the U.S., AI bellwether Nvidia‘s revenue forecast fell short of heightened investor expectations, sending its shares down 1.9% in premarket trading.

In commodities, crude prices fell amid lower U.S. fuel demand expectations as the summer travel season ended. The resumption of Russian supply to Hungary and Slovakia via the Druzhba pipeline also weighed. [O/R]

Gold held firm near a more than two-week peak due to a soft dollar and growing U.S. rate cut bets. Copper prices also gained. [GOL/] [MET/L]

U.S. weekly jobless claims and the second estimate of quarterly gross domestic product are due later in the day.

FOR CANADIAN MARKETS NEWS, CLICK ON CODES:

TSX market report [.TO]

Canadian dollar and bonds report [CAD/] [CA/]

Reuters global stocks poll for Canada

Canadian markets directory

($1 = 1.3817 Canadian dollars)

(Reporting by Nikhil Sharma; Editing by Shreya Biswas and Sahal Muhammed)