Insightful 13F Filing Analysis for Q2 2024 Reveals Strategic Portfolio Adjustments

Tweedy Browne (Trades, Portfolio), renowned for its value investing approach, has recently disclosed its 13F filing for the second quarter of 2024. The firm, steered by a seasoned Management Committee including Jay Hill, Thomas H. Shrager, John D. Spears, and Robert Q. Wyckoff, Jr., continues to execute its strategy of investing in undervalued U.S. and foreign equity securities. With a history linked to Benjamin Graham, Tweedy Browne (Trades, Portfolio) maintains a focus on developed markets and hedges against foreign currency exposure to safeguard its investments.

Significant Increases in Key Holdings

Tweedy Browne (Trades, Portfolio) has strategically increased its positions in three stocks during the quarter. Notably:

-

CNH Industrial NV (NYSE:CNH) saw an impressive addition of 14,280,501 shares, bringing the total to 15,362,043 shares. This massive 1,320.38% increase in shares now constitutes a 6.66% impact on the portfolio, with a total value of $155,617,500.

-

FMC Corp (NYSE:FMC) also experienced a substantial boost with an additional 651,957 shares, increasing the total to 3,159,056 shares. This adjustment represents a 26% increase in share count, totaling a value of $181,803,670.

Complete Exits from Positions

In a move to optimize the portfolio, Tweedy Browne (Trades, Portfolio) has completely exited from:

-

Carlisle Companies Inc (NYSE:CSL), where all 1,995 shares were sold, impacting the portfolio by -0.04%.

Reductions in Existing Investments

The firm also made significant reductions in several holdings, including:

-

Autoliv Inc (NYSE:ALV) saw a reduction of 490,808 shares, a 50.98% decrease, impacting the portfolio by -2.77%. The stock traded at an average price of $118.93 during the quarter and has seen a -23.38% return over the past three months and -13.03% year-to-date.

-

Alphabet Inc (NASDAQ:GOOG) was reduced by 265,503 shares, a 64.21% decrease, impacting the portfolio by -1.9%. The stock’s average trading price was $170.1 during the quarter, with a -3.61% return over the past three months and a 16.47% increase year-to-date.

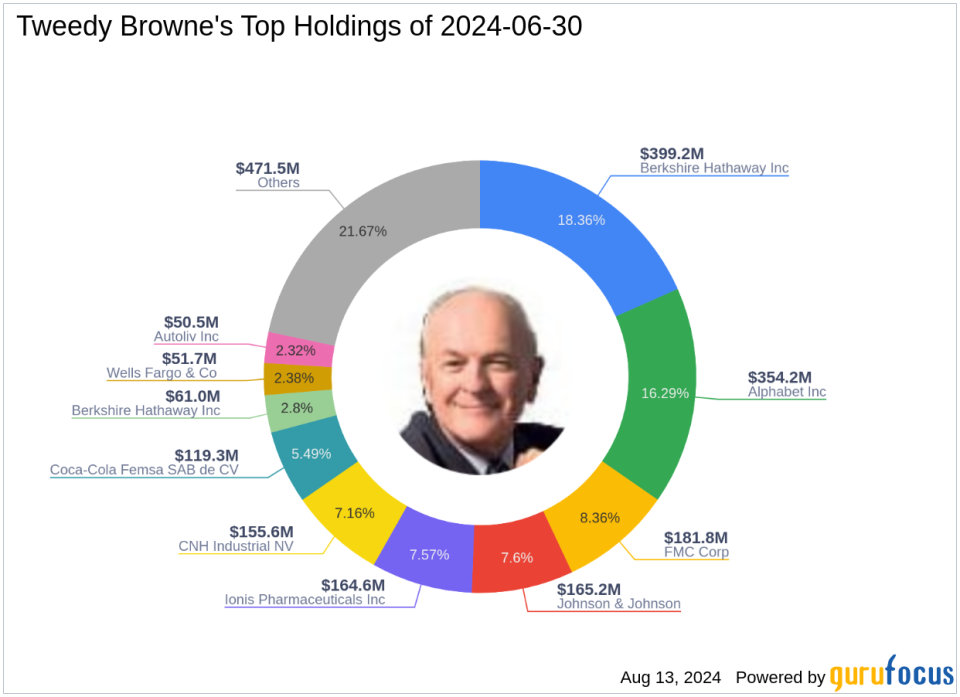

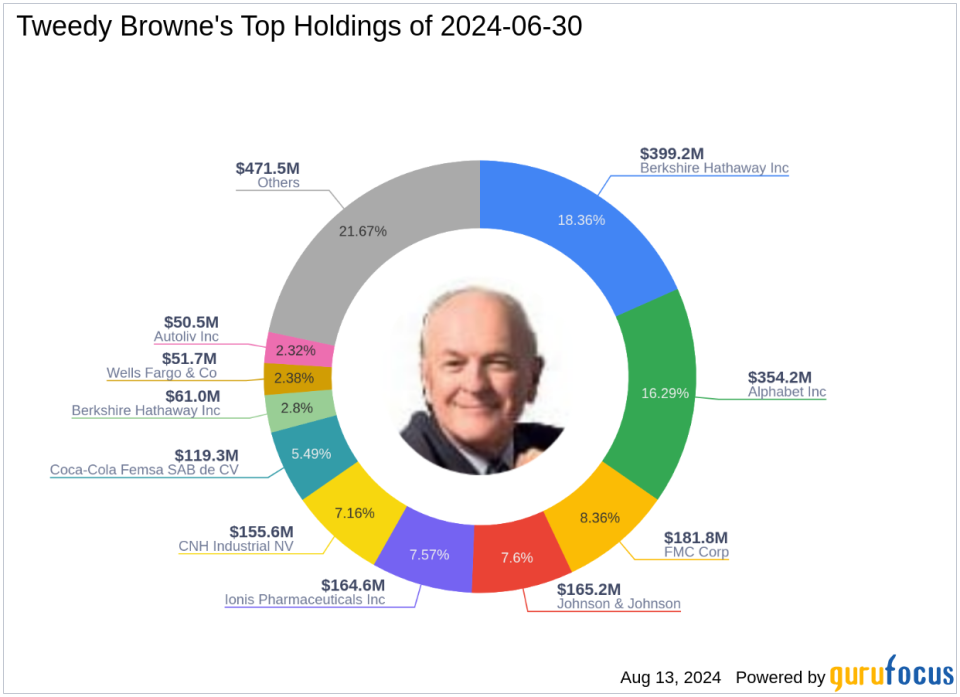

Portfolio Overview and Sector Allocation

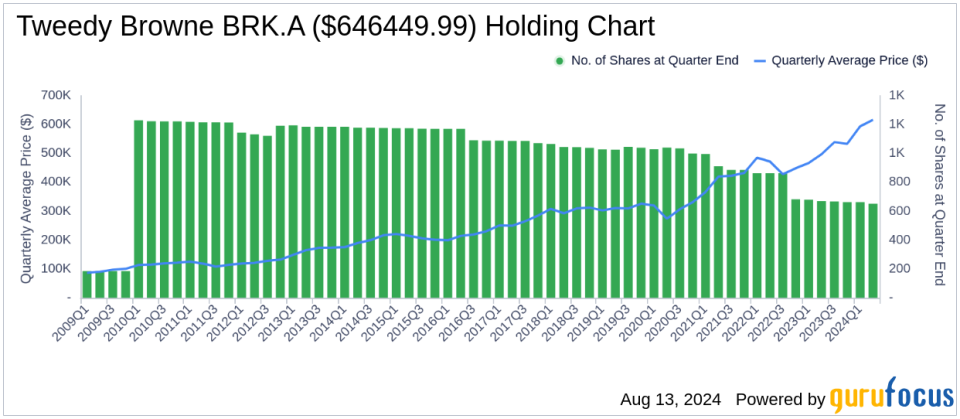

As of the second quarter of 2024, Tweedy Browne (Trades, Portfolio)’s portfolio comprises 44 stocks. The top holdings include 18.36% in Berkshire Hathaway Inc (NYSE:BRK.A), 16.29% in Alphabet Inc (NASDAQ:GOOGL), 8.36% in FMC Corp (NYSE:FMC), 7.60% in Johnson & Johnson (NYSE:JNJ), and 7.57% in Ionis Pharmaceuticals Inc (NASDAQ:IONS). The investments are predominantly concentrated across nine industries, including Financial Services, Healthcare, Communication Services, Industrials, Basic Materials, Consumer Defensive, Consumer Cyclical, Energy, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.