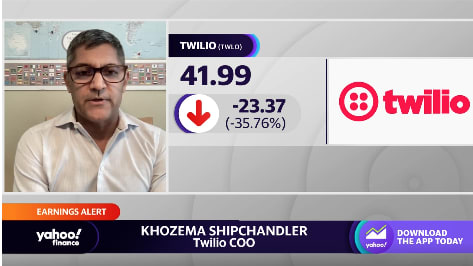

Twilio COO Khozema Shipchandler joins Yahoo Finance Live to discuss the sell-off in the company’s stock, earnings, growth, and maintaining profitability through cost-cutting measures.

Video Transcript

RACHELLE AKUFFO: Shares of Twilio plummeting after the communications software maker issued fourth quarter revenue guidance below estimates and posted a loss of $0.27 per share during the third quarter. The company saying it had more than 280,000 active customer accounts at the end of Q3, up 5,000 from the previous quarter. We’re joined by Kozema Chipchandler, Twilio’s COO. Thank you for joining us this afternoon. So as we’re seeing there, the stock really under pressure today. What do you think investors are perhaps not getting about this whole picture?

KHOZEMA SHIPCHANDLER: Yeah, first of all, thank you for having me. It certainly is a little bit of a humbling day with respect to the stock price, but I think, look, the financial framework for the company going forward is actually quite good. It’s a tough macro backdrop, no question about that. But as we look at our financial results, we put up a really strong Q3 in a tough macroeconomic environment.

We did take down some of our guidance for Q4 and provided a medium-term range on the revenue side that was 15% to 25% up over the next three to five years. That’s how we have kind of defined it. And we committed to being a profitable company over that time frame as well. So I certainly understand that there are some macro dynamics here and potentially some dynamics that investors are playing in a wait and see fashion. But we feel really good about the setup of the company and feel really good about the products and customers that we’ve got.

SEANA SMITH: Khozema, when you take a look at the performance in the stock today, obviously, Wall Street a little bit concerned about some of the macro headwinds not only facing Twilio, but more so this sector at large. Are you seeing, I guess, any delayed purchase decisions or longer sales cycles as a result? And do you potentially seeing those headwinds get worse here over the next quarter or two?

KHOZEMA SHIPCHANDLER: Yeah, I mean, I guess it’s hard to imagine them getting too much worse, but we are definitely seeing some sector impacts, right? Not surprisingly, we’re seeing some stuff in crypto. We’ve seen some impacts in social media. We’ve seen some in consumer on demand, as well as retail and e-commerce. So I think those are all sectors in which we’ve seen some impacts across the board.

I can imagine that you’ll see some additional reports come out from various companies, particularly around CPG and retail over the coming months. But we think we’ve largely baked that stuff in into our guidance. And so we feel pretty good about the setup of our company. And again, I think we feel like we’re going to be profitable irrespective of the environment. And we think it’s a good setup for investors going forward, in spite of the correction that occurred today.

RACHELLE AKUFFO: And in Bank of America’s note, I mean, they were complimentary about the analyst day that they had, presenting it as an opportunity to reset expectations and talk about the shift in focus from growth to delivering meaningful operating profits. What is the strategy there?

KHOZEMA SHIPCHANDLER: Well, we always want to be a growth company, right? I mean, we were a technology company. We’re of such a vintage that we think we can continue delivering high growth rates for a long period of time. Even at our scale, we’re growing 15% to 25% as about a $4 billion company, which I think is quite impressive. That said, I think we should also reap the economies of scale that come with being a large company.

We don’t just want to be a big company. We want to be a really great company. And I think part of that is being really profitable. So we committed to being profitable in 2023 on a non-GAAP basis. We will accomplish that. And then thereafter, we also committed to ongoing op margin accretion, which we have good plans to deliver. We’ll generate leverage across most of our cost categories. And I think our software products will really start picking up as well. And we’ve got some really exciting stuff in the pipeline between Flex, our contact center product, and then Segment and Engage on the data side.

SEANA SMITH: And speaking of cost there, your company announcing layoffs, 11% of the workers back in September. When you look ahead here, do you see the need to potentially, I guess, insert some more cost cutting measures as you do remain focused on profitability next year?

KHOZEMA SHIPCHANDLER: Yeah, I don’t see that today. I think that’s a fair question. But based on the plan that we put together, we came up with a variety of scenarios that we could imagine, some of which are relatively dire, in fact. And so we feel pretty good about what we did. I think we’d been thinking about rightsizing the workforce for a while. I think we got a little bit ahead of ourselves in terms of what happened during COVID vis a vis hiring.

It’s unfortunate, really difficult decision, obviously, but I think it was appropriate and the right thing for us to do to set up the long-term of the company. Going forward, I wouldn’t take anything off the table ever, obviously, but we feel pretty good about the setup right now. And I don’t see us having to do anything further currently.

RACHELLE AKUFFO: And some of the key partners of Twilio, that Bank of America survey talked about the competitive pricing pressure that might intensify because Twilio does have a premium pricing on it. Are there any plans to perhaps adjust pricing, given what the competition is doing and given the macroeconomic background?

KHOZEMA SHIPCHANDLER: No, not right now. I mean, honestly, we feel pretty good about the competitive dynamic. We feel pretty good about the way that we’re priced. We do feel like we offer a premium technology offering. And yeah, there’s a higher price that goes with that, but I think it’s also a better product.

And we have different products and different competitive sets based on the way that those things shake out. You know, so we’re different in data. We’re different in marketing. We’re different in contact center. And then, again, a little bit different competitive set in communications, but in each of those, we command a price premium. We feel like we deserve that, and we feel like the technology is superior to the competitors.

SEANA SMITH: Khozema, we really appreciate you coming on today, especially given that such a tough day when you take a look at the stock price, off just around 35%. We hope to have you back, Khozema Shipchandler, Twilio’s COO.

KHOZEMA SHIPCHANDLER: Great. Thanks for having me.