Twitter reported first-quarter 2020 earnings Thursday that beat estimates despite an expected hit to its ads business due to the coronavirus pandemic. The stock was up as much as 12% during premarket trading on news of the report, but the stock fell more than 6% during the earnings call as executives offered few signs of recovery or stability in the current quarter in its advertising business. The stock was down about 2% during morning trading.

Here’s what Twitter reported:

- Earnings per share (EPS): 11 cents

- Revenue: $808 million

- Monetizable daily active users (mDAUs): 166 million

Wall Street had been anticipating earnings per share of 10 cents on revenue of $776 million, based on Refinitiv consensus estimates. Monetizable daily active users (mDAUs) was expected to come in at 164 million, based on StreetAccount estimates. However, it’s difficult to compare reported earnings to analyst estimates for Twitter’s first quarter, as the coronavirus pandemic continues to hit global economies and makes earnings impact difficult to assess.

After an initial spike, the stock turned negative as executives failed to reassure analysts on the earnings call that it had seen signs of recovery. CFO Ned Segal said on a call with analysts pointed to weakened advertising spending at the end of March as a signal of what Twitter has been experiencing this month. By contrast, Google and Facebook said in their earnings reports this week that they have seen signs of recovery and stability in the first few weeks of April.

Segal said the business was impacted by cancelled and postponed events and said that toward the end of March, it saw a greater decline in ad spending in the U.S. compared to Asia. He added that as the economy in Asia began to reopen, it’s seen a lessened impact in the region in terms of ad spending.

While live sports events and some splashy product launches have been delayed, Twitter has benefited from virtual experiences during the pandemic, Segal told CNBC’s Andrew Ross Sorkin on “Squawk Box.”

“Live events are a really big way that people use the service, but that’s not just about something that’s scheduled,” he said. “It could be something like [ESPN documentary] ‘The Last Dance’ where you essentially have watch parties on the service.”

Segal also told CNBC Twitter has had less exposure to ad cuts in the travel industry as other services since many of its advertisers are focused on product launches and movie premieres.

The company pulled its guidance for the current quarter at the end of March, blaming the coronavirus for a slowdown in advertising revenue that made it hard to pin down its results. While Twitter said at the time that it expected revenue for the quarter to be slightly down year-over-year, Segal told analysts it was able to see revenue growth because deterioration by the end of March remained “relatively steady” directionally despite a “wide range of outcomes” over the period of March 11 to March 31.

Twitter did not provide guidance for the second quarter and is still suspending full year guidance, but it noted that its plans to build a new data center will likely be delayed, impacting capex spend in the 2020 fiscal year. It still expects stock-based compensation to grow sequentially in the second quarter by at least 25%.

The company said its mDAU growth represented the strongest ever year-over-year at 24%. It saw double digit growth in its top 10 markets, according to the shareholder letter. By the end of March, Twitter said, “The absolute number of mDAUs stabilized … as many people around the world settled into new routines.”

Twitter said in the letter that its revenue growth of 3% was due to “a strong start to the quarter that was impacted by widespread economic disruption related to COVID-19 in March.”

Total advertising revenue was $682 million, up about $3 million compared to last year. But the company said its ad revenue should be viewed as two distinct periods, with January through the beginning of March performing as expected and the end of March taking a hit.

“As an indication of the rapid change in advertising behavior, from March 11 (when many events around the world began to be canceled and we made working from home mandatory for nearly all our employees globally) until March 31, our total advertising revenue declined approximately 27% year over year,” the company wrote in its shareholder letter. “The downturn we saw in March was particularly pronounced in the US, and advertising weakness in Asia began to subside as work and travel restrictions were gradually lifted.”

To weather the pandemic, Twitter is shifting resources to focus on revenue-generating products including its Mobile App Promotion (MAP) product. It’s also lowering hiring and non-labor expense plans while continuing to invest in engineering, product and trust and safety.

After experiencing issues with its MAP product that negatively impacted its Q3 2019 earnings, Segal said Twitter still expects to complete its ad server rebuild by the end of the second quarter this year.

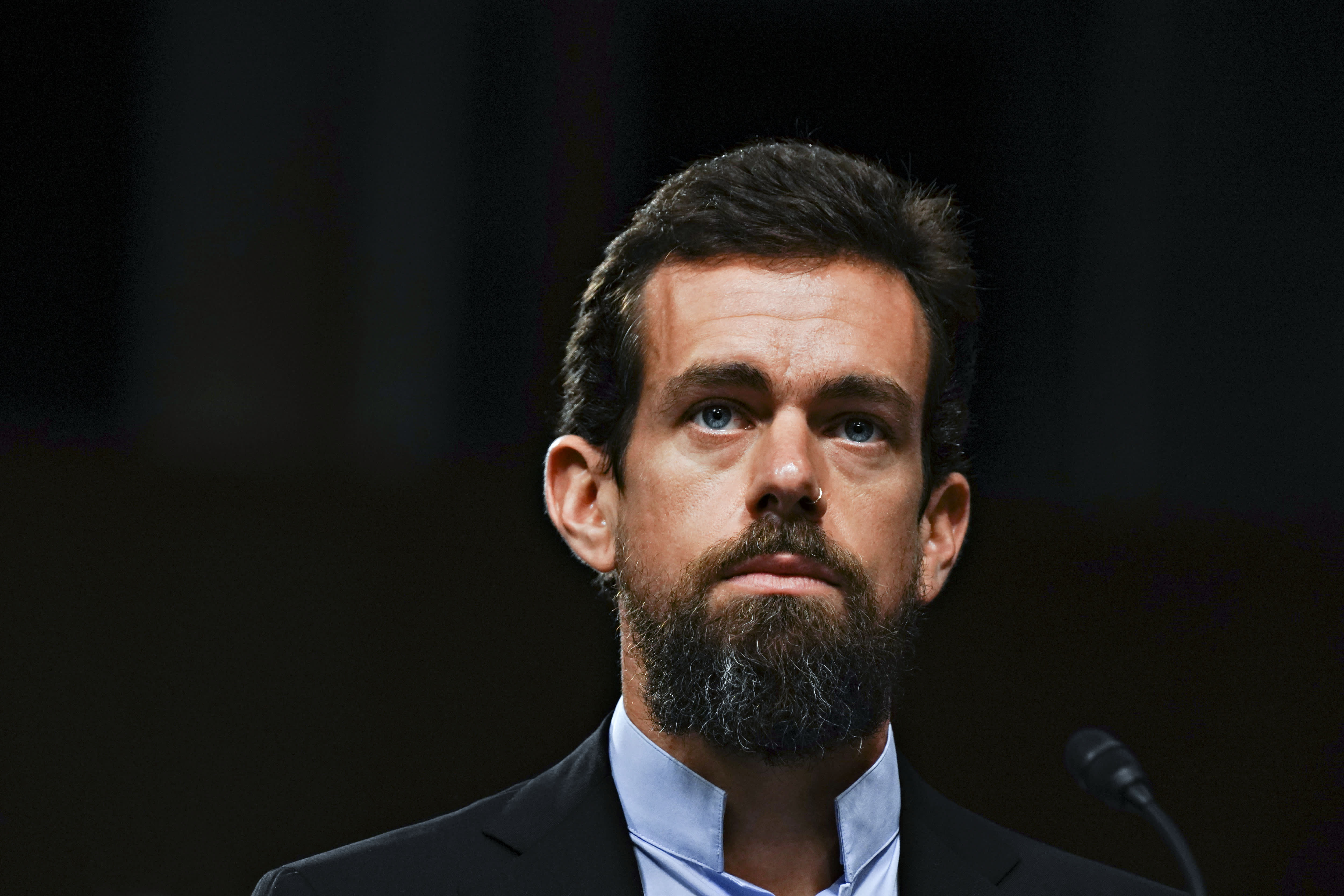

Prior to the pandemic, Jack Dorsey’s role as CEO was challenged by activist investment firm Elliott Management. The firm wanted Dorsey removed in part because of his split responsibility as chief executive of both Twitter and Square and his previous plans to move to Africa for several months. As the coronavirus spread throughout the world, Dorsey said he was reconsidering the move to Africa and Twitter struck a deal with Elliott and Silver Lake, leaving Dorsey in place for the time being.

Analysts at Bernstein said earlier this month that the involvement of Elliott and Silver Lake will help catalyze innovation at Twitter, especially in ad products. The deal included a $1 billion investment in the company by Silver Lake.

But in the near term, the analysts said, Twitter, like other digital ad platforms, will likely suffer from lower ad revenue even as engagement climbs since many brands are wary of advertising on coronavirus-related content.

WATCH: Here’s how Big Tech companies are combatting coronavirus misinformation

Add Comment