In this file photo taken on August 8, 2020, a nurse shows a COVID-19 coronavirus vaccine produced by Chinese company Sinovac Biotech at São Lucas Hospital in Porto Alegre, southern Brazil.

silvio avila/Agence France-Presse/Getty Images

The election relief rally has been interrupted by the COVID-19 vaccine rotation.

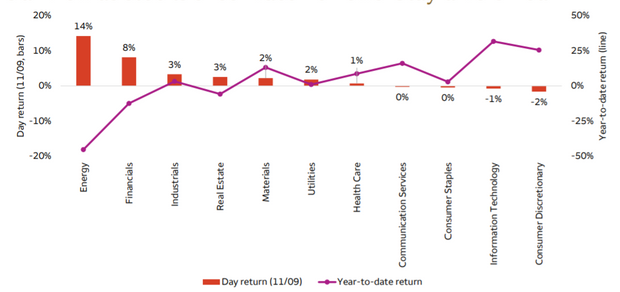

For two days, hard-hit sectors like energy SP500.10, +2.52% and financials SP500.40, +0.72% have boomed, after the news from one study that the vaccine being developed by drugmaker Pfizer PFE, -1.32% and its partner BioNTech BNTX, +7.59% was 90% effective. Over the last week, the energy sector of the S&P 500 SPX, -0.14% has rallied 15% and financials have jumped 9%.

Chao Ma, global portfolio and investment strategist at Wells Fargo Investment Institute, said an eventual vaccine will broaden out market participation, especially to hard-hit sectors like travel and leisure. But Ma advised holding a diversified portfolio, including in the suddenly out-of-form information technology sector. “Over the longer term, however, we expect that certain secular trends, including the virtual experience economy and supply chain reshoring, will continue to drive the stock market,” said Ma.

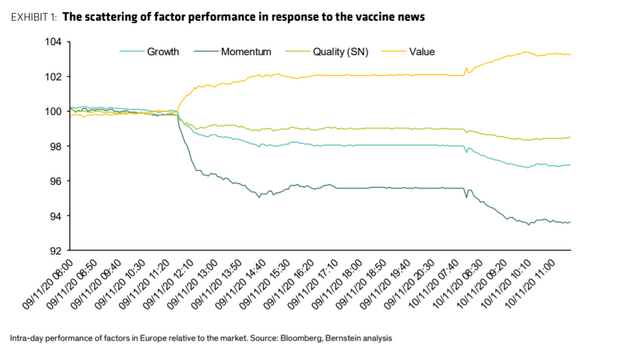

Inigo Fraser Jenkins, co-head of the portfolio strategy team at Bernstein Research, said the Pfizer news, which came during the European trading session, sent stocks scurrying like “tracks left in a cloud chamber from particles scattering in an accelerator.” But Fraser Jenkins isn’t convinced of the durability of this move.

“For a medium-term allocation other macro forces matter a lot. For example, we think that real yields will stay low, there is still likely to be a cycle in credit and bankruptcies and despite antitrust battles for tech companies there is still a generally greater longevity of growth for high growth companies,” he said. One measure of real yields, on 10-year Treasury inflation-protected securities, has climbed from -0.87% last week to -0.78% on Tuesday.

For financials to continue to rally, the yield curve will have to steepen, which he doesn’t expect.

“Moreover we continue to believe that a credit and bankruptcy cycle will still happen in some form,” he said. For value-minded investors, he prefers core cyclicals such as industrials if inflation materializes. “Owning the broader group of value stocks in the traditional sense is more likely to be a trade that benefits from short tactical bounces but may find it harder to find a sustained footing,” he said.

Citi’s global strategy team said similarly: “We would favor energy, where rising oil prices CL.1, +2.24% and break-evens (bond market inflation expectations) will help. Financials also look cheap, but the scope for further increases in nominal bond yields (which drive relative performance) is likely to be limited by further QE,” the team said. QE refers to quantitative easing, when central banks buy government securities and other forms of debt.

On Tuesday, the S&P 500 SPX, -0.14% ended down 0.1% and the tech-heavy Nasdaq Composite COMP, -1.36% lost 1.4%.

Add Comment