(Bloomberg Opinion) — Investors in Argentina would seem to have no peers among global losers.

After voters resoundingly rejected President Mauricio Macri and his free-market policies in primary elections earlier this month, the stock market, as measured by the S&P Merval Index, lost almost half its value in the biggest crash in at least six decades. The country’s currency, the peso, suffered its biggest decline since December 2015. The government’s benchmark-equivalent bond plummeted a record 26% to trade at 56 cents on the dollar, according to data compiled by Bloomberg.

Argentina, whose economy is the third largest in Latin America, was already reeling from recession and inflation as high as 57.3% in May. The fear among investors now is the return to power of the Peronist party that traditionally stiffed creditors, defaulted on the nation’s bonds and rigged economic data so much that lenders had no incentive for a rescue.

Amid the financial carnage, however, are two companies based in Argentina that highlight the country’s potential and showcase possible building blocks for its recovery. They are MercadoLibre Inc., Latin America’s largest online marketplace and biggest provider of online payment and digital financial services, and Globant SA, a software developer and technology services provider. Both are listed in the U.S., but if they were listed in their home country they would be 1.5 times the value of the local stock market, according to data compiled by Bloomberg. MercadoLibre and Globant increased their worldwide workforces 30% and 31%, respectively, to 7,239 and 8,384 in 2018 when most of the nation’s employers were either letting people go or not hiring during the recession.

MercadoLibre is the most valuable publicly traded company based in Argentina, with a market value of $30 billion and revenue last year of $1.4 billion. Chief Executive Officer Marcos Eduardo Galperin, who is 47, started the company in his Buenos Aires garage in 1999 after studying at Stanford University. When he was a student, he successfully pitched the idea for the company to an investor while he was driving him to the airport. The company he has built now has operations in 18 countries and is referred to frequently as the Amazon.com of Latin America, with a healthy dose of PayPal thrown in because of its successful payments system.

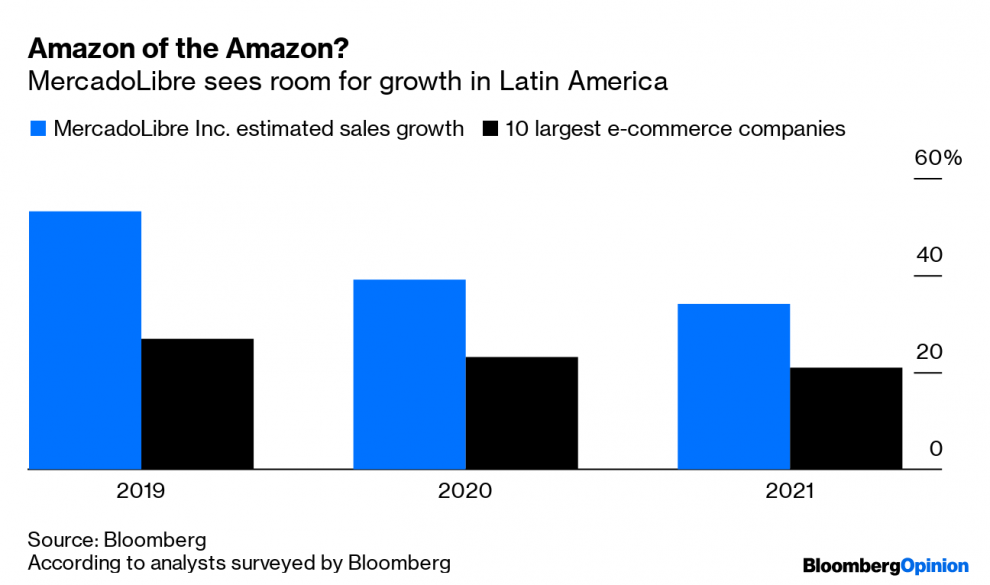

MercadoLibre, which went public in 2007, has gained 442% during the past five years and is still delivering a 109% total return this year. Its revenue is expected to increase 53% this year and 39% in 2020, according to analysts surveyed by Bloomberg. And while its 48% gross margin is down from previous years, it has been investing heavily in its businesses.

Even with that success, Galperin sees a lot more room for growth. “Latin America has 600 million people and we have roughly 50 million people using our platform, up from 4 million” when the company went public, he said during an interview earlier this month at his Buenos Aires headquarters. MercadoLibre “can grow another 10 times from 50 million to 500 million” because “the number of transactions that are done per user in Latin America is still a 10th of what is happening in China.” The company derives only 21% of its revenue inside Argentina, so there’s plenty of room for expansion there.

Martin Migoya, the 51-year-old chairman, CEO and co-founder of Globant, shared Galperin’s views about growth opportunities, calling the digital space “the largest single opportunity in the planet today.” His company, which was started in 2003, develops software and services for an array of mobile, social media, cloud-computing, gaming and big-data purposes, including artificial intelligence and machine learning. Its clients, 90% of which are in the U.S., have included such prominent companies as Google, Electronic Arts and Walt Disney.

During an interview earlier this month at his Buenos Aires headquarters, Migoya said Globant, which generates only 5% of its sales in Argentina, is especially prepared to benefit from “a $5 trillion market in the next five years” made up of “digital transformation and cognitive transformation, which means applying artificial intelligence to pretty much everything.”

Globant, which has a market value of $3.3 billion and generated $522 million in revenue last year, has gained 621% over the past five years and is returning 60% this year. Its sales are expected to increase 24% in 2019 and 21% next year, according to analysts surveyed by Bloomberg.

The performances of MercadoLibre and Globant haven’t gone unnoticed. Toronto-based Dynamic Power Global Growth Fund, managed by Noah Blackstein, produced the largest total returns during the past 10, five and one years among more than 1,000 global mutual funds, according to data compiled by Bloomberg. MercadoLibre is the largest holding, accounting for more than 7% of the fund, according to the most recent filing. Globant makes up 5%.

Blackstein looks for companies, not countries, when he invests. “My focus is finding the biggest opportunities for growth wherever they lie in the world, be they in technology, health care and retail,” he said in a July interview.

By his measure, Argentina has some of the brightest prospects. As the country descends once again into political and economic instability, MercadoLibre and Globant can remind citizens and investors alike that a downward spiral doesn’t have to be the status quo.

To contact the author of this story: Matthew A. Winkler at [email protected]

To contact the editor responsible for this story: Daniel Niemi at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Matthew A. Winkler is a Bloomberg Opinion columnist. He is the editor-in-chief emeritus of Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”65″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.